A

B

As most recently

Corrected amount

reported or adjusted

14

14

14

Write the amounts from Line 13.

____________|____

____________|____

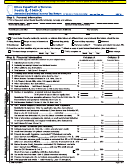

Step 5: Figure your income or loss

15

15

15

State, municipal, and other interest income excluded from Line 14.

____________|____

____________|____

16

16

16

Illinois replacement tax deducted in arriving at Line 14.

____________|____

____________|____

17

17

17

Illinois Bonus Depreciation addition (Form IL-4562).

____________|____

____________|____

18

18

18

Related-Party Expenses addition (Schedule 80/20).

____________|____

____________|____

19

19

19

Distributive share of additions (Schedule K-1-P or K-1-T).

____________|____

____________|____

20

20

20

Guaranteed payments to partners from U.S. Form 1065.

____________|____

____________|____

21

The amount of loss distributable to a partner subject to

21

21

replacement tax (Schedule B).

____________|____

____________|____

22

22

22

Other additions (Schedule M for businesses).

____________|____

____________|____

23

23

23

Add Lines 14 through 22. This is your total income or loss.

____________|____

____________|____

Step 6: Figure your base income or loss

24

24

24

Interest income from U.S. Treasury and exempt federal obligations.

____________|____

____________|____

25

25

25

August 1, 1969 valuation limitation amount (Schedule F).

____________|____

____________|____

26

Personal service income or reasonable allowance for

26

26

compensation of partners.

____________|____

____________|____

27

Share of income distributable to a partner subject to

27

27

replacement tax (Schedule B).

____________|____

____________|____

28

Expenses incurred in producing certain federally tax-exempt

28

28

income or credits.

____________|____

____________|____

29

Enterprise Zone or River Edge Redevelopment Zone

29

29

dividend subtraction (Schedule 1299-A).

____________|____

____________|____

30

30

30

High Impact Business dividend subtraction (Schedule 1299-A).

____________|____

____________|____

31

31

31

Illinois Bonus Depreciation subtraction (Form IL-4562).

____________|____

____________|____

32

32

32

Related-Party Expenses subtraction (Schedule 80/20).

____________|____

____________|____

33

33

33

Distributive share of subtractions (Schedule K-1-P or K-1-T).

____________|____

____________|____

34

34

34

Other subtractions (Schedule M for businesses).

____________|____

____________|____

35

35

35

Total subtractions. Add Lines 24 through 34.

____________|____

____________|____

36

36

36

Base income or net loss. Subtract Line 35 from Line 23.

____________|____

____________|____

If the amount on Line 36 is derived inside and outside Illinois, complete Step 7. Otherwise, go to Step 8.

Step 7: Figure your income allocable to Illinois

37

37

37

Nonbusiness income or loss (Schedule NB).

____________|____

____________|____

38

Non-unitary partnership business income or loss

38

38

included in Line 36.

____________|____

____________|____

39

39

39

Add Lines 37 and 38.

____________|____

____________|____

40

40

40

Business income or loss. Subtract Line 39 from Line 36.

____________|____

____________|____

41

41

41

Total sales everywhere (this amount cannot be negative).

____________|____

____________|____

42

42

42

Total sales inside Illinois (this amount cannot be negative).

____________|____

____________|____

.

.

43

43

43

Apportionment Factor. Divide Line 42 by Line 41.

_______________

_______________

44

Business income or loss apportionable to Illinois.

44

44

Multiply Line 40 by Line 43.

____________|____

____________|____

45

45

45

Nonbusiness income or loss allocable to Illinois (Sch. NB).

____________|____

____________|____

46

Non-unitary partnership business income or loss

46

46

apportionable to Illinois.

____________|____

____________|____

47

Base income or net loss allocable to Illinois.

47

47

Add Lines 44 through 46.

____________|____

____________|____

IL-1065-X (R-1/08)

Page 2 of 3

1

1 2

2 3

3