Form Cg-5/6-Att - Schedule B Cigarette Packages Stamped During The Month

ADVERTISEMENT

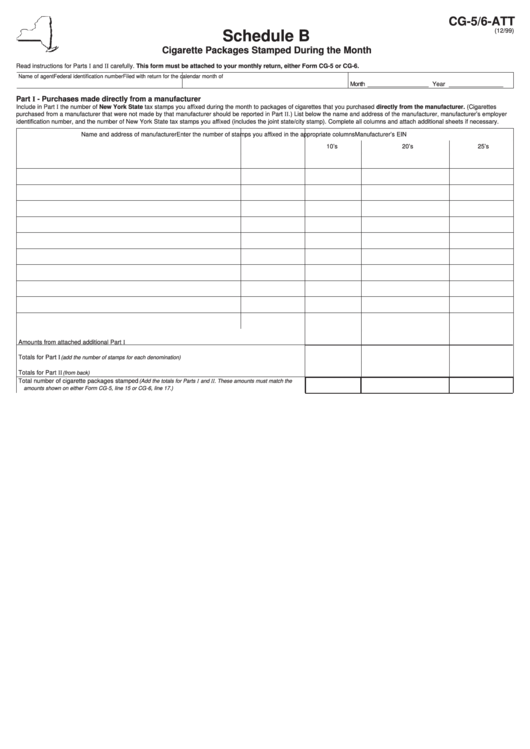

CG-5/6-ATT

(12/99)

Schedule B

Cigarette Packages Stamped During the Month

Read instructions for Parts I and II carefully. This form must be attached to your monthly return, either Form CG-5 or CG-6.

Name of agent

Federal identification number

Filed with return for the calendar month of

Month __________________ Year ________________

Part I - Purchases made directly from a manufacturer

Include in Part I the number of New York State tax stamps you affixed during the month to packages of cigarettes that you purchased directly from the manufacturer. (Cigarettes

purchased from a manufacturer that were not made by that manufacturer should be reported in Part II.) List below the name and address of the manufacturer, manufacturer’s employer

identification number, and the number of New York State tax stamps you affixed (includes the joint state/city stamp). Complete all columns and attach additional sheets if necessary.

Name and address of manufacturer

Manufacturer’s EIN

Enter the number of stamps you affixed in the appropriate columns

10’s

20’s

25’s

Amounts from attached additional Part I sheets ..............................................................................................

Totals for Part I

(add the number of stamps for each denomination)

......................................................................

Totals for Part II

.............................................................................................................................

(from back)

(Add the totals for Parts I and II . These amounts must match the

Total number of cigarette packages stamped

...........................................................................

amounts shown on either Form CG-5, line 15 or CG-6, line 17.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2