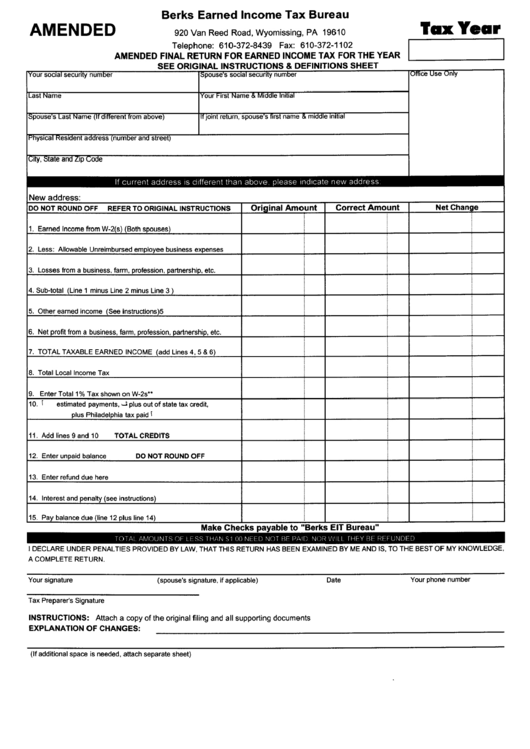

Amended Final Return For Earned Income Tax Form - Berks Earned Income Tax Bureau

ADVERTISEMENT

Berks Earned Income Tax Bureau

AMENDED

lax

Year

I

If current address

is different than above

please

indicate

new

address

New address:

DO NOT ROUND OFF

REFER TO ORIGINAL INSTRUCTIONS

Oriainal Amount

Correct Amount

Net

Change

1.

Earned Income from W-2(s) (Both spouses)

2.

Less:

Allowable Unreimbursed employee business expenses

3.

Losses from a business, farm, profession, partnership, etc.

4. Sub-total (Line 1 minus Line 2 minus Line 3 )

5. Other earned income (See instructions)5

,

6. Net profit from a business, farm, profession, partnership, etc.

7.

TOTAL TAXBLE EARNED INCOME

(add Lines 4, 5 & 6)

8.

Total Local

Income Tax

9.

Enter Total

1 % Tax shown on W-2s"

10.

í

estimated payments, .. plus out of state tax credit,

plus Philadelphia tax paid í

11.

Add lines 9 and 10

TOTAL CREDITS

12.

Enter unpaid balance

DO NOT ROUND OFF

,

13. Enter refund due here

14. Interest and penalty (see instructions)

15. Pay balance due (line 12 plus line 14)

TOTAL AMOUNT S OF LESS THAN 51 00 NEED NOT f3E IOAID NOR VJILL rHEY BE REFUNDED

Make Checks payable to "Berks Ell Bureau"

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN HAS BEEN EXAMINED BY ME AND IS, TO THE BEST OF MY KNOWLEDGE,

A COMPLETE RETURN.

Your signature

(spouse's signature, if applicable)

Date

Your phone number

Tax Preparer's Signature

INSTRUCTIONS: Attach a copy of the original fiing and all supporting documents

EXPLANATION OF CHANGES:

(If additional space is needed, attach separate sheet)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1