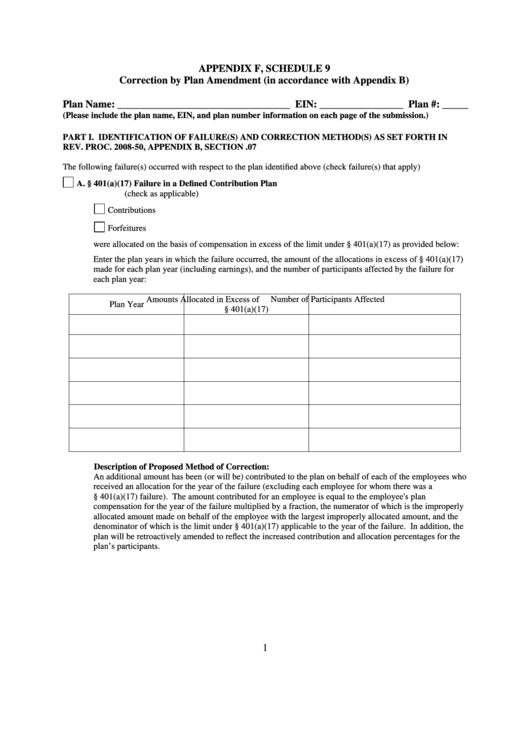

APPENDIX F, SCHEDULE 9

Correction by Plan Amendment (in accordance with Appendix B)

Plan Name: _________________________________ EIN: ________________ Plan #: _____

(Please include the plan name, EIN, and plan number information on each page of the submission.)

PART I. IDENTIFICATION OF FAILURE(S) AND CORRECTION METHOD(S) AS SET FORTH IN

REV. PROC. 2008-50, APPENDIX B, SECTION .07

The following failure(s) occurred with respect to the plan identified above (check failure(s) that apply)

A.

§ 401(a)(17) Failure in a Defined Contribution Plan

(check as applicable)

Contributions

Forfeitures

were allocated on the basis of compensation in excess of the limit under § 401(a)(17) as provided below:

Enter the plan years in which the failure occurred, the amount of the allocations in excess of § 401(a)(17)

made for each plan year (including earnings), and the number of participants affected by the failure for

each plan year:

Amounts Allocated in Excess of

Number of Participants Affected

Plan Year

§ 401(a)(17)

Description of Proposed Method of Correction:

An additional amount has been (or will be) contributed to the plan on behalf of each of the employees who

received an allocation for the year of the failure (excluding each employee for whom there was a

§ 401(a)(17) failure). The amount contributed for an employee is equal to the employee's plan

compensation for the year of the failure multiplied by a fraction, the numerator of which is the improperly

allocated amount made on behalf of the employee with the largest improperly allocated amount, and the

denominator of which is the limit under § 401(a)(17) applicable to the year of the failure. In addition, the

plan will be retroactively amended to reflect the increased contribution and allocation percentages for the

plan’s participants.

1

1

1 2

2 3

3 4

4 5

5 6

6