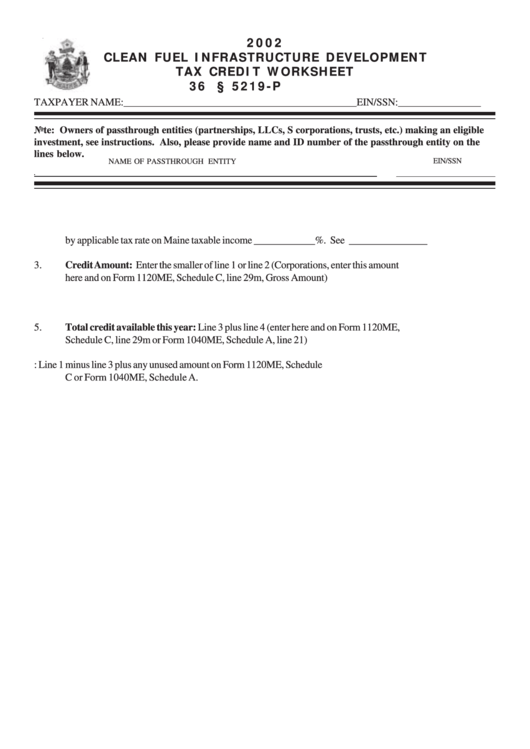

Clean Fuel Infrastructure Development Tax Credit Worksheet - 2002

ADVERTISEMENT

2002

CLEAN FUEL INFRASTRUCTURE DEVELOPMENT

TAX CREDIT WORKSHEET

36 M.R.S.A. § 5219-P

TAXPAYER NAME:_____________________________________________EIN/SSN:________________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the passthrough entity on the

lines below.

EIN/SSN

NAME OF PASSTHROUGH ENTITY

1.

Qualified expenditures in 2002______________X .25 ............................................... _______________

2.

Maine taxable income generated from the sale of clean fuels_______________multiplied

by applicable tax rate on Maine taxable income ____________%. See instructions. ... _______________

3.

Credit Amount: Enter the smaller of line 1 or line 2 (Corporations, enter this amount

here and on Form 1120ME, Schedule C, line 29m, Gross Amount) ............................. _______________

4.

Carryforward from previous year ................................................................................ _______________

5.

Total credit available this year: Line 3 plus line 4 (enter here and on Form 1120ME,

Schedule C, line 29m or Form 1040ME, Schedule A, line 21) ..................................... _______________

6.

Carryforward: Line 1 minus line 3 plus any unused amount on Form 1120ME, Schedule

C or Form 1040ME, Schedule A. ............................................................................... _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1