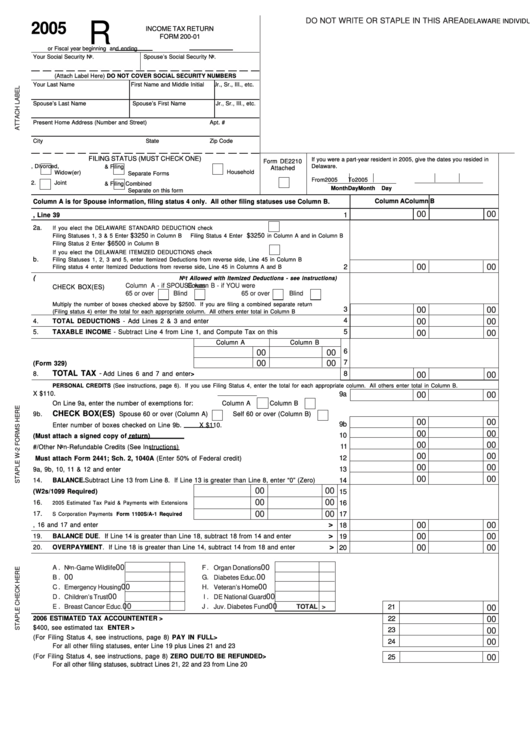

Form 200-01 - Delaware Individual Resident Income Tax Return - 2005

ADVERTISEMENT

DO NOT WRITE OR STAPLE IN THIS AREA

DELAWARE INDIVIDUAL RESIDENT

R

2005

INCOME TAX RETURN

FORM 200-01

or Fiscal year beginning

and ending

Your Social Security No.

Spouse’s Social Security No.

(Attach Label Here) DO NOT COVER SOCIAL SECURITY NUMBERS

Your Last Name

First Name and Middle Initial

Jr., Sr., III., etc.

Spouse’s Last Name

Spouse’s First Name

Jr., Sr., III., etc.

Present Home Address (Number and Street)

Apt. #

City

State

Zip Code

FILING STATUS (MUST CHECK ONE)

If you were a part-year resident in 2005, give the dates you resided in

Form DE2210

5.

Head of

1.

Single, Divorced,

Delaware.

3.

Married & Filing

Attached

Household

Widow(er)

Separate Forms

From

2005

To

2005

2.

Joint

4.

Married & Filing Combined

Month

Day

Month

Day

Separate on this form

Column A

Column B

Column A is for Spouse information, filing status 4 only. All other filing statuses use Column B.

00

00

1.

DELAWARE ADJUSTED GROSS INCOME. Enter amount from reverse side, Line 39 .............

1

2a.

If you elect the DELAWARE STANDARD DEDUCTION check here.....................

$3250

$3250

Filing Statuses 1, 3 & 5 Enter

in Column B

Filing Status 4 Enter

in Column A and in Column B

$6500

Filing Status 2 Enter

in Column B

If you elect the DELAWARE ITEMIZED DEDUCTIONS check here.....................

b.

Filing Statuses 1, 2, 3 and 5, enter Itemized Deductions from reverse side, Line 45 in Column B

00

00

2

Filing status 4 enter Itemized Deductions from reverse side, Line 45 in Columns A and B

3.

ADDITIONAL STANDARD DEDUCTIONS (

Not Allowed with Itemized Deductions - see instructions)

Column A - if SPOUSE was

Column B - if YOU were

CHECK BOX(ES)

65 or over

Blind

65 or over

Blind

Multiply the number of boxes checked above by $2500. If you are filing a combined separate return

3

00

00

(Filing status 4) enter the total for each appropriate column. All others enter total in Column B

4

4.

TOTAL DEDUCTIONS - Add Lines 2 & 3 and enter here..............................................................

00

00

5

5.

TAXABLE INCOME - Subtract Line 4 from Line 1, and Compute Tax on this Amount.....................

00

00

Column A

Column B

6

00

00

6.

Tax Liability from Tax Rate Table/Schedule

00

00

7

7.

Tax on Lump Sum Distribution (Form 329)

TOTAL TAX -

8.

Add Lines 6 and 7 and enter here...................................................................>

8

00

00

PERSONAL CREDITS (See instructions, page 6). If you use Filing Status 4, enter the total for each appropriate column. All others enter total in Column B.

9a.

Enter number of exemptions claimed on Federal return

X $110. ..........................

9a

00

00

On Line 9a, enter the number of exemptions for:

Column A

Column B

CHECK BOX(ES)

9b.

Spouse 60 or over (Column A)

Self 60 or over (Column B)

00

00

9b

Enter number of boxes checked on Line 9b.

X $110. ..............................................

00

00

10

10.

Tax imposed by State of

(Must attach a signed copy of return)................

00

00

11

11.

Volunteer Firefighter Company #

/Other Non-Refundable Credits (See Instructions)......

00

00

12

12.

Child Care Credit. Must attach Form 2441; Sch. 2, 1040A (Enter 50% of Federal credit)............

00

00

13

13.

Total Non-Refundable Credits. Add Lines 9a, 9b, 10, 11 & 12 and enter here...............................

00

00

14.

BALANCE. Subtract Line 13 from Line 8. If Line 13 is greater than Line 8, enter “0” (Zero).........

14

00

00

15.

Delaware Tax Withheld (W2s/1099 Required)

15

00

00

16.

16

2005 Estimated Tax Paid & Payments with Extensions

00

00

17.

17

S Corporation Payments Form 1100S/A-1 Required

>

18.

TOTAL Refundable Credits. Add Lines 15, 16 and 17 and enter here.....................................

00

00

18

>

00

00

19.

BALANCE DUE. If Line 14 is greater than Line 18, subtract 18 from 14 and enter here...........

19

>

20.

OVERPAYMENT. If Line 18 is greater than Line 14, subtract 14 from 18 and enter here..........

00

00

20

21.

CONTRIBUTIONS TO SPECIAL FUNDS

00

00

A

.

Non-Game Wildlife

F

.

Organ Donations

00

00

B

.

U.S. Olympics

G

.

Diabetes Educ.

00

00

C

.

Emergency Housing

H

.

Veteran’s Home

00

00

D

.

Children’s Trust

I

.

DE National Guard

00

00

E

.

Breast Cancer Educ.

J

.

Juv. Diabetes Fund

TOTAL >

21

00

22.

AMOUNT OF LINE 20 TO BE APPLIED TO 2006 ESTIMATED TAX ACCOUNT..................................ENTER >

22

00

23.

PENALTIES AND INTEREST DUE. If Line 19 is greater than $400, see estimated tax instructions.....ENTER >

23

00

24.

NET BALANCE DUE (For Filing Status 4, see instructions, page 8)...........................................PAY IN FULL >

24

00

For all other filing statuses, enter Line 19 plus Lines 21 and 23

25.

NET REFUND (For Filing Status 4, see instructions, page 8).........................ZERO DUE/TO BE REFUNDED >

00

25

For all other filing statuses, subtract Lines 21, 22 and 23 from Line 20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2