Form Rv-R0012301 - Business Tax Return - Payment To Subcontractor Worksheet

ADVERTISEMENT

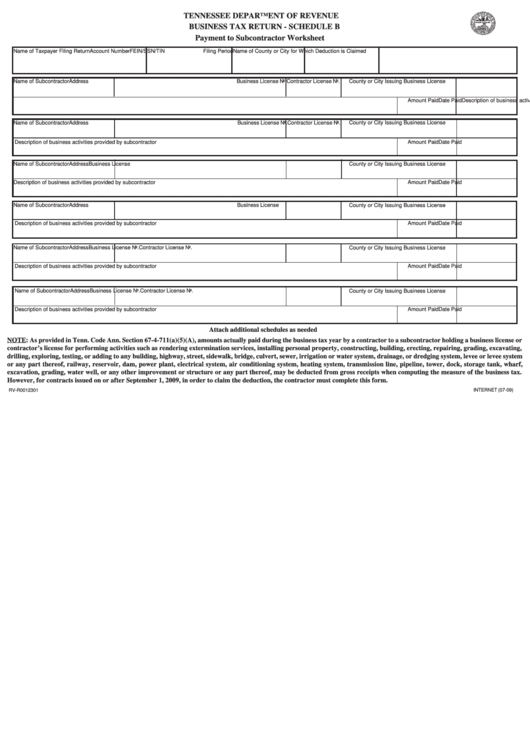

TENNESSEE DEPARTMENT OF REVENUE

BUSINESS TAX RETURN - SCHEDULE B

Payment to Subcontractor Worksheet

Name of Taxpayer Filing Return

Account Number

FEIN/SSN/TIN

Filing Period

Name of County or City for Which Deduction is Claimed

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Contractor License No.

Description of business activities provided by subcontractor

Amount Paid

Date Paid

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Contractor License No.

Description of business activities provided by subcontractor

Amount Paid

Date Paid

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Contractor License No.

Description of business activities provided by subcontractor

Amount Paid

Date Paid

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Contractor License No.

Description of business activities provided by subcontractor

Amount Paid

Date Paid

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Contractor License No.

Date Paid

Description of business activities provided by subcontractor

Amount Paid

Contractor License No.

Name of Subcontractor

Address

Business License No.

County or City Issuing Business License

Description of business activities provided by subcontractor

Amount Paid

Date Paid

Attach additional schedules as needed

NOTE: As provided in Tenn. Code Ann. Section 67-4-711(a)(5)(A), amounts actually paid during the business tax year by a contractor to a subcontractor holding a business license or

contractor’s license for performing activities such as rendering extermination services, installing personal property, constructing, building, erecting, repairing, grading, excavating,

drilling, exploring, testing, or adding to any building, highway, street, sidewalk, bridge, culvert, sewer, irrigation or water system, drainage, or dredging system, levee or levee system

or any part thereof, railway, reservoir, dam, power plant, electrical system, air conditioning system, heating system, transmission line, pipeline, tower, dock, storage tank, wharf,

excavation, grading, water well, or any other improvement or structure or any part thereof, may be deducted from gross receipts when computing the measure of the business tax.

However, for contracts issued on or after September 1, 2009, in order to claim the deduction, the contractor must complete this form.

RV-R0012301

INTERNET (07-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1