Form W - Worksheet Ix - Tax Benefit Rule For Recoveries Of Itemized Deductions, Page 2

ADVERTISEMENT

MONTANA

Form W

Worksheet IX - Tax Benefit Rule for Recoveries of Itemized Deductions, Page 2

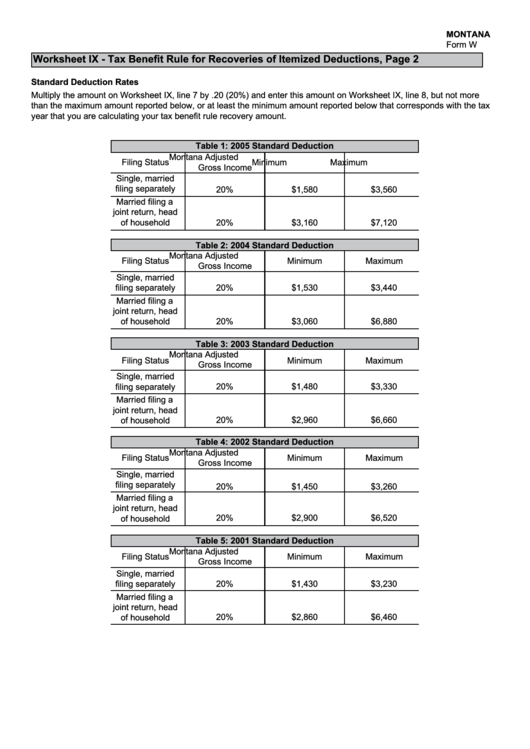

Standard Deduction Rates

Multiply the amount on Worksheet IX, line 7 by .20 (20%) and enter this amount on Worksheet IX, line 8, but not more

than the maximum amount reported below, or at least the minimum amount reported below that corresponds with the tax

year that you are calculating your tax benefit rule recovery amount.

Table 1: 2005 Standard Deduction

Montana Adjusted

Filing Status

Minimum

Maximum

Gross Income

Single, married

filing separately

20%

$1,580

$3,560

Married filing a

joint return, head

of household

20%

$3,160

$7,120

Table 2: 2004 Standard Deduction

Montana Adjusted

Filing Status

Minimum

Maximum

Gross Income

Single, married

filing separately

20%

$1,530

$3,440

Married filing a

joint return, head

of household

20%

$3,060

$6,880

Table 3: 2003 Standard Deduction

Montana Adjusted

Filing Status

Minimum

Maximum

Gross Income

Single, married

filing separately

20%

$1,480

$3,330

Married filing a

joint return, head

20%

$2,960

$6,660

of household

Table 4: 2002 Standard Deduction

Montana Adjusted

Filing Status

Minimum

Maximum

Gross Income

Single, married

filing separately

20%

$1,450

$3,260

Married filing a

joint return, head

20%

$2,900

$6,520

of household

Table 5: 2001 Standard Deduction

Montana Adjusted

Filing Status

Minimum

Maximum

Gross Income

Single, married

filing separately

20%

$1,430

$3,230

Married filing a

joint return, head

20%

$2,860

$6,460

of household

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1