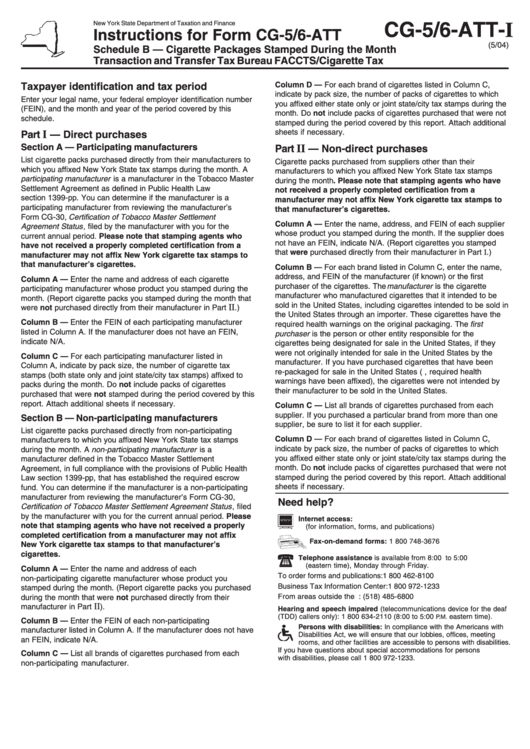

Instructions For Form Cg-5/6-Att, Schedule B - Cigarette Packages Stamped During The Month Transaction And Transfer Tax Bureau Faccts/cigarette Tax 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

CG-5/6-ATT-I

Instructions for Form CG-5/6-ATT

(5/04)

Schedule B — Cigarette Packages Stamped During the Month

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

Column D — For each brand of cigarettes listed in Column C,

Taxpayer identification and tax period

indicate by pack size, the number of packs of cigarettes to which

Enter your legal name, your federal employer identification number

you affixed either state only or joint state/city tax stamps during the

(FEIN), and the month and year of the period covered by this

month. Do not include packs of cigarettes purchased that were not

schedule.

stamped during the period covered by this report. Attach additional

sheets if necessary.

Part

I

— Direct purchases

Section A — Participating manufacturers

II

Part

— Non-direct purchases

List cigarette packs purchased directly from their manufacturers to

Cigarette packs purchased from suppliers other than their

which you affixed New York State tax stamps during the month. A

manufacturers to which you affixed New York State tax stamps

participating manufacturer is a manufacturer in the Tobacco Master

during the month. Please note that stamping agents who have

Settlement Agreement as defined in Public Health Law

not received a properly completed certification from a

section 1399-pp. You can determine if the manufacturer is a

manufacturer may not affix New York cigarette tax stamps to

participating manufacturer from reviewing the manufacturer’s

that manufacturer’s cigarettes.

Form CG-30, Certification of Tobacco Master Settlement

Column A — Enter the name, address, and FEIN of each supplier

Agreement Status , filed by the manufacturer with you for the

whose product you stamped during the month. If the supplier does

current annual period. Please note that stamping agents who

not have an FEIN, indicate N/A. (Report cigarettes you stamped

have not received a properly completed certification from a

that were purchased directly from their manufacturer in Part I.)

manufacturer may not affix New York cigarette tax stamps to

that manufacturer’s cigarettes.

Column B — For each brand listed in Column C, enter the name,

address, and FEIN of the manufacturer (if known) or the first

Column A — Enter the name and address of each cigarette

purchaser of the cigarettes. The manufacturer is the cigarette

participating manufacturer whose product you stamped during the

manufacturer who manufactured cigarettes that it intended to be

month. (Report cigarette packs you stamped during the month that

sold in the United States, including cigarettes intended to be sold in

II

were not purchased directly from their manufacturer in Part

.)

the United States through an importer. These cigarettes have the

Column B — Enter the FEIN of each participating manufacturer

required health warnings on the original packaging. The first

listed in Column A. If the manufacturer does not have an FEIN,

purchaser is the person or other entity responsible for the

indicate N/A.

cigarettes being designated for sale in the United States, if they

were not originally intended for sale in the United States by the

Column C — For each participating manufacturer listed in

manufacturer. If you have purchased cigarettes that have been

Column A, indicate by pack size, the number of cigarette tax

re-packaged for sale in the United States (i.e., required health

stamps (both state only and joint state/city tax stamps) affixed to

warnings have been affixed), the cigarettes were not intended by

packs during the month. Do not include packs of cigarettes

their manufacturer to be sold in the United States.

purchased that were not stamped during the period covered by this

report. Attach additional sheets if necessary.

Column C — List all brands of cigarettes purchased from each

supplier. If you purchased a particular brand from more than one

Section B — Non-participating manufacturers

supplier, be sure to list it for each supplier.

List cigarette packs purchased directly from non-participating

Column D — For each brand of cigarettes listed in Column C,

manufacturers to which you affixed New York State tax stamps

indicate by pack size, the number of packs of cigarettes to which

during the month. A non-participating manufacturer is a

you affixed either state only or joint state/city tax stamps during the

manufacturer defined in the Tobacco Master Settlement

month. Do not include packs of cigarettes purchased that were not

Agreement, in full compliance with the provisions of Public Health

stamped during the period covered by this report. Attach additional

Law section 1399-pp, that has established the required escrow

sheets if necessary.

fund. You can determine if the manufacturer is a non-participating

manufacturer from reviewing the manufacturer’s Form CG-30,

Need help?

Certification of Tobacco Master Settlement Agreement Status , filed

by the manufacturer with you for the current annual period. Please

Internet access:

note that stamping agents who have not received a properly

(for information, forms, and publications)

completed certification from a manufacturer may not affix

Fax-on-demand forms: 1 800 748-3676

New York cigarette tax stamps to that manufacturer’s

cigarettes.

Telephone assistance is available from 8:00

to 5:00

A.M.

P.M.

(eastern time), Monday through Friday.

Column A — Enter the name and address of each

To order forms and publications:

1 800 462-8100

non-participating cigarette manufacturer whose product you

Business Tax Information Center:

1 800 972-1233

stamped during the month. (Report cigarette packs you purchased

From areas outside the U.S. and outside Canada:

(518) 485-6800

during the month that were not purchased directly from their

II

manufacturer in Part

).

Hearing and speech impaired (telecommunications device for the deaf

(TDD) callers only): 1 800 634-2110 (8:00

to 5:00

eastern time).

A.M.

P.M.

Column B — Enter the FEIN of each non-participating

Persons with disabilities: In compliance with the Americans with

manufacturer listed in Column A. If the manufacturer does not have

Disabilities Act, we will ensure that our lobbies, offices, meeting

an FEIN, indicate N/A.

rooms, and other facilities are accessible to persons with disabilities.

If you have questions about special accommodations for persons

Column C — List all brands of cigarettes purchased from each

with disabilities, please call 1 800 972-1233.

non-participating manufacturer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1