Business Tangible Property Return - Prince William County Tax Administration Division - 2010

ADVERTISEMENT

P rince Wil li am Coun ty

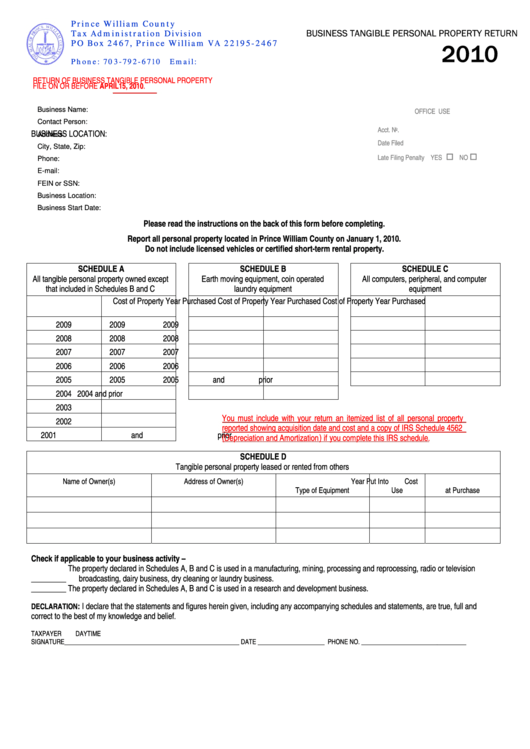

BUSINESS TANGIBLE PERSONAL PROPERTY RETURN

Tax Administ ration Di vi s ion

P O B o x 2 46 7 , P r i n c e W i l l i am VA 2 2 1 9 5 - 2 467

2010

P h o n e : 7 0 3 - 7 9 2 - 6 7 1 0

E m a i l : T a x p a y e r _ S e r v i c e s @ p w c g o v . o r g

RETURN OF BUSINESS TANGIBLE PERSONAL PROPERTY

FILE ON OR BEFORE APRIL15, 2010.

Business Name:

OFFICE USE

Contact Person:

Acct. No.

BUSINESS LOCATION:

Address:

Date Filed

City, State, Zip:

Late Filing Penalty YES

NO

Phone:

E-mail:

FEIN or SSN:

Business Location:

Business Start Date:

Please read the instructions on the back of this form before completing.

Report all personal property located in Prince William County on January 1, 2010.

Do not include licensed vehicles or certified short-term rental property.

SCHEDULE A

SCHEDULE B

SCHEDULE C

All tangible personal property owned except

Earth moving equipment, coin operated

All computers, peripheral, and computer

that included in Schedules B and C

laundry equipment

equipment

Year Purchased

Cost of Property

Year Purchased

Cost of Property

Year Purchased

Cost of Property

2009

2009

2009

2008

2008

2008

2007

2007

2007

2006

2006

2006

2005

2005

2005 and prior

2004

2004 and prior

2003

You must include with your return an itemized list of all personal property

2002

reported showing acquisition date and cost and a copy of IRS Schedule 4562

2001 and prior

(Depreciation and Amortization) if you complete this IRS schedule.

SCHEDULE D

Tangible personal property leased or rented from others

Year Put Into

Cost

Name of Owner(s)

Address of Owner(s)

Type of Equipment

Use

at Purchase

Check if applicable to your business activity –

The property declared in Schedules A, B and C is used in a manufacturing, mining, processing and reprocessing, radio or television

_________

broadcasting, dairy business, dry cleaning or laundry business.

_________

The property declared in Schedules A, B and C is used in a research and development business.

: I declare that the statements and figures herein given, including any accompanying schedules and statements, are true, full and

DECLARATION

correct to the best of my knowledge and belief

.

TAXPAYER

DAYTIME

SIGNATURE _______________________________________________________

DATE _____________________

PHONE NO. _________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2