Workers' Compensation Employer'S Quarterly Report

ADVERTISEMENT

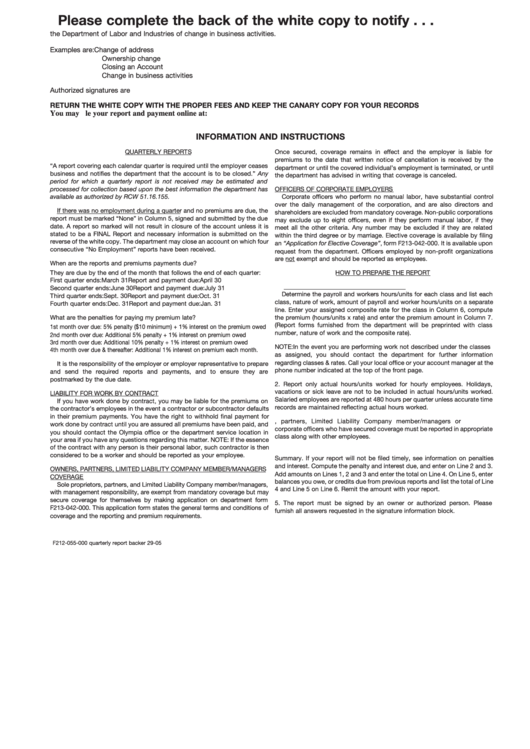

Please complete the back of the white copy to notify . . .

the Department of Labor and Industries of change in business activities.

Examples are:

Change of address

Ownership change

Closing an Account

Change in business activities

Authorized signatures are required.

Please make a copy for your records.

RETURN THE WHITE COPY WITH THE PROPER FEES AND KEEP THE CANARY COPY FOR YOUR RECORDS

You may file your report and payment online at:

INFORMATION AND INSTRUCTIONS

QUARTERLY REPORTS

Once secured, coverage remains in effect and the employer is liable for

premiums to the date that written notice of cancellation is received by the

“A report covering each calendar quarter is required until the employer ceases

department or until the covered individual’s employment is terminated, or until

business and notifies the department that the account is to be closed.” Any

the department has advised in writing that coverage is canceled.

period for which a quarterly report is not received may be estimated and

processed for collection based upon the best information the department has

OFFICERS OF CORPORATE EMPLOYERS

available as authorized by RCW 51.16.155.

Corporate officers who perform no manual labor, have substantial control

over the daily management of the corporation, and are also directors and

If there was no employment during a quarter and no premiums are due, the

shareholders are excluded from mandatory coverage. Non-public corporations

report must be marked “None” in Column 5, signed and submitted by the due

may exclude up to eight officers, even if they perform manual labor, if they

date. A report so marked will not result in closure of the account unless it is

meet all the other criteria. Any number may be excluded if they are related

stated to be a FINAL Report and necessary information is submitted on the

within the third degree or by marriage. Elective coverage is available by filing

reverse of the white copy. The department may close an account on which four

an “Application for Elective Coverage”, form F213-042-000. It is available upon

consecutive “No Employment” reports have been received.

request from the department. Officers employed by non-profit organizations

are not exempt and should be reported as employees.

When are the reports and premiums payments due?

They are due by the end of the month that follows the end of each quarter:

HOW TO PREPARE THE REPORT

First quarter ends:

March 31

Report and payment due:

April 30

1. Employees and Personal Labor Contractors

Second quarter ends:

June 30

Report and payment due:

July 31

Determine the payroll and workers hours/units for each class and list each

Third quarter ends:

Sept. 30

Report and payment due:

Oct. 31

class, nature of work, amount of payroll and worker hours/units on a separate

Fourth quarter ends:

Dec. 31

Report and payment due:

Jan. 31

line. Enter your assigned composite rate for the class in Column 6, compute

What are the penalties for paying my premium late?

the premium (hours/units x rate) and enter the premium amount in Column 7.

(Report forms furnished from the department will be preprinted with class

1st month over due: 5% penalty ($10 minimum) + 1% interest on the premium owed

number, nature of work and the composite rate).

2nd month over due: Additional 5% penalty + 1% interest on premium owed

3rd month over due: Additional 10% penalty + 1% interest on premium owed

NOTE: In the event you are performing work not described under the classes

4th month over due & thereafter: Additional 1% interest on premium each month.

as assigned, you should contact the department for further information

regarding classes & rates. Call your local office or your account manager at the

It is the responsibility of the employer or employer representative to prepare

phone number indicated at the top of the front page.

and send the required reports and payments, and to ensure they are

postmarked by the due date.

2. Report only actual hours/units worked for hourly employees. Holidays,

vacations or sick leave are not to be included in actual hours/units worked.

LIABILITY FOR WORK BY CONTRACT

Salaried employees are reported at 480 hours per quarter unless accurate time

If you have work done by contract, you may be liable for the premiums on

records are maintained reflecting actual hours worked.

the contractor’s employees in the event a contractor or subcontractor defaults

in their premium payments. You have the right to withhold final payment for

3. Owners, partners, Limited Liability Company member/managers or

work done by contract until you are assured all premiums have been paid, and

corporate officers who have secured coverage must be reported in appropriate

you should contact the Olympia office or the department service location in

class along with other employees.

your area if you have any questions regarding this matter. NOTE: If the essence

of the contract with any person is their personal labor, such contractor is then

4. Add the premium amounts in Column 7 and list the total on Line 1 of the

considered to be a worker and should be reported as your employee.

Summary. If your report will not be filed timely, see information on penalties

and interest. Compute the penalty and interest due, and enter on Line 2 and 3.

OWNERS, PARTNERS, LIMITED LIABILITY COMPANY MEMBER/MANAGERS

Add amounts on Lines 1, 2 and 3 and enter the total on Line 4. On Line 5, enter

COVERAGE

balances you owe, or credits due from previous reports and list the total of Line

Sole proprietors, partners, and Limited Liability Company member/managers,

4 and Line 5 on Line 6. Remit the amount with your report.

with management responsibility, are exempt from mandatory coverage but may

secure coverage for themselves by making application on department form

5. The report must be signed by an owner or authorized person. Please

F213-042-000. This application form states the general terms and conditions of

furnish all answers requested in the signature information block.

coverage and the reporting and premium requirements.

6. Mail the original report with your remittance to the department.

F212-055-000 quarterly report backer 2

9-05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1