Form Op-236 - Real Estate Conveyance Tax Return

ADVERTISEMENT

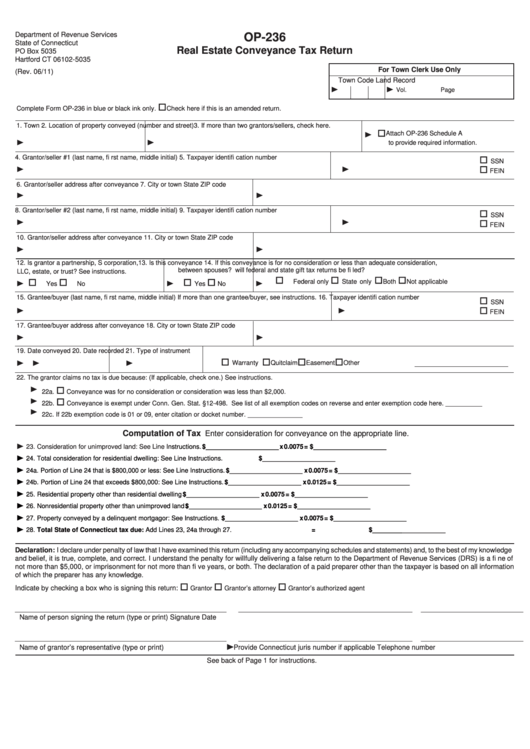

Department of Revenue Services

OP-236

State of Connecticut

Real Estate Conveyance Tax Return

PO Box 5035

Hartford CT 06102-5035

For Town Clerk Use Only

(Rev. 06/11)

Town Code

Land Record

Vol.

Page

Complete Form OP-236 in blue or black ink only.

Check here if this is an amended return.

1. Town

2. Location of property conveyed (number and street)

3. If more than two grantors/sellers, check here.

Attach OP-236 Schedule A

to provide required information.

4. Grantor/seller #1 (last name, fi rst name, middle initial)

5. Taxpayer identifi cation number

SSN

FEIN

6. Grantor/seller address after conveyance

7. City or town

State

ZIP code

8. Grantor/seller #2 (last name, fi rst name, middle initial)

9. Taxpayer identifi cation number

SSN

FEIN

10. Grantor/seller address after conveyance

11. City or town

State

ZIP code

12. Is grantor a partnership, S corporation,

13. Is this conveyance

14. If this conveyance is for no consideration or less than adequate consideration,

between spouses?

will federal and state gift tax returns be fi led?

LLC, estate, or trust? See instructions.

Yes

No

Yes

No

Federal only

State only

Both

Not applicable

15. Grantee/buyer (last name, fi rst name, middle initial) If more than one grantee/buyer, see instructions.

16. Taxpayer identifi cation number

SSN

FEIN

17. Grantee/buyer address after conveyance

18. City or town

State

ZIP code

19. Date conveyed

20. Date recorded

21. Type of instrument

Warranty

Quitclaim

Easement

Other

22. The grantor claims no tax is due because: (If applicable, check one.) See instructions.

22a.

Conveyance was for no consideration or consideration was less than $2,000.

22b.

Conveyance is exempt under Conn. Gen. Stat. §12-498. See list of all exemption codes on reverse and enter exemption code here. __________

22c.

If 22b exemption code is 01 or 09, enter citation or docket number. _______________

Computation of Tax

Enter consideration for conveyance on the appropriate line.

23. Consideration for unimproved land: See Line

Instructions.

$____________________

x 0.0075

=

$____________________

24. Total consideration for residential dwelling: See Line Instructions.

$____________________

24a. Portion of Line 24 that is $800,000 or less: See Line Instructions.

$____________________

x 0.0075

=

$____________________

24b. Portion of Line 24 that exceeds $800,000: See Line Instructions.

$____________________

x 0.0125

=

$____________________

25. Residential property other than residential dwelling

$____________________

x 0.0075

=

$____________________

26. Nonresidential property other than unimproved land

$____________________

x 0.0125

=

$____________________

27. Property conveyed by a delinquent mortgagor: See Instructions.

$____________________

x 0.0075

=

$____________________

28. Total State of Connecticut tax due: Add Lines 23, 24a through 27.

=

$____________________

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to the Department of Revenue Services (DRS) is a fi ne of

not more than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Indicate by checking a box who is signing this return:

Grantor

Grantor’s attorney

Grantor’s authorized agent

______________________________________________________________

___________________________________________________

______________________________

Name of person signing the return (type or print)

Signature

Date

______________________________________________________________

___________________________________________________

______________________________

Provide Connecticut juris number if applicable

Name of grantor’s representative (type or print)

Telephone number

See back of Page 1 for instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2