CLEAR FORM

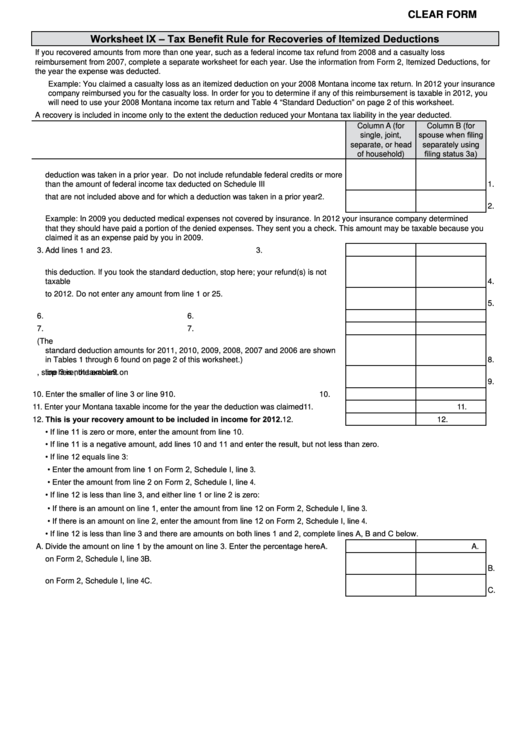

Worksheet IX – Tax Benefit Rule for Recoveries of Itemized Deductions

If you recovered amounts from more than one year, such as a federal income tax refund from 2008 and a casualty loss

reimbursement from 2007, complete a separate worksheet for each year. Use the information from Form 2, Itemized Deductions, for

the year the expense was deducted.

Example: You claimed a casualty loss as an itemized deduction on your 2008 Montana income tax return. In 2012 your insurance

company reimbursed you for the casualty loss. In order for you to determine if any of this reimbursement is taxable in 2012, you

will need to use your 2008 Montana income tax return and Table 4 “Standard Deduction” on page 2 of this worksheet.

A recovery is included in income only to the extent the deduction reduced your Montana tax liability in the year deducted.

Column A (for

Column B (for

spouse when filing

single, joint,

separate, or head

separately using

filing status 3a)

of household)

1. Enter the total of your federal income tax refunds received in 2012 for which a

deduction was taken in a prior year. Do not include refundable federal credits or more

than the amount of federal income tax deducted on Schedule III .................................1.

1.

2. Enter the total of all other itemized deductions refunded or reimbursed to you in 2012

that are not included above and for which a deduction was taken in a prior year .........2.

2.

Example: In 2009 you deducted medical expenses not covered by insurance. In 2012 your insurance company determined

that they should have paid a portion of the denied expenses. They sent you a check. This amount may be taxable because you

claimed it as an expense paid by you in 2009.

3. Add lines 1 and 2 ...........................................................................................................3.

3.

4. Enter the total Montana allowable itemized deductions for the year that you claimed

this deduction. If you took the standard deduction, stop here; your refund(s) is not

taxable ...........................................................................................................................4.

4.

5. Enter any federal income tax refund or other itemized deductions refunded to you prior

to 2012. Do not enter any amount from line 1 or 2 ........................................................5.

5.

6. Subtract line 5 from line 4 ..............................................................................................6.

6.

7. Montana adjusted gross income for the year you claimed the deduction .....................7.

7.

8. Enter the standard deduction for the year that this deduction was claimed. (The

standard deduction amounts for 2011, 2010, 2009, 2008, 2007 and 2006 are shown

in Tables 1 through 6 found on page 2 of this worksheet.) ............................................8.

8.

9. Subtract line 8 from line 6. If the result is zero or less, stop here; the amount on

line 3 is not taxable ........................................................................................................9.

9.

10. Enter the smaller of line 3 or line 9 ..............................................................................10.

10.

11. Enter your Montana taxable income for the year the deduction was claimed .............11.

11.

12. This is your recovery amount to be included in income for 2012. .......................12.

12.

• If line 11 is zero or more, enter the amount from line 10.

• If line 11 is a negative amount, add lines 10 and 11 and enter the result, but not less than zero.

• If line 12 equals line 3:

• Enter the amount from line 1 on Form 2, Schedule I, line 3.

• Enter the amount from line 2 on Form 2, Schedule I, line 4.

• If line 12 is less than line 3, and either line 1 or line 2 is zero:

• If there is an amount on line 1, enter the amount from line 12 on Form 2, Schedule I, line 3.

• If there is an amount on line 2, enter the amount from line 12 on Form 2, Schedule I, line 4.

• If line 12 is less than line 3 and there are amounts on both lines 1 and 2, complete lines A, B and C below.

A. Divide the amount on line 1 by the amount on line 3. Enter the percentage here ........ A.

A.

B. Multiply the amount on line 12 by the percentage on line A. Enter the result here and

on Form 2, Schedule I, line 3 ........................................................................................ B.

B.

C. Subtract the amount on line B from the amount on line 12. Enter the result here and

on Form 2, Schedule I, line 4 ........................................................................................C.

C.

1

1 2

2