Nonresident Withholding Payments Pa S Corporation And Partnership (Nw)/ Income From Estates Or Trusts (J) Instructions

ADVERTISEMENT

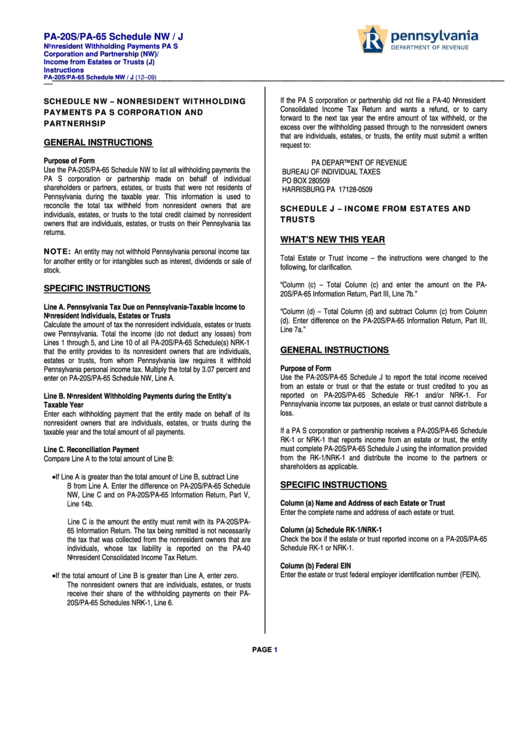

PA-20S/PA-65 Schedule NW / J

Nonresident Withholding Payments PA S

Corporation and Partnership (NW)/

Income from Estates or Trusts (J)

Instructions

PA-20S/PA-65 Schedule NW / J (12–09)

-----

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

SCHEDULE NW – NONRESIDENT WITHHOLDING

If the PA S corporation or partnership did not file a PA-40 Nonresident

Consolidated Income Tax Return and wants a refund, or to carry

PAYMENTS PA S CORPORATION AND

forward to the next tax year the entire amount of tax withheld, or the

PARTNERHSIP

excess over the withholding passed through to the nonresident owners

that are individuals, estates, or trusts, the entity must submit a written

GENERAL INSTRUCTIONS

request to:

Purpose of Form

PA DEPARTMENT OF REVENUE

Use the PA-20S/PA-65 Schedule NW to list all withholding payments the

BUREAU OF INDIVIDUAL TAXES

PA S corporation or partnership made on behalf of individual

PO BOX 280509

shareholders or partners, estates, or trusts that were not residents of

HARRISBURG PA 17128-0509

Pennsylvania during the taxable year. This information is used to

reconcile the total tax withheld from nonresident owners that are

SCHEDULE J – INCOME FROM ESTATES AND

individuals, estates, or trusts to the total credit claimed by nonresident

TRUSTS

owners that are individuals, estates, or trusts on their Pennsylvania tax

returns.

WHAT’S NEW THIS YEAR

NOTE: An entity may not withhold Pennsylvania personal income tax

Total Estate or Trust Income – the instructions were changed to the

for another entity or for intangibles such as interest, dividends or sale of

following, for clarification.

stock.

“Column (c) – Total Column (c) and enter the amount on the PA-

SPECIFIC INSTRUCTIONS

20S/PA-65 Information Return, Part III, Line 7b.”

Line A. Pennsylvania Tax Due on Pennsylvania-Taxable Income to

“Column (d) – Total Column (d) and subtract Column (c) from Column

Nonresident Individuals, Estates or Trusts

(d). Enter difference on the PA-20S/PA-65 Information Return, Part III,

Calculate the amount of tax the nonresident individuals, estates or trusts

Line 7a.”

owe Pennsylvania. Total the income (do not deduct any losses) from

Lines 1 through 5, and Line 10 of all PA-20S/PA-65 Schedule(s) NRK-1

that the entity provides to its nonresident owners that are individuals,

GENERAL INSTRUCTIONS

estates or trusts, from whom Pennsylvania law requires it withhold

Purpose of Form

Pennsylvania personal income tax. Multiply the total by 3.07 percent and

Use the PA-20S/PA-65 Schedule J to report the total income received

enter on PA-20S/PA-65 Schedule NW, Line A.

from an estate or trust or that the estate or trust credited to you as

reported on PA-20S/PA-65 Schedule RK-1 and/or NRK-1. For

Line B. Nonresident Withholding Payments during the Entity’s

Pennsylvania income tax purposes, an estate or trust cannot distribute a

Taxable Year

loss.

Enter each withholding payment that the entity made on behalf of its

nonresident owners that are individuals, estates, or trusts during the

If a PA S corporation or partnership receives a PA-20S/PA-65 Schedule

taxable year and the total amount of all payments.

RK-1 or NRK-1 that reports income from an estate or trust, the entity

must complete PA-20S/PA-65 Schedule J using the information provided

Line C. Reconciliation Payment

from the RK-1/NRK-1 and distribute the income to the partners or

Compare Line A to the total amount of Line B:

shareholders as applicable.

If Line A is greater than the total amount of Line B, subtract Line

B from Line A. Enter the difference on PA-20S/PA-65 Schedule

SPECIFIC INSTRUCTIONS

NW, Line C and on PA-20S/PA-65 Information Return, Part V,

Column (a) Name and Address of each Estate or Trust

Line 14b.

Enter the complete name and address of each estate or trust.

Line C is the amount the entity must remit with its PA-20S/PA-

Column (a) Schedule RK-1/NRK-1

65 Information Return. The tax being remitted is not necessarily

Check the box if the estate or trust reported income on a PA-20S/PA-65

the tax that was collected from the nonresident owners that are

Schedule RK-1 or NRK-1.

individuals, whose tax liability is reported on the PA-40

Nonresident Consolidated Income Tax Return.

Column (b) Federal EIN

Enter the estate or trust federal employer identification number (FEIN).

If the total amount of Line B is greater than Line A, enter zero.

The nonresident owners that are individuals, estates, or trusts

receive their share of the withholding payments on their PA-

20S/PA-65 Schedules NRK-1, Line 6.

PAGE

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2