Form Nc-478 - Summary Of Tax Credits Limited To 50% Of Tax - 2005

ADVERTISEMENT

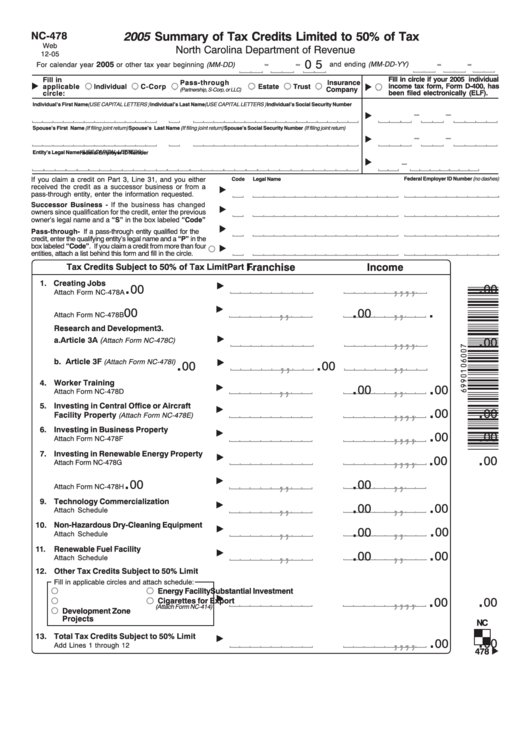

NC-478

2005 Summary of Tax Credits Limited to 50% of Tax

Web

North Carolina Department of Revenue

12-05

0 5

2005

and ending (MM-DD-YY)

For calendar year

or other tax year beginning (MM-DD)

Fill in circle if your 2005 individual

Fill in

Pass-through

Insurance

income tax form, Form D-400, has

applicable

Individual

C-Corp

Estate

Trust

Company

(Partnership, S-Corp, or LLC)

been filed electronically (ELF).

circle:

Individual’s Social Security Number

Individual’s First Name (USE CAPITAL LETTERS )

M.I.

Individual’s Last Name (USE CAPITAL LETTERS )

Spouse’s First Name (If filing joint return)

M.I.

Spouse’s Last Name (If filing joint return)

Spouse’s Social Security Number (If filing joint return)

(USE CAPITAL LETTERS )

Entity’s Legal Name

Federal Employer ID Number

If you claim a credit on Part 3, Line 31, and you either

Code

Legal Name

Federal Employer ID Number (no dashes)

received the credit as a successor business or from a

pass-through entity, enter the information requested.

Successor Business - If the business has changed

owners since qualification for the credit, enter the previous

owner’s legal name and a “S” in the box labeled “Code”

Pass-through - If a pass-through entity qualified for the

credit, enter the qualifying entity’s legal name and a “P” in the

box labeled “Code”. If you claim a credit from more than four

entities, attach a list behind this form and fill in the circle.

Franchise

Income

Part 1.

Tax Credits Subject to 50% of Tax Limit

,

,

.

,

,

.

1. Creating Jobs

00

00

Attach Form NC-478A

,

,

,

,

.

.

2. Investing in Machinery and Equipment

00

00

Attach Form NC-478B

3.

Research and Development

,

,

,

,

.

.

00

00

a. Article 3A (

Attach Form NC-478C)

,

,

.

,

,

.

b. Article 3F

(Attach Form NC-478I)

00

00

,

,

.

,

,

.

4.

Worker Training

00

00

Attach Form NC-478D

,

,

.

,

,

.

Investing in Central Office or Aircraft

5.

00

00

Facility Property

(Attach Form NC-478E)

,

,

.

,

,

.

6.

Investing in Business Property

00

00

Attach Form NC-478F

,

,

.

,

,

.

7.

Investing in Renewable Energy Property

00

00

Attach Form NC-478G

,

,

.

,

,

.

8. Low-Income Housing

00

00

Attach Form NC-478H

,

,

.

,

,

.

9.

Technology Commercialization

00

00

Attach Schedule

,

,

.

,

,

.

10.

Non-Hazardous Dry-Cleaning Equipment

00

00

Attach Schedule

,

,

.

,

,

.

11.

Renewable Fuel Facility

00

00

Attach Schedule

12. Other Tax Credits Subject to 50% Limit

Fill in applicable circles and attach schedule:

Substantial Investment

Energy Facility

,

,

.

,

,

.

00

00

Cigarettes for Export

N.C. Ports

(Attach Form NC-414)

Development Zone

Projects

NC

,

,

.

,

,

.

13.

Total Tax Credits Subject to 50% Limit

00

00

Add Lines 1 through 12

478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2