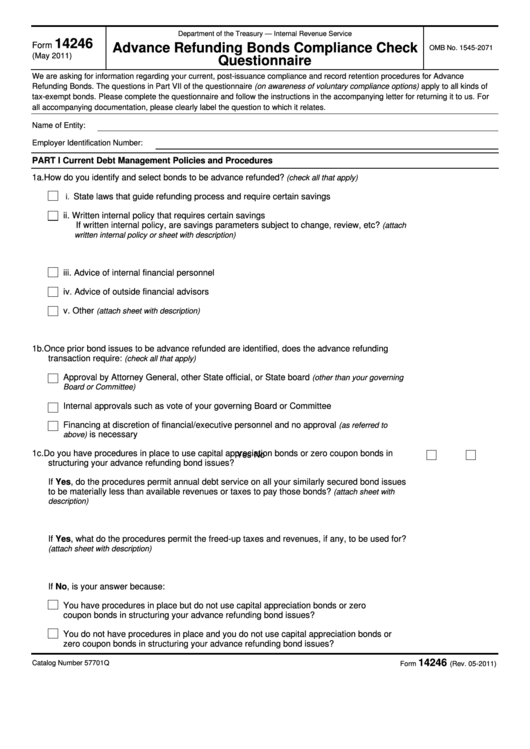

Department of the Treasury — Internal Revenue Service

14246

Form

Advance Refunding Bonds Compliance Check

OMB No. 1545-2071

(May 2011)

Questionnaire

We are asking for information regarding your current, post-issuance compliance and record retention procedures for Advance

Refunding Bonds. The questions in Part VII of the questionnaire (on awareness of voluntary compliance options) apply to all kinds of

tax-exempt bonds. Please complete the questionnaire and follow the instructions in the accompanying letter for returning it to us. For

all accompanying documentation, please clearly label the question to which it relates.

Name of Entity:

Employer Identification Number:

PART I Current Debt Management Policies and Procedures

1a. How do you identify and select bonds to be advance refunded?

(check all that apply)

State laws that guide refunding process and require certain savings

i.

ii. Written internal policy that requires certain savings

If written internal policy, are savings parameters subject to change, review, etc?

(attach

written internal policy or sheet with description)

iii. Advice of internal financial personnel

iv. Advice of outside financial advisors

v. Other

(attach sheet with description)

1b. Once prior bond issues to be advance refunded are identified, does the advance refunding

transaction require:

(check all that apply)

Approval by Attorney General, other State official, or State board

(other than your governing

Board or Committee)

Internal approvals such as vote of your governing Board or Committee

Financing at discretion of financial/executive personnel and no approval

(as referred to

is necessary

above)

1c. Do you have procedures in place to use capital appreciation bonds or zero coupon bonds in

Yes

No

structuring your advance refunding bond issues?

If Yes, do the procedures permit annual debt service on all your similarly secured bond issues

to be materially less than available revenues or taxes to pay those bonds?

(attach sheet with

description)

If Yes, what do the procedures permit the freed-up taxes and revenues, if any, to be used for?

(attach sheet with description)

If No, is your answer because:

You have procedures in place but do not use capital appreciation bonds or zero

coupon bonds in structuring your advance refunding bond issues?

You do not have procedures in place and you do not use capital appreciation bonds or

zero coupon bonds in structuring your advance refunding bond issues?

14246

Catalog Number 57701Q

Form

(Rev. 05-2011)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8