Form Ex-01 - Exemption Application For Owners - 2011 Page 2

ADVERTISEMENT

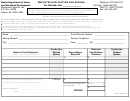

Exemption Application for Owners

Page 2

SECTION IV - ELIGIBILITY INFORMATION

1. a. Are any of the owners listed in Section I veterans, or a spouse,

unremarried widow or widower, or a registered domestic partner

YES

NO

K

K

of a veteran; or the parent of a soldier killed in action?

If “YES” to 1a, answer Questions 1b through 1d.

If “NO” to 1a, skip to Question 2.

b. Did the veteran serve during a period of conflict?

YES

NO

K

K

c. Did the veteran serve in a combat zone?

YES

NO

K

K

d. Was the veteran disabled in the line of duty?

YES

NO

K

K

e. If you checked “YES” to 1d, please indicate the

percentage of the veteranʼs disability:

________%

2. Are you an active or retired member of the clergy who is/was

primarily responsible for ministerial work or the unmarried surviving

YES

NO

K

K

spouse or registered domestic partner of a member of the clergy?

SECTION V - SIGNATURES AND CERTIFICATIONS

By signing below, I certify that all statements made on this application are true and correct to the best of my knowl-

edge and that I have made no willful false statements of material fact. I understand that this information is subject to

audit, and should Finance determine that I do not qualify for tax exemptions, I will be disqualified from future exemp-

tions and will be responsible for all applicable taxes due, accrued interest, and the maximum penalty allowable by law.

All owners must sign and date this application, whether they reside at the property or not.

___________________________________________________ _________/_________/________

ʼ

OWNER

S SIGNATURE

DATE

___________________________________________________ _________/_________/________

ʼ

OWNER

S SIGNATURE

DATE

___________________________________________________ _________/_________/________

ʼ

OWNER

S SIGNATURE

DATE

___________________________________________________ _________/_________/________

ʼ

OWNER

S SIGNATURE

DATE

___________________________________________________ _________/_________/________

ʼ

OWNER

S SIGNATURE

DATE

Contact Information:

If we have a question about this application, whom should we contact?

Contact Name: _____________________________________________________________________

Telephone #: _________________________ Email Address: _______________________________

PLEASE KEEP A COPY OF THIS APPLICATION FOR YOUR RECORDS.

The Department of Finance will inform you of all exemption benefits that you are eligible for on your Statement of Account.

PRIVACY ACT NOTIFICATION

Under the Federal Privacy Act of 1974, if we ask you to give us your social security number, we must tell you whether or not you are obligated to provide us with the

social security number, our legal right to ask you for the information, and how we plan to use it. You must list your taxpayer identification number (social security num-

ber or employer identification number) in order to apply for an exemption from real property taxes. We are asking for this information to make sure that our records

are accurate, and that you have submitted accurate information. Our legal right to require this information is contained in Section 11-102.1 of the Administrative Code.

This authorizes the Department of Finance to require any person to provide a taxpayer identification number so that we may administer and collect taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2