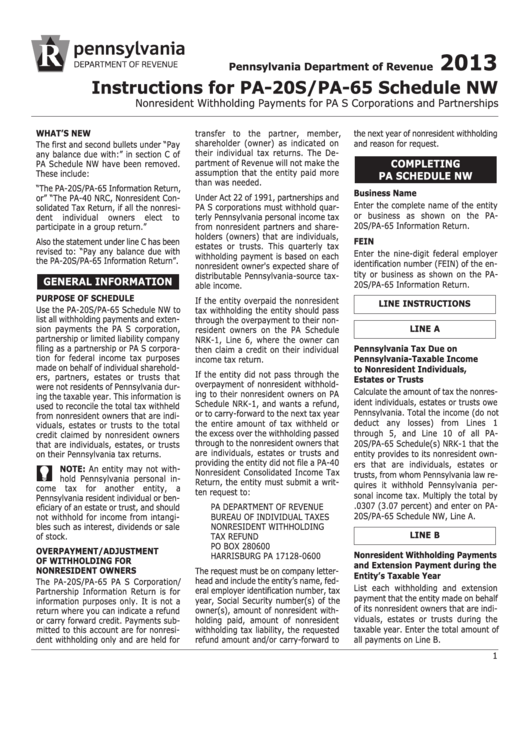

Instructions For Form Pa-20s/pa-65 - Schedule Nw - Nonresident Withholding Payments For Pa S Corporations And Partnerships - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule NW

Nonresident Withholding Payments for PA S Corporations and Partnerships

WHAT’S NEW

transfer to the partner, member,

the next year of nonresident withholding

shareholder (owner) as indicated on

and reason for request.

The first and second bullets under “Pay

their individual tax returns. The De-

any balance due with:” in section C of

partment of Revenue will not make the

COMPLETING

PA Schedule NW have been removed.

assumption that the entity paid more

These include:

PA SCHEDULE NW

than was needed.

“The PA-20S/PA-65 Information Return,

Business Name

Under Act 22 of 1991, partnerships and

or” “The PA-40 NRC, Nonresident Con-

Enter the complete name of the entity

PA S corporations must withhold quar-

solidated Tax Return, if all the nonresi-

or business as shown on the PA-

dent

individual

owners

elect

to

terly Pennsylvania personal income tax

20S/PA-65 Information Return.

participate in a group return.”

from nonresident partners and share-

holders (owners) that are individuals,

FEIN

Also the statement under line C has been

estates or trusts. This quarterly tax

revised to: “Pay any balance due with

Enter the nine-digit federal employer

withholding payment is based on each

the PA-20S/PA-65 Information Return”.

identification number (FEIN) of the en-

nonresident owner's expected share of

tity or business as shown on the PA-

distributable Pennsylvania-source tax-

GENERAL INFORMATION

20S/PA-65 Information Return.

able income.

PURPOSE OF SCHEDULE

If the entity overpaid the nonresident

LINE INSTRUCTIONS

Use the PA-20S/PA-65 Schedule NW to

tax withholding the entity should pass

list all withholding payments and exten-

through the overpayment to their non-

sion payments the PA S corporation,

LINE A

resident owners on the PA Schedule

partnership or limited liability company

NRK-1, Line 6, where the owner can

filing as a partnership or PA S corpora-

Pennsylvania Tax Due on

then claim a credit on their individual

tion for federal income tax purposes

Pennsylvania-Taxable Income

income tax return.

made on behalf of individual sharehold-

to Nonresident Individuals,

If the entity did not pass through the

ers, partners, estates or trusts that

Estates or Trusts

overpayment of nonresident withhold-

were not residents of Pennsylvania dur-

Calculate the amount of tax the nonres-

ing to their nonresident owners on PA

ing the taxable year. This information is

ident individuals, estates or trusts owe

Schedule NRK-1, and wants a refund,

used to reconcile the total tax withheld

Pennsylvania. Total the income (do not

or to carry-forward to the next tax year

from nonresident owners that are indi-

deduct any losses) from Lines 1

the entire amount of tax withheld or

viduals, estates or trusts to the total

the excess over the withholding passed

through 5, and Line 10 of all PA-

credit claimed by nonresident owners

through to the nonresident owners that

20S/PA-65 Schedule(s) NRK-1 that the

that are individuals, estates, or trusts

are individuals, estates or trusts and

entity provides to its nonresident own-

on their Pennsylvania tax returns.

providing the entity did not file a PA-40

ers that are individuals, estates or

NOTE: An entity may not with-

Nonresident Consolidated Income Tax

trusts, from whom Pennsylvania law re-

hold Pennsylvania personal in-

Return, the entity must submit a writ-

quires it withhold Pennsylvania per-

come tax for another entity, a

ten request to:

sonal income tax. Multiply the total by

Pennsylvania resident individual or ben-

.0307 (3.07 percent) and enter on PA-

PA DEPARTMENT OF REVENUE

eficiary of an estate or trust, and should

20S/PA-65 Schedule NW, Line A.

not withhold for income from intangi-

BUREAU OF INDIVIDUAL TAXES

bles such as interest, dividends or sale

NONRESIDENT WITHHOLDING

LINE B

of stock.

TAX REFUND

PO BOX 280600

OVERPAYMENT/ADJUSTMENT

Nonresident Withholding Payments

HARRISBURG PA 17128-0600

OF WITHHOLDING FOR

and Extension Payment during the

NONRESIDENT OWNERS

The request must be on company letter-

Entity’s Taxable Year

head and include the entity’s name, fed-

The PA-20S/PA-65 PA S Corporation/

List each withholding and extension

eral employer identification number, tax

Partnership Information Return is for

payment that the entity made on behalf

year, Social Security number(s) of the

information purposes only. It is not a

of its nonresident owners that are indi-

owner(s), amount of nonresident with-

return where you can indicate a refund

viduals, estates or trusts during the

holding paid, amount of nonresident

or carry forward credit. Payments sub-

taxable year. Enter the total amount of

withholding tax liability, the requested

mitted to this account are for nonresi-

dent withholding only and are held for

refund amount and/or carry-forward to

all payments on Line B.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2