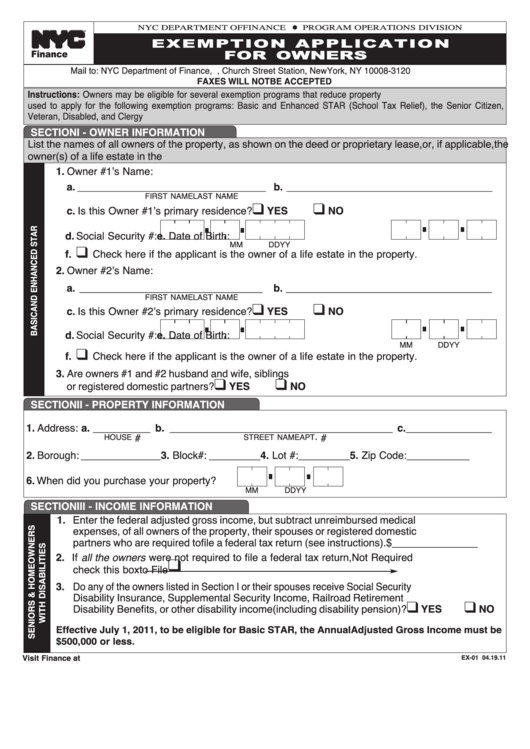

Form Ex-01 - Exemption Application For Owners - 2011

ADVERTISEMENT

NYC DEPARTMENT OF FINANCE

PROGRAM OPERATIONS DIVISION

G

E X E M P T I O N A P P L I C AT I O N

TM

F O R OW N E R S

Finance

Mail to: NYC Department of Finance, P.O. Box 3120, Church Street Station, New York, NY 10008-3120

FAXES WILL NOT BE ACCEPTED

Instructions: Owners may be eligible for several exemption programs that reduce property taxes. This application can be

used to apply for the following exemption programs: Basic and Enhanced STAR (School Tax Relief), the Senior Citizen,

Veteran, Disabled, and Clergy exemptions. Read the instructions for further information on how to complete this application.

SECTION I - OWNER INFORMATION

List the names of all owners of the property, as shown on the deed or proprietary lease, or, if applicable, the

owner(s) of a life estate in the property. Attach a separate sheet if the property has more than two owners.

1. Owner #1ʼs Name:

a. _________________________________ b. ____________________________________

FIRST NAME

LAST NAME

c. Is this Owner #1ʼs primary residence?

YES

NO

K

K

d. Social Security #:

e. Date of Birth:

MM

DD

YY

f.

K

Check here if the applicant is the owner of a life estate in the property.

2. Owner #2ʼs Name:

a. ________________________________

b. ____________________________________

FIRST NAME

LAST NAME

c. Is this Owner #2ʼs primary residence?

YES

NO

K

K

d. Social Security #:

e. Date of Birth:

MM

DD

YY

f.

K

Check here if the applicant is the owner of a life estate in the property.

3. Are owners #1 and #2 husband and wife, siblings

YES

NO

K

K

or registered domestic partners?

SECTION II - PROPERTY INFORMATION

1. Address: a. __________ b. _______________________________________ c._______________

. #

#

HOUSE

STREET NAME

APT

2. Borough: ______________ 3. Block #: _________ 4. Lot #:_________ 5. Zip Code: ___________

6. When did you purchase your property?

MM

DD

YY

SECTION III - INCOME INFORMATION

1. Enter the federal adjusted gross income, but subtract unreimbursed medical

expenses, of all owners of the property, their spouses or registered domestic

partners who are required to file a federal tax return (see instructions).

$_______________

2. If all the owners were not required to file a federal tax return,

Not Required

K

check this box

to File

3. Do any of the owners listed in Section I or their spouses receive Social Security

Disability Insurance, Supplemental Security Income, Railroad Retirement

YES

NO

Disability Benefits, or other disability income (including disability pension)?

K

K

Effective July 1, 2011, to be eligible for Basic STAR, the Annual Adjusted Gross Income must be

$500,000 or less.

Visit Finance at nyc.gov/finance

EX-01 04.19.11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2