Itr-1/2 Schedule - Part-Year Resident Schedule/non-Reciprocal State/philadelphia Credit Schedule

ADVERTISEMENT

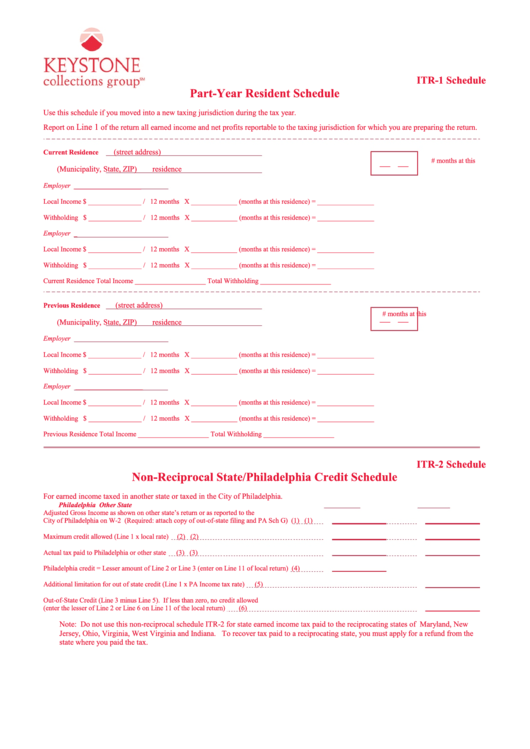

ITR-1 Schedule

Part-Year Resident Schedule

Use this schedule if you moved into a new taxing jurisdiction during the tax year.

Line 1

Report on

of the return all earned income and net profits reportable to the taxing jurisdiction for which you are preparing the return.

(street address)

Current Residence

__ __

# months at this

(Municipality, State, ZIP)

residence

Employer ___________________

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Employer _

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Current Residence Total Income ____________________ Total Withholding ____________________

(street address)

Previous Residence

# months at this

__ __

(Municipality, State, ZIP)

residence

Employer

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Employer ___________________

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Previous Residence Total Income ____________________ Total Withholding ____________________

ITR-2 Schedule

Non-Reciprocal State/Philadelphia Credit Schedule

For earned income taxed in another state or taxed in the City of Philadelphia.

Philadelphia

Other State

Adjusted Gross Income as shown on other state’s return or as reported to the

City of Philadelphia on W-2 (Required: attach copy of out-of-state filing and PA Sch G)

(1)

(1)

Maximum credit allowed (Line 1 x local rate)

(2)

(2)

Actual tax paid to Philadelphia or other state

(3)

(3)

Philadelphia credit = Lesser amount of Line 2 or Line 3 (enter on Line 11 of local return)

(4)

Additional limitation for out of state credit (Line 1 x PA Income tax rate)

(5)

Out-of-State Credit (Line 3 minus Line 5). If less than zero, no credit allowed

(enter the lesser of Line 2 or Line 6 on Line 11 of the local return)

(6)

Note: Do not use this non-reciprocal schedule ITR-2 for state earned income tax paid to the reciprocating states of Maryland, New

Jersey, Ohio, Virginia, West Virginia and Indiana. To recover tax paid to a reciprocating state, you must apply for a refund from the

state where you paid the tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1