Form Cg-5/6-Att - Schedule B - Cigarette Packages Stamped During The Month - State Of New York

ADVERTISEMENT

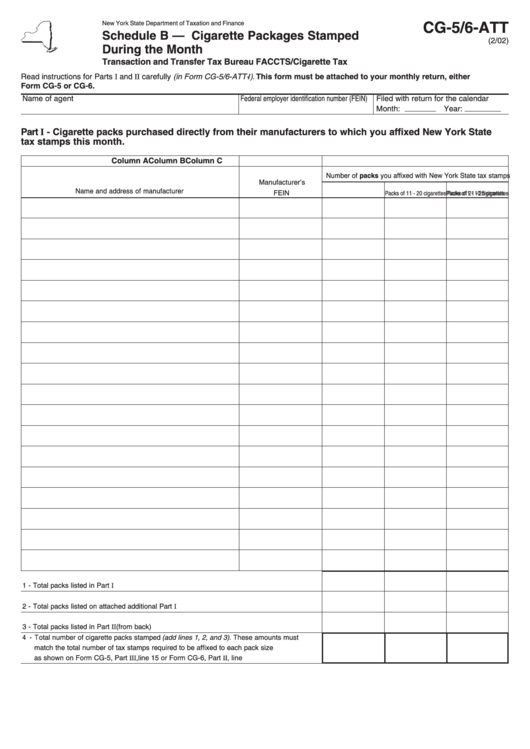

New York State Department of Taxation and Finance

CG-5/6-ATT

Schedule B — Cigarette Packages Stamped

(2/02)

During the Month

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

Read instructions for Parts I and II carefully (in Form CG-5/6-ATT- I ) . This form must be attached to your monthly return, either

Form CG-5 or CG-6.

Name of agent

Federal employer identification number (FEIN)

Filed with return for the calendar

Month:

Year:

Part I - Cigarette packs purchased directly from their manufacturers to which you affixed New York State

tax stamps this month.

Column A

Column B

Column C

Number of packs you affixed with New York State tax stamps

Manufacturer’s

Name and address of manufacturer

FEIN

Packs of 1 - 10 cigarettes

Packs of 11 - 20 cigarettes

Packs of 21 - 25 cigarettes

1 - Total packs listed in Part I ......................................................................................................................

2 - Total packs listed on attached additional Part I sheets ..............................................................

3 - Total packs listed in Part II (from back) ......................................................................................

4 - Total number of cigarette packs stamped (add lines 1, 2, and 3) . These amounts must

match the total number of tax stamps required to be affixed to each pack size

as shown on Form CG-5, Part III, line 15 or Form CG-6, Part II, line 17. ................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2