Form D-20 Cs - Authorization And Consent Of Subsidiary Corporation To Be Included In A Consolidated Corporation Franchise Tax Return

ADVERTISEMENT

33

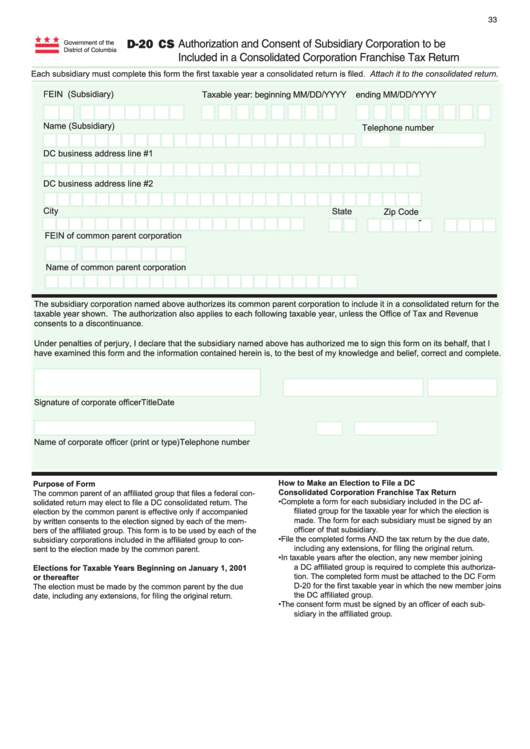

Authorization and Consent of Subsidiary Corporation to be

D-20 CS

Government of the

District of Columbia

Included in a Consolidated Corporation Franchise Tax Return

.

Each subsidiary must complete this form the first taxable year a consolidated return is filed. Attach it to the consolidated return

FEIN (Subsidiary)

Taxable year: beginning MM/DD/YYYY

ending MM/DD/YYYY

Name (Subsidiary)

Telephone number

DC business address line #1

DC business address line #2

City

State

Zip Code

-

FEIN of common parent corporation

Name of common parent corporation

The subsidiary corporation named above authorizes its common parent corporation to include it in a consolidated return for the

taxable year shown. The authorization also applies to each following taxable year, unless the Office of Tax and Revenue

consents to a discontinuance.

Under penalties of perjury, I declare that the subsidiary named above has authorized me to sign this form on its behalf, that I

have examined this form and the information contained herein is, to the best of my knowledge and belief, correct and complete.

Signature of corporate officer

Title

Date

Name of corporate officer (print or type)

Telephone number

How to Make an Election to File a DC

Purpose of Form

Consolidated Corporation Franchise Tax Return

The common parent of an affiliated group that files a federal con-

•

Complete a form for each subsidiary included in the DC af-

solidated return may elect to file a DC consolidated return. The

filiated group for the taxable year for which the election is

election by the common parent is effective only if accompanied

made. The form for each subsidiary must be signed by an

by written consents to the election signed by each of the mem-

officer of that subsidiary.

bers of the affiliated group. This form is to be used by each of the

•

File the completed forms AND the tax return by the due date,

subsidiary corporations included in the affiliated group to con-

including any extensions, for filing the original return.

sent to the election made by the common parent.

•

In taxable years after the election, any new member joining

a DC affiliated group is required to complete this authoriza-

Elections for Taxable Years Beginning on January 1, 2001

tion. The completed form must be attached to the DC Form

or thereafter

D-20 for the first taxable year in which the new member joins

The election must be made by the common parent by the due

the DC affiliated group.

date, including any extensions, for filing the original return.

•

The consent form must be signed by an officer of each sub-

sidiary in the affiliated group.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1