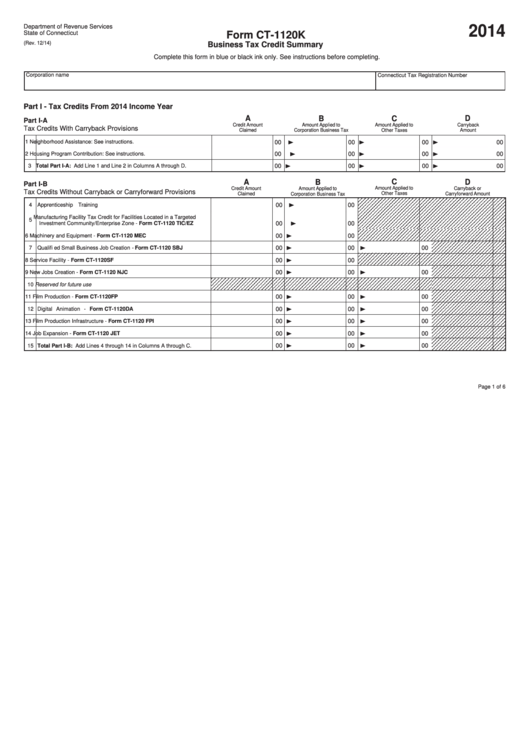

Form Ct-1120k - Business Tax Credit Summary - Connecticut Department Of Revenue - 2014

ADVERTISEMENT

Department of Revenue Services

2014

State of Connecticut

Form CT-1120K

(Rev. 12/14)

Business Tax Credit Summary

Complete this form in blue or black ink only. See instructions before completing.

Corporation name

Connecticut Tax Registration Number

Part I - Tax Credits From 2014 Income Year

A

B

C

D

Part I-A

Credit Amount

Amount Applied to

Carryback

Amount Applied to

Tax Credits With Carryback Provisions

Claimed

Amount

Corporation Business Tax

Other Taxes

1

Neighborhood Assistance: See instructions.

00

00

00

00

2

Housing Program Contribution: See instructions.

00

00

00

00

3

Total Part I-A: Add Line 1 and Line 2 in Columns A through D.

00

00

00

00

C

A

B

D

Part I-B

Amount Applied to

Credit Amount

Amount Applied to

Carryback or

Tax Credits Without Carryback or Carryforward Provisions

Other Taxes

Claimed

Corporation Business Tax

Carryforward Amount

4

Apprenticeship Training

00

00

Manufacturing Facility Tax Credit for Facilities Located in a Targeted

5

Investment Community/Enterprise Zone - Form CT-1120 TIC/EZ

00

00

00

00

6

Machinery and Equipment - Form CT-1120 MEC

7

Qualifi ed Small Business Job Creation - Form CT-1120 SBJ

00

00

00

00

8

Service Facility - Form CT-1120SF

00

00

00

00

9

New Jobs Creation - Form CT-1120 NJC

10 Reserved for future use

00

11 Film Production - Form CT-1120FP

00

00

00

00

00

12 Digital Animation - Form CT-1120DA

00

13 Film Production Infrastructure - Form CT-1120 FPI

00

00

14 Job Expansion - Form CT-1120 JET

00

00

00

00

00

00

15 Total Part I-B: Add Lines 4 through 14 in Columns A through C.

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6