Instructions For Form Op-236i - Real Estate Conveyance Tax Return

ADVERTISEMENT

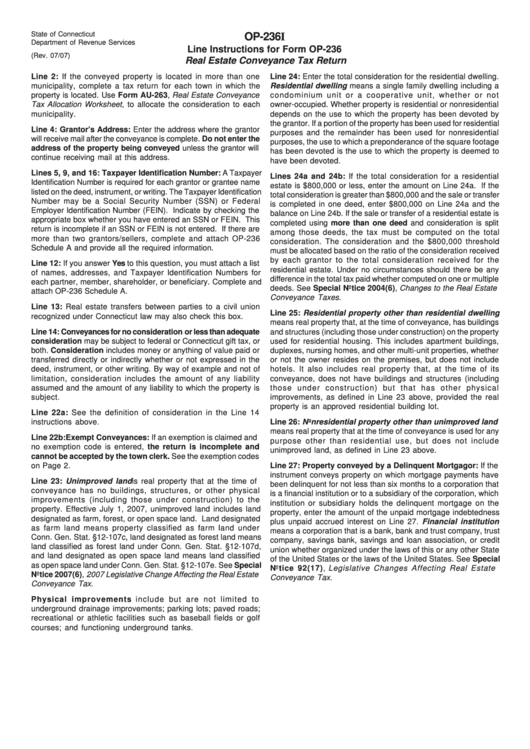

State of Connecticut

OP-236I

Department of Revenue Services

Line Instructions for Form OP-236

(Rev. 07/07)

Real Estate Conveyance Tax Return

Line 2: If the conveyed property is located in more than one

Line 24: Enter the total consideration for the residential dwelling.

municipality, complete a tax return for each town in which the

Residential dwelling means a single family dwelling including a

property is located. Use Form AU-263, Real Estate Conveyance

condominium unit or a cooperative unit, whether or not

Tax Allocation Worksheet, to allocate the consideration to each

owner-occupied. Whether property is residential or nonresidential

municipality.

depends on the use to which the property has been devoted by

the grantor. If a portion of the property has been used for residential

Line 4: Grantor’s Address: Enter the address where the grantor

purposes and the remainder has been used for nonresidential

will receive mail after the conveyance is complete. Do not enter the

purposes, the use to which a preponderance of the square footage

address of the property being conveyed unless the grantor will

has been devoted is the use to which the property is deemed to

continue receiving mail at this address.

have been devoted.

Lines 5, 9, and 16: Taxpayer Identification Number: A Taxpayer

Lines 24a and 24b: If the total consideration for a residential

Identification Number is required for each grantor or grantee name

estate is $800,000 or less, enter the amount on Line 24a. If the

listed on the deed, instrument, or writing. The Taxpayer Identification

total consideration is greater than $800,000 and the sale or transfer

Number may be a Social Security Number (SSN) or Federal

is completed in one deed, enter $800,000 on Line 24a and the

Employer Identification Number (FEIN). Indicate by checking the

balance on Line 24b. If the sale or transfer of a residential estate is

appropriate box whether you have entered an SSN or FEIN. This

completed using more than one deed and consideration is split

return is incomplete if an SSN or FEIN is not entered. If there are

among those deeds, the tax must be computed on the total

more than two grantors/sellers, complete and attach OP-236

consideration. The consideration and the $800,000 threshold

Schedule A and provide all the required information.

must be allocated based on the ratio of the consideration received

by each grantor to the total consideration received for the

Line 12: If you answer Yes to this question, you must attach a list

residential estate. Under no circumstances should there be any

of names, addresses, and Taxpayer Identification Numbers for

difference in the total tax paid whether computed on one or multiple

each partner, member, shareholder, or beneficiary. Complete and

deeds. See Special Notice 2004(6), Changes to the Real Estate

attach OP-236 Schedule A.

Conveyance Taxes.

Line 13: Real estate transfers between parties to a civil union

Line 25: Residential property other than residential dwelling

recognized under Connecticut law may also check this box.

means real property that, at the time of conveyance, has buildings

Line 14: Conveyances for no consideration or less than adequate

and structures (including those under construction) on the property

consideration may be subject to federal or Connecticut gift tax, or

used for residential housing. This includes apartment buildings,

both. Consideration includes money or anything of value paid or

duplexes, nursing homes, and other multi-unit properties, whether

transferred directly or indirectly whether or not expressed in the

or not the owner resides on the premises, but does not include

deed, instrument, or other writing. By way of example and not of

hotels. It also includes real property that, at the time of its

limitation, consideration includes the amount of any liability

conveyance, does not have buildings and structures (including

assumed and the amount of any liability to which the property is

those under construction) but that has other physical

subject.

improvements, as defined in Line 23 above, provided the real

property is an approved residential building lot.

Line 22a: See the definition of consideration in the Line 14

instructions above.

Line 26: Nonresidential property other than unimproved land

means real property that at the time of conveyance is used for any

Line 22b: Exempt Conveyances: If an exemption is claimed and

purpose other than residential use, but does not include

no exemption code is entered, the return is incomplete and

unimproved land, as defined in Line 23 above.

cannot be accepted by the town clerk. See the exemption codes

on Page 2.

Line 27: Property conveyed by a Delinquent Mortgagor: If the

instrument conveys property on which mortgage payments have

Line 23: Unimproved land is real property that at the time of

been delinquent for not less than six months to a corporation that

conveyance has no buildings, structures, or other physical

is a financial institution or to a subsidiary of the corporation, which

improvements (including those under construction) to the

institution or subsidiary holds the delinquent mortgage on the

property. Effective July 1, 2007, unimproved land includes land

property, enter the amount of the unpaid mortgage indebtedness

designated as farm, forest, or open space land. Land designated

plus unpaid accrued interest on Line 27. Financial institution

as farm land means property classified as farm land under

means a corporation that is a bank, bank and trust company, trust

Conn. Gen. Stat. §12-107c, land designated as forest land means

company, savings bank, savings and loan association, or credit

land classified as forest land under Conn. Gen. Stat. §12-107d,

union whether organized under the laws of this or any other State

and land designated as open space land means land classified

of the United States or the laws of the United States. See Special

as open space land under Conn. Gen. Stat. §12-107e. See Special

Notice 92(17), Legislative Changes Affecting Real Estate

Notice 2007(6), 2007 Legislative Change Affecting the Real Estate

Conveyance Tax.

Conveyance Tax.

Physical improvements include but are not limited to

underground drainage improvements; parking lots; paved roads;

recreational or athletic facilities such as baseball fields or golf

courses; and functioning underground tanks.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2