TAXABLE YEAR

TAXPAYER NAME

ACCOUNT NO./FEIN/SSN

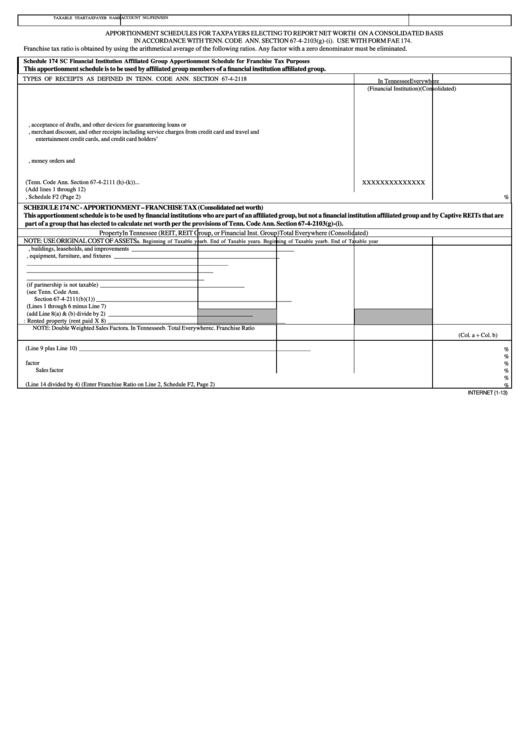

APPORTIONMENT SCHEDULES FOR TAXPAYERS ELECTING TO REPORT NET WORTH ON A CONSOLIDATED BASIS

IN ACCORDANCE WITH TENN. CODE ANN. SECTION 67-4-2103(g)-(i). USE WITH FORM FAE 174.

Franchise tax ratio is obtained by using the arithmetical average of the following ratios. Any factor with a zero denominator must be eliminated.

Schedule 174 SC Financial Institution Affiliated Group Apportionment Schedule for Franchise Tax Purposes

This apportionment schedule is to be used by affiliated group members of a financial institution affiliated group.

TYPES OF RECEIPTS AS DEFINED IN TENN. CODE ANN. SECTION 67-4-2118

In Tennessee

Everywhere

(Financial Institution)

(Consolidated)

1. Receipts from leases of real property .................................................................................................................................................... ____________________________________________________

2. Interest income and other receipts from loans or installment sales secured by real or tangible personal property ............................... ____________________________________________________

3. Interest income and other receipts from consumer loans which are not secured .................................................................................... ____________________________________________________

4. Interest income and receipts from commercial and installment loans which are not secured by real or tangible property .................... ____________________________________________________

5. Receipts and fee income from letters of credit, acceptance of drafts, and other devices for guaranteeing loans or credit ...................... ____________________________________________________

6. Interest income, merchant discount, and other receipts including service charges from credit card and travel and

entertainment credit cards, and credit card holders’ fees ........................................................................................................................ ____________________________________________________

7. Sales of an intangible or tangible asset .................................................................................................................................................... ____________________________________________________

8. Receipts from fiduciary and other services ............................................................................................................................................ ____________________________________________________

9. Receipts from the issuance of travelers checks, money orders and U.S. Savings Bonds ....................................................................... ____________________________________________________

10. Interest income and other receipts from participation loans .................................................................................................................. ____________________________________________________

11. Other financial institution receipts ......................................................................................................................................................... ____________________________________________________

12. Receipts of non-unitary members of the financial institution affiliated group (Tenn. Code Ann. Section 67-4-2111 (h)-(k)) .............. ____________________________________________________

XXXXXXXXXXXXXX

13. Total receipts (Add lines 1 through 12) .................................................................................................................................................. ____________________________________________________

14. Divide Total Tennessee receipts by Total Everywhere receipts and enter ratio on Line 2, Schedule F2 (Page 2) ..................................................................................... __________________________

%

SCHEDULE 174 NC - APPORTIONMENT – FRANCHISE TAX (Consolidated net worth)

This apportionment schedule is to be used by financial institutions who are part of an affiliated group, but not a financial institution affiliated group and by Captive REITs that are

part of a group that has elected to calculate net worth per the provisions of Tenn. Code Ann. Section 67-4-2103(g)-(i).

Property

In Tennessee (REIT, REIT Group, or Financial Inst. Group)

Total Everywhere (Consolidated)

NOTE: USE ORIGINAL COST OF ASSETS

a. Beginning of Taxable year

b. End of Taxable year

a. Beginning of Taxable year

b. End of Taxable year

l. Land, buildings, leaseholds, and improvements .............................. ________________________________________________________________________________________________________

2. Machinery, equipment, furniture, and fixtures ............................... ________________________________________________________________________________________________________

3. Automobiles and trucks .................................................................. ________________________________________________________________________________________________________

4. Inventories and work in progress ................................................... ________________________________________________________________________________________________________

5. Prepaid supplies and other property ............................................. ________________________________________________________________________________________________________

6. Share of partnership property (if partnership is not taxable) ........ ________________________________________________________________________________________________________

7. Less exempt inventory (see Tenn. Code Ann.

Section 67-4-2111(b)(1)) ................................................................ ________________________________________________________________________________________________________

8. Franchise tax total (Lines 1 through 6 minus Line 7) ..................... ________________________________________________________________________________________________________

9. Franchise tax average value (add Line 8(a) & (b) divide by 2) ........ ________________________________________________________________________________________________________

10. Add: Rented property (rent paid X 8) ........................................... ________________________________________________________________________________________________________

NOTE: Double Weighted Sales Factor

a. In Tennessee

b. Total Everywhere

c. Franchise Ratio

(Col. a ÷ Col. b)

11. Franchise Tax property factor (Line 9 plus Line 10) ........................................................................ ______________________________________________________________________________

%

12. Payroll factor ..................................................................................................................................... ______________________________________________________________________________

%

13. Sales factor ......................................................................................................................................... ______________________________________________________________________________

%

Sales factor ......................................................................................................................................... ______________________________________________________________________________

%

14. Total Ratios ................................................................................................................................................................................................................................................ __________________________

%

15. Apportionment Ratio (Line 14 divided by 4) (Enter Franchise Ratio on Line 2, Schedule F2, Page 2) .................................................................................................... __________________________

%

INTERNET (1-13)

1

1