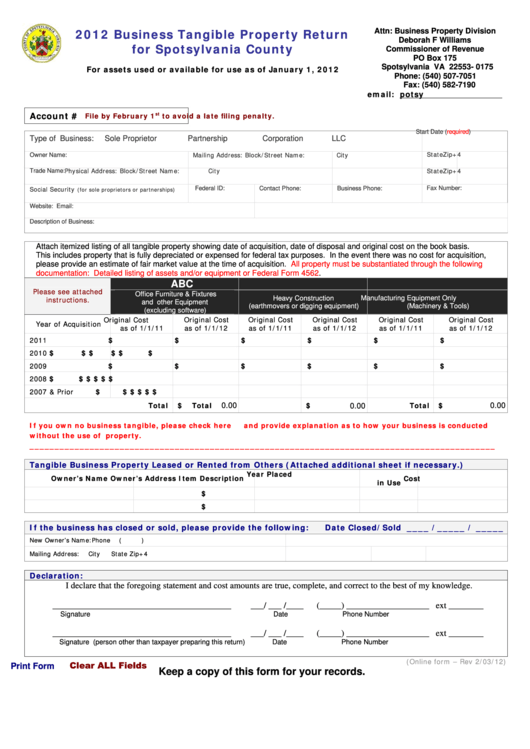

2012 Business Tangible Property Return

Attn: Business Property Division

Deborah F Williams

for Spotsylvania County

Commissioner of Revenue

PO Box 175

Spotsylvania VA 22553- 0175

For assets used or available for use as of January 1, 2012

Phone: (540) 507-7051

Fax: (540) 582-7190

email: cor@spotsylvania.va.us

Account #

st

File by February 1

to avoid a late filing penalty.

Start Date (required)

Type of Business:

Sole Proprietor

Partnership

Corporation

LLC

Mailing Address: Block/Street Name:

City

State

Zip+4

Owner Name:

Physical Address: Block/Street Name:

City

State

Zip+4

Trade Name:

Social Security

Federal ID:

Contact Phone:

Business Phone:

Fax Number:

(for sole proprietors or partnerships)

Website:

Email:

Description of Business:

Attach itemized listing of all tangible property showing date of acquisition, date of disposal and original cost on the book basis.

This includes property that is fully depreciated or expensed for federal tax purposes. In the event there was no cost for acquisition,

please provide an estimate of fair market value at the time of acquisition.

All property must be substantiated through the following

documentation: Detailed listing of assets and/or equipment or Federal Form

4562.

A

B

C

Please see attached

Office Furniture & Fixtures

Heavy Construction

Manufacturing Equipment Only

instructions.

and other Equipment

(earthmovers or digging equipment)

(Machinery & Tools)

(excluding software)

Original Cost

Original Cost

Original Cost

Original Cost

Original Cost

Original Cost

Year of Acquisition

as of 1/1/11

as of 1/1/12

as of 1/1/11

as of 1/1/12

as of 1/1/11

as of 1/1/12

2011

$

$

$

$

$

$

2010

$

$

$

$

$

$

2009

$

$

$

$

$

$

2008

$

$

$

$

$

$

2007 & Prior

$

$

$

$

$

$

Total

$

Total

$

Total

$

0.00

0.00

0.00

If you own no business tangible, please check here

and provide explanation as to how your business is conducted

without the use of property.

_____________________________________________________________________________________________

Tangible Business Property Leased or Rented from Others (Attached additional sheet if necessary.)

Year Placed

Owner’s Name

Owner’s Address

Item Description

Cost

in Use

$

$

If the business has closed or sold, please provide the following:

Date Closed/Sold ____ /_____ / _____

New Owner’s Name:

Phone

(

)

Mailing Address:

City

State

Zip+4

Declaration:

I declare that the foregoing statement and cost amounts are true, complete, and correct to the best of my knowledge.

_________________________________________

___/ ___ /____

(_____) ___________________ ext ________

Signature

Date

Phone Number

_________________________________________

___/ ___ /____

(_____) ___________________ ext ________

Signature (person other than taxpayer preparing this return)

Date

Phone Number

(Online form – Rev 2/03/12)

Clear ALL Fields

Print Form

Keep a copy of this form for your records.

1

1 2

2 3

3