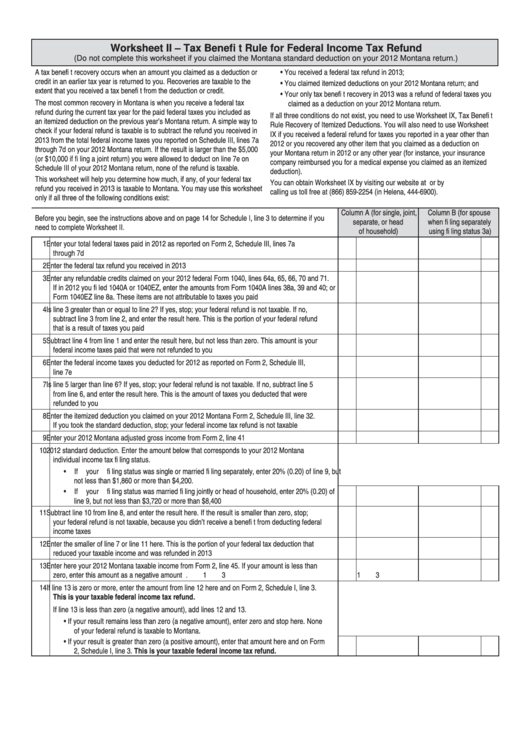

Worksheet II – Tax Benefi t Rule for Federal Income Tax Refund

(Do not complete this worksheet if you claimed the Montana standard deduction on your 2012 Montana return.)

A tax benefi t recovery occurs when an amount you claimed as a deduction or

• You received a federal tax refund in 2013;

credit in an earlier tax year is returned to you. Recoveries are taxable to the

• You claimed itemized deductions on your 2012 Montana return; and

extent that you received a tax benefi t from the deduction or credit.

• Your only tax benefi t recovery in 2013 was a refund of federal taxes you

The most common recovery in Montana is when you receive a federal tax

claimed as a deduction on your 2012 Montana return.

refund during the current tax year for the paid federal taxes you included as

If all three conditions do not exist, you need to use Worksheet IX, Tax Benefi t

an itemized deduction on the previous year’s Montana return. A simple way to

Rule Recovery of Itemized Deductions. You will also need to use Worksheet

check if your federal refund is taxable is to subtract the refund you received in

IX if you received a federal refund for taxes you reported in a year other than

2013 from the total federal income taxes you reported on Schedule III, lines 7a

2012 or you recovered any other item that you claimed as a deduction on

through 7d on your 2012 Montana return. If the result is larger than the $5,000

your Montana return in 2012 or any other year (for instance, your insurance

(or $10,000 if fi ling a joint return) you were allowed to deduct on line 7e on

company reimbursed you for a medical expense you claimed as an itemized

Schedule III of your 2012 Montana return, none of the refund is taxable.

deduction).

This worksheet will help you determine how much, if any, of your federal tax

You can obtain Worksheet IX by visiting our website at revenue.mt.gov or by

refund you received in 2013 is taxable to Montana. You may use this worksheet

calling us toll free at (866) 859-2254 (in Helena, 444-6900).

only if all three of the following conditions exist:

Column A (for single, joint,

Column B (for spouse

Before you begin, see the instructions above and on page 14 for Schedule I, line 3 to determine if you

separate, or head

when fi ling separately

need to complete Worksheet II.

of household)

using fi ling status 3a)

1 Enter your total federal taxes paid in 2012 as reported on Form 2, Schedule III, lines 7a

through 7d ..........................................................................................................................................

1

1

2 Enter the federal tax refund you received in 2013 ..............................................................................

2

2

3 Enter any refundable credits claimed on your 2012 federal Form 1040, lines 64a, 65, 66, 70 and 71.

If in 2012 you fi led 1040A or 1040EZ, enter the amounts from Form 1040A lines 38a, 39 and 40; or

Form 1040EZ line 8a. These items are not attributable to taxes you paid .........................................

3

3

4 Is line 3 greater than or equal to line 2? If yes, stop; your federal refund is not taxable. If no,

subtract line 3 from line 2, and enter the result here. This is the portion of your federal refund

that is a result of taxes you paid .........................................................................................................

4

4

5 Subtract line 4 from line 1 and enter the result here, but not less than zero. This amount is your

federal income taxes paid that were not refunded to you ...................................................................

5

5

6 Enter the federal income taxes you deducted for 2012 as reported on Form 2, Schedule III,

line 7e .................................................................................................................................................

6

6

7 Is line 5 larger than line 6? If yes, stop; your federal refund is not taxable. If no, subtract line 5

from line 6, and enter the result here. This is the amount of taxes you deducted that were

refunded to you ...................................................................................................................................

7

7

8 Enter the itemized deduction you claimed on your 2012 Montana Form 2, Schedule III, line 32.

If you took the standard deduction, stop; your federal income tax refund is not taxable ....................

8

8

9 Enter your 2012 Montana adjusted gross income from Form 2, line 41 .............................................

9

9

10 2012 standard deduction. Enter the amount below that corresponds to your 2012 Montana

individual income tax fi ling status.

• If your fi ling status was single or married fi ling separately, enter 20% (0.20) of line 9, but

not less than $1,860 or more than $4,200.

• If your fi ling status was married fi ling jointly or head of household, enter 20% (0.20) of

line 9, but not less than $3,720 or more than $8,400 .............................................................

10

10

11 Subtract line 10 from line 8, and enter the result here. If the result is smaller than zero, stop;

your federal refund is not taxable, because you didn’t receive a benefi t from deducting federal

income taxes ......................................................................................................................................

11

11

12 Enter the smaller of line 7 or line 11 here. This is the portion of your federal tax deduction that

reduced your taxable income and was refunded in 2013 ...................................................................

12

12

13 Enter here your 2012 Montana taxable income from Form 2, line 45. If your amount is less than

zero, enter this amount as a negative amount ...................................................................................

13

13

14 If line 13 is zero or more, enter the amount from line 12 here and on Form 2, Schedule I, line 3.

This is your taxable federal income tax refund.

If line 13 is less than zero (a negative amount), add lines 12 and 13.

• If your result remains less than zero (a negative amount), enter zero and stop here. None

of your federal refund is taxable to Montana.

• If your result is greater than zero (a positive amount), enter that amount here and on Form

2, Schedule I, line 3. This is your taxable federal income tax refund. ...............................

14

14

1

1