Form Au-263 - Real Estate Conveyance Tax Allocation Worksheet - 2007

ADVERTISEMENT

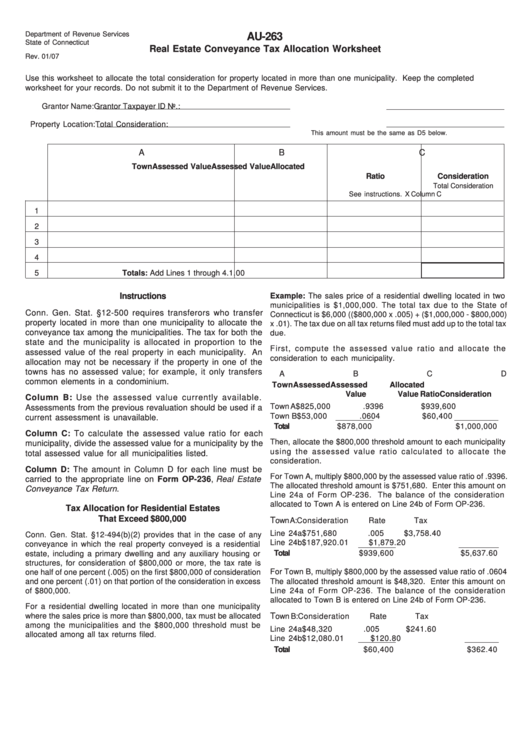

Department of Revenue Services

AU-263

State of Connecticut

Real Estate Conveyance Tax Allocation Worksheet

Rev. 01/07

Use this worksheet to allocate the total consideration for property located in more than one municipality. Keep the completed

worksheet for your records. Do not submit it to the Department of Revenue Services.

Grantor Name:

Grantor Taxpayer ID No.:

Property Location:

Total Consideration:

This amount must be the same as D5 below.

A

B

C

D

Town

Assessed Value

Assessed Value

Allocated

Ratio

Consideration

Total Consideration

See instructions.

X Column C

1

2

3

4

5

Totals: Add Lines 1 through 4.

1.00

Instructions

Example: The sales price of a residential dwelling located in two

municipalities is $1,000,000. The total tax due to the State of

Conn. Gen. Stat. §12-500 requires transferors who transfer

Connecticut is $6,000 (($800,000 x .005) + ($1,000,000 - $800,000)

property located in more than one municipality to allocate the

x .01). The tax due on all tax returns filed must add up to the total tax

conveyance tax among the municipalities. The tax for both the

due.

state and the municipality is allocated in proportion to the

First, compute the assessed value ratio and allocate the

assessed value of the real property in each municipality. An

consideration to each municipality.

allocation may not be necessary if the property in one of the

towns has no assessed value; for example, it only transfers

A

B

C

D

common elements in a condominium.

Town

Assessed

Assessed

Allocated

Value

Value Ratio

Consideration

Column B: Use the assessed value currently available.

Town A

$825,000

.9396

$939,600

Assessments from the previous revaluation should be used if a

Town B

$53,000

.0604

$60,400

current assessment is unavailable.

Total

$878,000

$1,000,000

Column C: To calculate the assessed value ratio for each

Then, allocate the $800,000 threshold amount to each municipality

municipality, divide the assessed value for a municipality by the

using the assessed value ratio calculated to allocate the

total assessed value for all municipalities listed.

consideration.

Column D: The amount in Column D for each line must be

For Town A, multiply $800,000 by the assessed value ratio of .9396.

carried to the appropriate line on Form OP-236, Real Estate

The allocated threshold amount is $751,680. Enter this amount on

Conveyance Tax Return.

Line 24a of Form OP-236. The balance of the consideration

allocated to Town A is entered on Line 24b of Form OP-236.

Tax Allocation for Residential Estates

That Exceed $800,000

T

own A:

Consideration

Rate

Tax

Line 24a

$751,680

.005

$3,758.40

Conn. Gen. Stat. §12-494(b)(2) provides that in the case of any

Line 24b

$187,920

.01

$1,879.20

conveyance in which the real property conveyed is a residential

Total

$939,600

$5,637.60

estate, including a primary dwelling and any auxiliary housing or

structures, for consideration of $800,000 or more, the tax rate is

one half of one percent (.005) on the first $800,000 of consideration

For Town B, multiply $800,000 by the assessed value ratio of .0604

The allocated threshold amount is $48,320. Enter this amount on

and one percent (.01) on that portion of the consideration in excess

Line 24a of Form OP-236. The balance of the consideration

of $800,000.

allocated to Town B is entered on Line 24b of Form OP-236.

For a residential dwelling located in more than one municipality

T

where the sales price is more than $800,000, tax must be allocated

own B:

Consideration

Rate

Tax

among the municipalities and the $800,000 threshold must be

Line 24a

$48,320

.005

$241.60

allocated among all tax returns filed.

Line 24b

$12,080

.01

$120.80

Total

$60,400

$362.40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1