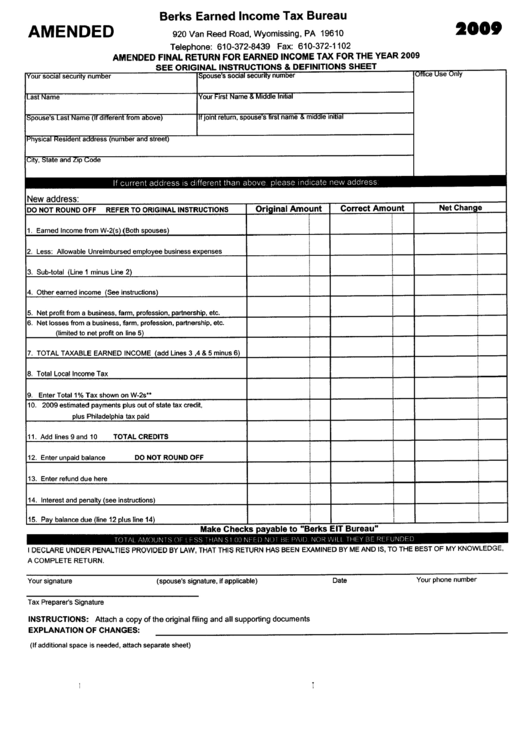

Amended Final Return For Earned Income Tax For The Year 2009

ADVERTISEMENT

Berks Earned Income Tax Bureau

AMENDED

2009

If current address is different than above please indicate new address

New address:

DO NOT ROUND OFF

REFER TO ORIGINAL INSTRUCTIONS

Original Amount

Correct Amount

Net

Change

,

1.

Earned Income from W-2(s) (Both spouses)

!

,

2.

Less:

Allowable Unreimbursed employee business expenses

,

,

3.

Sub-total

(Line 1 minus Line 2)

!

,

,

4. Other earned income (See instructions)

¡

,

5. Net profit from a business, farm, profession, partnership, etc.

6. Net losses from a business, farm, profession, partnership, etc.

(limited to net profit on line 5)

,

7.

TOTAL TAXBLE EARNED INCOME

(add Lines 3 ,4 & 5 minus 6)

,

8.

Total Local

Income Tax

¡

9.

Enter Total

1 % Tax shown on W-2s..

¡

10. 2009 estimated payments plus out of state tax credit,

i

¡

plus Philadelphia tax paid

,

11.

Add lines 9 and 10

TOTAL CREDITS

¡

,

12.

Enter unpaid balance

DO NOT ROUND OFF

13. Enter refund due here

¡

I

,

14. Interest and penalty (see instructions)

,

15. Pay balance due (line 12 plus line 14)

I

TOl AL AMOUN i S Of~ I FSS THAN S1 00 NFFD NOT Bi fOAID NOR Will THEY BE REFUNDED

Make Checks payable to "Berks EIT Bureau"

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND IS, TO THE BEST OF MY KNOWLEDGE,

A COMPLETE RETURN.

Your signature

(spouse's signature, if applicable)

Date

Your phone number

Tax Preparer's Signature

INSTRUCTIONS: Attach a copy of the original filing and all supporting documents

EXPLANATION OF CHANGES:

(If additional space is needed, attach separate sheet)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1