Form A1-Qrt - Arizona Quarterly Withholding Tax Return

ADVERTISEMENT

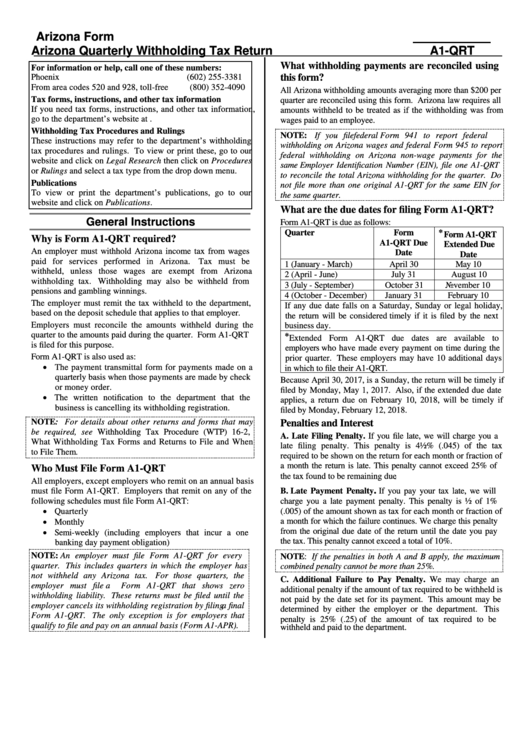

Arizona Form

Arizona Quarterly Withholding Tax Return

A1-QRT

What withholding payments are reconciled using

For information or help, call one of these numbers:

Phoenix

(602) 255-3381

this form?

From area codes 520 and 928, toll-free

(800) 352-4090

All Arizona withholding amounts averaging more than $200 per

Tax forms, instructions, and other tax information

quarter are reconciled using this form. Arizona law requires all

If you need tax forms, instructions, and other tax information,

amounts withheld to be treated as if the withholding was from

go to the department’s website at

wages paid to an employee.

Withholding Tax Procedures and Rulings

NOTE:

If you file federal Form 941 to report federal

These instructions may refer to the department’s withholding

withholding on Arizona wages and federal Form 945 to report

tax procedures and rulings. To view or print these, go to our

federal withholding on Arizona non-wage payments for the

website and click on Legal Research then click on Procedures

same Employer Identification Number (EIN), file one A1-QRT

or Rulings and select a tax type from the drop down menu.

to reconcile the total Arizona withholding for the quarter. Do

Publications

not file more than one original A1-QRT for the same EIN for

To view or print the department’s publications, go to our

the same quarter.

website and click on Publications.

What are the due dates for filing Form A1-QRT?

General Instructions

Form A1-QRT is due as follows:

Quarter

Form

* Form A1-QRT

Why is Form A1-QRT required?

A1-QRT Due

Extended Due

An employer must withhold Arizona income tax from wages

Date

Date

paid for services performed in Arizona.

Tax must be

1 (January - March)

April 30

May 10

withheld, unless those wages are exempt from Arizona

2 (April - June)

July 31

August 10

withholding tax. Withholding may also be withheld from

3 (July - September)

October 31

November 10

pensions and gambling winnings.

4 (October - December)

January 31

February 10

The employer must remit the tax withheld to the department,

If any due date falls on a Saturday, Sunday or legal holiday,

based on the deposit schedule that applies to that employer.

the return will be considered timely if it is filed by the next

Employers must reconcile the amounts withheld during the

business day.

quarter to the amounts paid during the quarter. Form A1-QRT

* Extended Form A1-QRT due dates are available to

is filed for this purpose.

employers who have made every payment on time during the

Form A1-QRT is also used as:

prior quarter. These employers may have 10 additional days

• The payment transmittal form for payments made on a

in which to file their A1-QRT.

quarterly basis when those payments are made by check

Because April 30, 2017, is a Sunday, the return will be timely if

or money order.

filed by Monday, May 1, 2017. Also, if the extended due date

• The written notification to the department that the

applies, a return due on February 10, 2018, will be timely if

business is cancelling its withholding registration.

filed by Monday, February 12, 2018.

NOTE: For details about other returns and forms that may

Penalties and Interest

be required, see Withholding Tax Procedure (WTP) 16-2,

A. Late Filing Penalty. If you file late, we will charge you a

What Withholding Tax Forms and Returns to File and When

late filing penalty. This penalty is 4½% (.045) of the tax

to File Them.

required to be shown on the return for each month or fraction of

a month the return is late. This penalty cannot exceed 25% of

Who Must File Form A1-QRT

the tax found to be remaining due .

All employers, except employers who remit on an annual basis

.

must file Form A1-QRT. Employers that remit on any of the

B. Late Payment Penalty

If you pay your tax late, we will

following schedules must file Form A1-QRT:

charge you a late payment penalty. This penalty is ½ of 1%

• Quarterly

(.005) of the amount shown as tax for each month or fraction of

• Monthly

a month for which the failure continues. We charge this penalty

• Semi-weekly (including employers that incur a one

from the original due date of the return until the date you pay

the tax. This penalty cannot exceed a total of 10%.

banking day payment obligation)

NOTE: An employer must file Form A1-QRT for every

NOTE: If the penalties in both A and B apply, the maximum

quarter. This includes quarters in which the employer has

combined penalty cannot be more than 25%.

not withheld any Arizona tax.

For those quarters, the

C. Additional Failure to Pay Penalty. We may charge an

employer must file a Form A1-QRT that shows zero

additional penalty if the amount of tax required to be withheld is

withholding liability. These returns must be filed until the

not paid by the date set for its payment. This amount may be

employer cancels its withholding registration by filing a final

determined by either the employer or the department. This

Form A1-QRT. The only exception is for employers that

penalty is 25% (.25) of the amount of tax required to be

qualify to file and pay on an annual basis (Form A1-APR).

withheld and paid to the department.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6