Clean Fuel Infrastructure Development Tax Credit Worksheet Instructions - 2005

ADVERTISEMENT

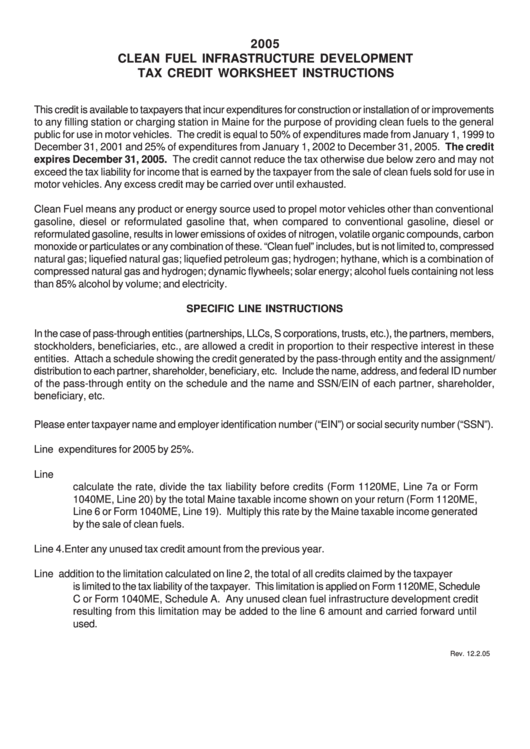

2005

CLEAN FUEL INFRASTRUCTURE DEVELOPMENT

TAX CREDIT WORKSHEET INSTRUCTIONS

This credit is available to taxpayers that incur expenditures for construction or installation of or improvements

to any filling station or charging station in Maine for the purpose of providing clean fuels to the general

public for use in motor vehicles. The credit is equal to 50% of expenditures made from January 1, 1999 to

December 31, 2001 and 25% of expenditures from January 1, 2002 to December 31, 2005. The credit

expires December 31, 2005. The credit cannot reduce the tax otherwise due below zero and may not

exceed the tax liability for income that is earned by the taxpayer from the sale of clean fuels sold for use in

motor vehicles. Any excess credit may be carried over until exhausted.

Clean Fuel means any product or energy source used to propel motor vehicles other than conventional

gasoline, diesel or reformulated gasoline that, when compared to conventional gasoline, diesel or

reformulated gasoline, results in lower emissions of oxides of nitrogen, volatile organic compounds, carbon

monoxide or particulates or any combination of these. “Clean fuel” includes, but is not limited to, compressed

natural gas; liquefied natural gas; liquefied petroleum gas; hydrogen; hythane, which is a combination of

compressed natural gas and hydrogen; dynamic flywheels; solar energy; alcohol fuels containing not less

than 85% alcohol by volume; and electricity.

SPECIFIC LINE INSTRUCTIONS

In the case of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.), the partners, members,

stockholders, beneficiaries, etc., are allowed a credit in proportion to their respective interest in these

entities. Attach a schedule showing the credit generated by the pass-through entity and the assignment/

distribution to each partner, shareholder, beneficiary, etc. Include the name, address, and federal ID number

of the pass-through entity on the schedule and the name and SSN/EIN of each partner, shareholder,

beneficiary, etc.

Please enter taxpayer name and employer identification number (“EIN”) or social security number (“SSN”).

Line 1. Multiply the total qualified expenditures for 2005 by 25%.

Line 2. The credit is limited to the tax liability on income generated by the sale of clean fuels. To

calculate the rate, divide the tax liability before credits (Form 1120ME, Line 7a or Form

1040ME, Line 20) by the total Maine taxable income shown on your return (Form 1120ME,

Line 6 or Form 1040ME, Line 19). Multiply this rate by the Maine taxable income generated

by the sale of clean fuels.

Line 4. Enter any unused tax credit amount from the previous year.

Line 6. In addition to the limitation calculated on line 2, the total of all credits claimed by the taxpayer

is limited to the tax liability of the taxpayer. This limitation is applied on Form 1120ME, Schedule

C or Form 1040ME, Schedule A. Any unused clean fuel infrastructure development credit

resulting from this limitation may be added to the line 6 amount and carried forward until

used.

Rev. 12.2.05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1