Form Ct-1120fp - Film Production Tax Credit 2006 - Connecticut Department Of Revenue Services

ADVERTISEMENT

Department of Revenue Services

2006

State of Connecticut

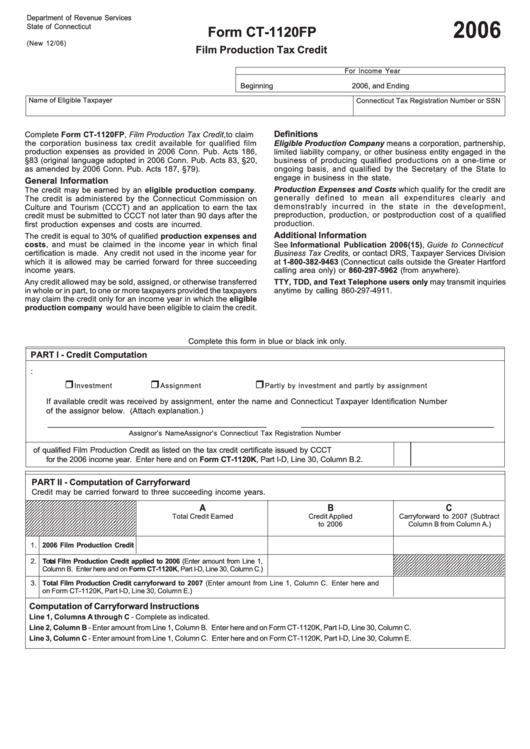

Form CT-1120FP

(New 12/06)

Film Production Tax Credit

For Income Year

Beginning

2006, and Ending

Name of Eligible Taxpayer

Connecticut Tax Registration Number or SSN

Definitions

Complete Form CT-1120FP, Film Production Tax Credit, to claim

the corporation business tax credit available for qualified film

Eligible Production Company means a corporation, partnership,

production expenses as provided in 2006 Conn. Pub. Acts 186,

limited liability company, or other business entity engaged in the

§83 (original language adopted in 2006 Conn. Pub. Acts 83, §20,

business of producing qualified productions on a one-time or

as amended by 2006 Conn. Pub. Acts 187, §79).

ongoing basis, and qualified by the Secretary of the State to

engage in business in the state.

General Information

Production Expenses and Costs which qualify for the credit are

The credit may be earned by an eligible production company.

generally defined to mean all expenditures clearly and

The credit is administered by the Connecticut Commission on

demonstrably incurred in the state in the development,

Culture and Tourism (CCCT) and an application to earn the tax

preproduction, production, or postproduction cost of a qualified

credit must be submitted to CCCT not later than 90 days after the

production.

first production expenses and costs are incurred.

Additional Information

The credit is equal to 30% of qualified production expenses and

costs, and must be claimed in the income year in which final

See Informational Publication 2006(15), Guide to Connecticut

certification is made. Any credit not used in the income year for

Business Tax Credits, or contact DRS, Taxpayer Services Division

which it is allowed may be carried forward for three succeeding

at 1-800-382-9463 (Connecticut calls outside the Greater Hartford

income years.

calling area only) or 860-297-5962 (from anywhere).

Any credit allowed may be sold, assigned, or otherwise transferred

TTY, TDD, and Text Telephone users only may transmit inquiries

in whole or in part, to one or more taxpayers provided the taxpayers

anytime by calling 860-297-4911.

may claim the credit only for an income year in which the eligible

production company would have been eligible to claim the credit.

Complete this form in blue or black ink only.

PART I - Credit Computation

1.

Available credit was received by:

Investment

Assignment

Partly by investment and partly by assignment

If available credit was received by assignment, enter the name and Connecticut Taxpayer Identification Number

of the assignor below. (Attach explanation.)

__________________________________________________

____________________________________________

Assignor’s Name

Assignor’s Connecticut Tax Registration Number

2.

Total amount of qualified Film Production Credit as listed on the tax credit certificate issued by CCCT

for the 2006 income year. Enter here and on Form CT-1120K, Part I-D, Line 30, Column B.

2.

PART II - Computation of Carryforward

Credit may be carried forward to three succeeding income years.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

A

B

C

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

Total Credit Earned

Credit Applied

Carryforward to 2007 (Subtract

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

to 2006

Column B from Column A.)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1. 2006 Film Production Credit

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

2. Total Film Production Credit applied to 2006 (Enter amount from Line 1,

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

Column B. Enter here and on Form CT-1120K, Part I-D, Line 30, Column C.)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

3. Total Film Production Credit carryforward to 2007 (Enter amount from Line 1, Column C. Enter here and

on Form CT-1120K, Part I-D, Line 30, Column E.)

Computation of Carryforward Instructions

Line 1, Columns A through C - Complete as indicated.

Line 2, Column B - Enter amount from Line 1, Column B. Enter here and on Form CT-1120K, Part I-D, Line 30, Column C.

Line 3, Column C - Enter amount from Line 1, Column C. Enter here and on Form CT-1120K, Part I-D, Line 30, Column E.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1