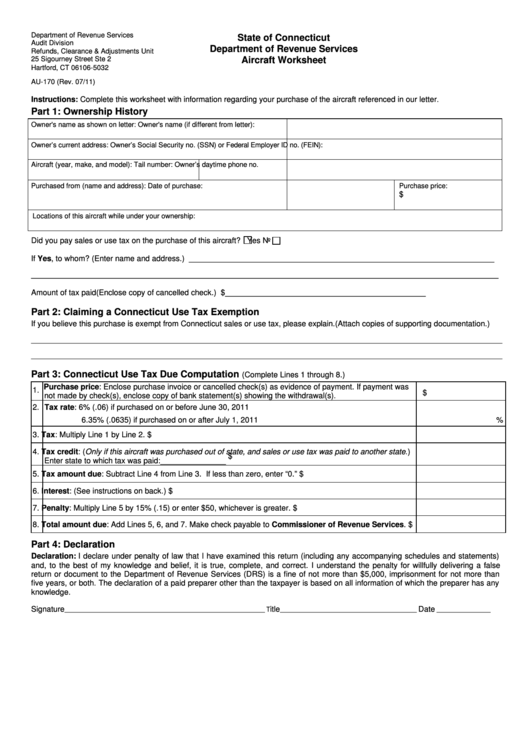

Form Au-170 - Aircraft Worksheet

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

Audit Division

Department of Revenue Services

Refunds, Clearance & Adjustments Unit

25 Sigourney Street Ste 2

Aircraft Worksheet

Hartford, CT 06106-5032

AU-170 (Rev. 07/11)

Instructions: Complete this worksheet with information regarding your purchase of the aircraft referenced in our letter.

Part 1: Ownership History

Owner's name as shown on letter:

Owner's name (if different from letter):

Owner’s current address:

Owner’s Social Security no. (SSN) or Federal Employer ID no. (FEIN):

Aircraft (year, make, and model):

Tail number:

Owner’s daytime phone no.

Purchased from (name and address):

Date of purchase:

Purchase price:

$

Locations of this aircraft while under your ownership:

Did you pay sales or use tax on the purchase of this aircraft?

Yes

No

If Yes, to whom? (Enter name and address.) ______________________________________________________________________

________________________________________________________________________________________________________________________

Amount of tax paid (Enclose copy of cancelled check.) $______________________________________________

Part 2: Claiming a Connecticut Use Tax Exemption

If you believe this purchase is exempt from Connecticut sales or use tax, please explain. (Attach copies of supporting documentation.)

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Part 3: Connecticut Use Tax Due Computation

(Complete Lines 1 through 8.)

1. Purchase price: Enclose purchase invoice or cancelled check(s) as evidence of payment. If payment was

$

not made by check(s), enclose copy of bank statement(s) showing the withdrawal(s).

2. Tax rate: 6% (.06) if purchased on or before June 30, 2011

6.35% (.0635) if purchased on or after July 1, 2011

%

3. Tax: Multiply Line 1 by Line 2.

$

4. Tax credit: (Only if this aircraft was purchased out of state, and sales or use tax was paid to another state.)

$

Enter state to which tax was paid:_______________

5. Tax amount due: Subtract Line 4 from Line 3. If less than zero, enter “0.”

$

6. Interest: (See instructions on back.)

$

7. Penalty: Multiply Line 5 by 15% (.15) or enter $50, whichever is greater.

$

8. Total amount due: Add Lines 5, 6, and 7. Make check payable to Commissioner of Revenue Services.

$

Part 4: Declaration

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false

return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than

five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any

knowledge.

_______________________________________________________________ T

___________________________________________

_________________

Signature

itle

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2