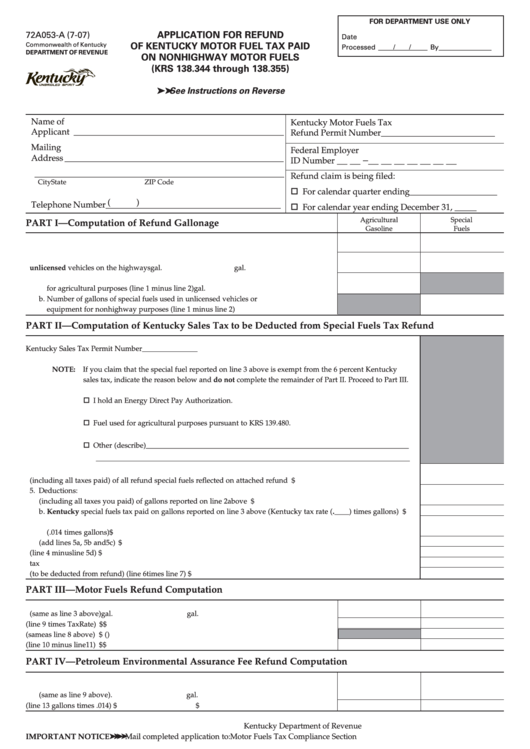

Form 72a053-A - Application For Refund Of Kentucky Motor Fuel Tax Paid On Nonhighway Motor Fuels - 2007

ADVERTISEMENT

FOR DEPARTMENT USE ONLY

APPLICATION FOR REFUND

72A053-A (7-07)

Date

Commonwealth of Kentucky

OF KENTUCKY MOTOR FUEL TAX PAID

Processed ______________ By

/

/

_______________

DEPARTMENT OF REVENUE

ON NONHIGHWAY MOTOR FUELS

(KRS 138.344 through 138.355)

➤ ➤ ➤ ➤ ➤ See Instructions on Reverse

Name of

Kentucky Motor Fuels Tax

Applicant ________________________________________________

Refund Permit Number __________________________

Mailing

Federal Employer

Address __________________________________________________

__ __ –__ __ __ __ __ __ __

ID Number

_________________________________________________________

Refund claim is being filed:

City

State

ZIP Code

For calendar quarter ending ____________________

(

)

Telephone Number ________________________________________

For calendar year ending December 31, _____

Agricultural

Special

PART I—Computation of Refund Gallonage

Gasoline

Fuels

1. Kentucky tax-paid motor fuel gallons reflected on attached refund invoices ......................

gal.

gal.

2. Number of line 1 gallons used in unlicensed vehicles on the highways ...............................

gal.

gal.

3. a. Number of gallons of gasoline used in stationary engines or tractors

for agricultural purposes (line 1 minus line 2) .......................................................................

gal.

b. Number of gallons of special fuels used in unlicensed vehicles or

equipment for nonhighway purposes (line 1 minus line 2) .................................................

gal.

PART II—Computation of Kentucky Sales Tax to be Deducted from Special Fuels Tax Refund

Kentucky Sales Tax Permit Number _______________

NOTE: If you claim that the special fuel reported on line 3 above is exempt from the 6 percent Kentucky

sales tax, indicate the reason below and do not complete the remainder of Part II. Proceed to Part III.

I hold an Energy Direct Pay Authorization.

Fuel used for agricultural purposes pursuant to KRS 139.480.

Other (describe) ________________________________________________________________________

______________________________________________________________________________________

4. Total purchase price (including all taxes paid) of all refund special fuels reflected on attached refund invoices ........

$

5. Deductions:

a. Purchase price (including all taxes you paid) of gallons reported on line 2 above .........................................................

$

b. Kentucky special fuels tax paid on gallons reported on line 3 above (Kentucky tax rate (.____) times gallons) ......

$

c. Kentucky Petroleum Environmental Assurance Fee paid on gallons reported on line 3 above

(.014 times gallons) ......................................................................................................................................................................

$

d. Total deduction (add lines 5a, 5b and 5c) ................................................................................................................................

$

6. Amount subject to Kentucky sales tax (line 4 minus line 5d) ..................................................................................................

$

7. Kentucky sales tax rate ...................................................................................................................................................................

.06

8. Total Kentucky sales tax due (to be deducted from refund) (line 6 times line 7) .................................................................

$

PART III—Motor Fuels Refund Computation

9. Total gallons subject to Kentucky motor fuels tax refund (same as line 3 above) ..................

gal.

gal.

10. Gross motor fuels tax refund claimed (line 9 times Tax Rate) ....................................................

$

$

11. Sales tax liability (same as line 8 above) .........................................................................................

$ (

)

12. Net motor fuels tax refund claimed (line 10 minus line 11) ........................................................

$

$

PART IV—Petroleum Environmental Assurance Fee Refund Computation

13. Total gallons subject to Petroleum Environmental Assurance Fee

(same as line 9 above) ........................................................................................................................

gal.

gal.

14. Fee refund claimed (line 13 gallons times .014) .............................................................................

$

$

Kentucky Department of Revenue

IMPORTANT NOTICE ➤ ➤ ➤ ➤ ➤ Mail completed application to:

Motor Fuels Tax Compliance Section

P.O. Box 1303, Station 63

Frankfort, KY 40602-1303

I hereby certify that this requested refund of Kentucky motor fuels tax is supported by correct and unaltered refund invoices issued by a

licensed motor fuels dealer for motor fuel purchases, that the motor fuel for which refund is claimed herein was placed in a tank marked

"Refund Motor Fuel," and that all information contained herein is true to the best of my knowledge and belief. I further certify that none of

the fuel for which refund is claimed was or will be used in licensed vehicles on public highways.

______________________________________________________________

Date ______________________________________ , 20 ______

Signature of Refund Permit Holder or Authorized Representative

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2