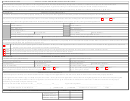

SECTION C1:

COMPLETE THIS SECTION TO DETERMINE ELIGIBILITY FOR NET INCOME REQUIREMENT

If filing Joint Income Tax Return, Applicant must complete Column 1A only. If filing separately, both Columns 1A and 1B must be completed

INCOME FOR TAX YEAR ENDING DECEMBER 31, 20______

COLUMN 1A

COLUMN 1B

APPLICANT

SPOUSE

Line 1

Total Income from Public or Private retirement, disability or pension system

2

Line

Total Income from Social Security

Line 3

Total Income from both retirement and Social Security (Line 1 plus Line 2)

Line 4

Maximum Social Security amount (from Tax Receiver)

Line 5

Retirement Income over maximum Social Security (Line 3 less Line 4) - If less than 0, use 0

Line 6

Other income from all sources

Line 7

Adjusted Income (Line 5 plus Line 6)

Line

8

Standard or Itemized Deductions from Georgia Income Tax Return

Line 9

Personal Exemption amount from Georgia Income Tax Return

Line 10

Net Income (Line 7 less Lines 8 and 9)

If filing Joint Income Tax Return, Line 10, Column 1A must be less than $10,000. If filing Separately, Total of Line 10, Column 1A plus 1B must be less than $10,000

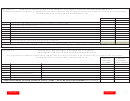

SECTION C2:

COMPLETE THIS SECTION TO DETERMINE ELIGIBILITY

FOR FEDERAL ADJUSTED GROSS INCOME REQUIREMENT

For each member residing in the household, complete the social security number & federal adjusted gross income in the spaces below

INCOME FOR TAX YEAR ENDING DECEMBER 31, 20______

FEDERAL

SOCIAL

SECURITY

ADJUSTED

NUMBER

GROSS INCOME

Line 1

Name of Household Member

2

Line

Name of Household Member

Line 3

Name of Household Member

Line 4

Name of Household Member

Line 5

Name of Household Member

Line 6

Name of Household Member

Line 7

Name of Household Member

ADJUSTED GROSS INCOME-TOTAL OF LINES 1 THRU 7 MUST BE LESS THAN $30,000>>>>>>>>>>>>>

Clear Form

Print Form

1

1 2

2