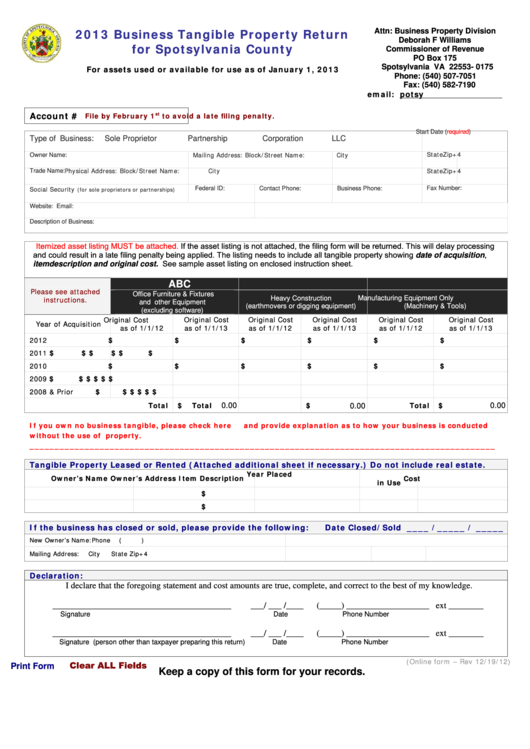

2013 Business Tangible Property Return

Attn: Business Property Division

Deborah F Williams

for Spotsylvania County

Commissioner of Revenue

PO Box 175

Spotsylvania VA 22553- 0175

For assets used or available for use as of January 1, 2013

Phone: (540) 507-7051

Fax: (540) 582-7190

email: cor@spotsylvania.va.us

Account #

st

File by February 1

to avoid a late filing penalty.

Start Date (required)

Type of Business:

Sole Proprietor

Partnership

Corporation

LLC

Mailing Address: Block/Street Name:

City

State

Zip+4

Owner Name:

Physical Address: Block/Street Name:

City

State

Zip+4

Trade Name:

Social Security

Federal ID:

Contact Phone:

Business Phone:

Fax Number:

(for sole proprietors or partnerships)

Website:

Email:

Description of Business:

Itemized asset listing MUST be attached.

If the asset listing is not attached, the filing form will be returned. This will delay processing

and could result in a late filing penalty being applied. The listing needs to include all tangible property showing date of acquisition,

item description and original cost. See sample asset listing on enclosed instruction sheet.

A

B

C

Please see attached

Office Furniture & Fixtures

Heavy Construction

Manufacturing Equipment Only

instructions.

and other Equipment

(earthmovers or digging equipment)

(Machinery & Tools)

(excluding software)

Original Cost

Original Cost

Original Cost

Original Cost

Original Cost

Original Cost

Year of Acquisition

as of 1/1/12

as of 1/1/13

as of 1/1/12

as of 1/1/13

as of 1/1/12

as of 1/1/13

2012

$

$

$

$

$

$

2011

$

$

$

$

$

$

2010

$

$

$

$

$

$

2009

$

$

$

$

$

$

2008 & Prior

$

$

$

$

$

$

Total

$

Total

$

Total

$

0.00

0.00

0.00

If you own no business tangible, please check here

and provide explanation as to how your business is conducted

without the use of property.

_____________________________________________________________________________________________

Tangible Property Leased or Rented (Attached additional sheet if necessary.) Do not include real estate.

Year Placed

Owner’s Name

Owner’s Address

Item Description

Cost

in Use

$

$

If the business has closed or sold, please provide the following:

Date Closed/Sold ____ /_____ / _____

New Owner’s Name:

Phone

(

)

Mailing Address:

City

State

Zip+4

Declaration:

I declare that the foregoing statement and cost amounts are true, complete, and correct to the best of my knowledge.

_________________________________________

___/ ___ /____

(_____) ___________________ ext ________

Signature

Date

Phone Number

_________________________________________

___/ ___ /____

(_____) ___________________ ext ________

Signature (person other than taxpayer preparing this return)

Date

Phone Number

(Online form – Rev 12/19/12)

Clear ALL Fields

Print Form

Keep a copy of this form for your records.

1

1 2

2 3

3