A

B

As most recently

Corrected amount

reported or adjusted

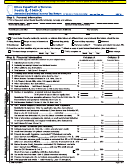

Step 8: Figure your net income

48

48

48

Base income or net loss from Line 36 or Line 47.

____________|____

____________|____

49

Illinois net loss deduction (Schedule NLD).

49

49

If Line 48 is zero or a negative amount, write “0.”

____________|____

____________|____

50

50

50

Income after NLD. Subtract Line 49 from Line 48.

____________|____

____________|____

51

51

51

Write the amount from Step 5, Line 36.

____________|____

____________|____

.

.

52

52

52

Divide Line 48 by Line 51. (This fi gure cannot be greater than “1.”)

___

____________

___

____________

53

53

53

Exemption allowance. Multiply Line 52 by $1,000.

____________|____

____________|____

54

54

54

Net income. Subtract Line 53 from Line 50.

____________|____

____________|____

Step 9: Figure your net replacement tax

55

55

55

Replacement Tax. Multiply Line 54 by 1.5% (.015).

____________|____

___________|____

56

56

56

Recapture of investment credits (Schedule 4255).

____________|____

___________|____

57

57

57

Replacement Tax before investment credits. Add Lines 55 and 56

____________|____

___________|____

.

58

58

58

Investment credits (Form IL-477).

____________|____

___________|____

59

Net replacement tax. Subtract Line 58 from Line 57.

59

59

If negative, write “0.”

____________|____

____________|____

Step 10: Figure your refund or balance due

60

Payments

a

a

Credit from prior year overpayment.

____________|____

b

b

Form IL-505-B (extension) payment.

____________|____

60

Total payments. Add Lines 60a and 60b.

____________|____

61

61

Tax paid with original return (do not include penalties and interest).

____________|____

62

62

Subsequent tax payments made since the original return.

____________|____

63

63

Total tax paid. Add Lines 60, 61, and 62.

____________|____

64

64

Total amount previously refunded and/or credited for the year being amended.

____________|____

65

65

Net tax paid. Subtract Line 64 from Line 63.

____________|____

66

66

Refund. Subtract Line 59 from Line 65.

____________|____

67

67

Tax due. Subtract Line 65 from Line 59.

____________|____

68

68

Penalty (See instructions.)

____________|____

69

69

Interest (See instructions.)

____________|____

70

70

Total balance due. Add Lines 67 through 69.

____________|____

Make your check payable to “Illinois Department of Revenue.”

Write the amount of your payment on the top of Page 1 in the space provided.

Step 11: Sign here

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

________________________________________________ _____/_____/______

________________________

(____)________________

Signature of authorized offi cer

Date

Title

Phone

________________________________________________ _____/____/_______

________________________________

Signature of preparer

Date

Preparer’s Social Security Number of fi rm’s FEIN

______________________________________

_______________________________________________________ (____)________________

Preparer fi rm’s name (or yours, if self-employed)

Address

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19016, Springfi eld, IL 62794-9016

Reset

Print

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could

IL-1065-X (R-1/08)

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-4506

Page 3 of 3

1

1 2

2 3

3