Form Rb-32 Instructions

ADVERTISEMENT

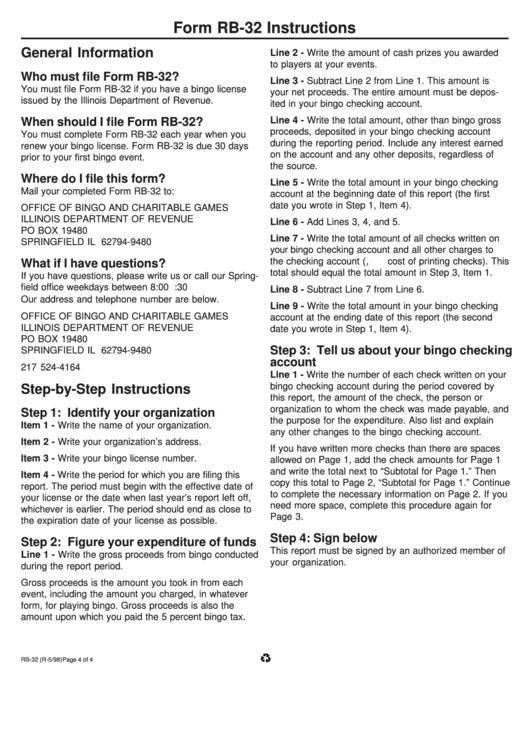

Form RB-32 Instructions

General Information

Line 2 - Write the amount of cash prizes you awarded

to players at your events.

Who must file Form RB-32?

Line 3 - Subtract Line 2 from Line 1. This amount is

You must file Form RB-32 if you have a bingo license

your net proceeds. The entire amount must be depos-

issued by the Illinois Department of Revenue.

ited in your bingo checking account.

Line 4 - Write the total amount, other than bingo gross

When should I file Form RB-32?

proceeds, deposited in your bingo checking account

You must complete Form RB-32 each year when you

during the reporting period. Include any interest earned

renew your bingo license. Form RB-32 is due 30 days

on the account and any other deposits, regardless of

prior to your first bingo event.

the source.

Where do I file this form?

Line 5 - Write the total amount in your bingo checking

Mail your completed Form RB-32 to:

account at the beginning date of this report (the first

date you wrote in Step 1, Item 4).

OFFICE OF BINGO AND CHARITABLE GAMES

ILLINOIS DEPARTMENT OF REVENUE

Line 6 - Add Lines 3, 4, and 5.

PO BOX 19480

Line 7 - Write the total amount of all checks written on

SPRINGFIELD IL 62794-9480

your bingo checking account and all other charges to

the checking account ( e.g., cost of printing checks). This

What if I have questions?

total should equal the total amount in Step 3, Item 1.

If you have questions, please write us or call our Spring-

field office weekdays between 8:00 a.m. and 4:30 p.m.

Line 8 - Subtract Line 7 from Line 6.

Our address and telephone number are below.

Line 9 - Write the total amount in your bingo checking

OFFICE OF BINGO AND CHARITABLE GAMES

account at the ending date of this report (the second

ILLINOIS DEPARTMENT OF REVENUE

date you wrote in Step 1, Item 4).

PO BOX 19480

Step 3: Tell us about your bingo checking

SPRINGFIELD IL 62794-9480

account

217 524-4164

Line 1 - Write the number of each check written on your

bingo checking account during the period covered by

Step-by-Step Instructions

this report, the amount of the check, the person or

organization to whom the check was made payable, and

Step 1: Identify your organization

the purpose for the expenditure. Also list and explain

Item 1 - Write the name of your organization.

any other changes to the bingo checking account.

Item 2 - Write your organization’s address.

If you have written more checks than there are spaces

Item 3 - Write your bingo license number.

allowed on Page 1, add the check amounts for Page 1

and write the total next to “Subtotal for Page 1.” Then

Item 4 - Write the period for which you are filing this

copy this total to Page 2, “Subtotal for Page 1.” Continue

report. The period must begin with the effective date of

to complete the necessary information on Page 2. If you

your license or the date when last year’s report left off,

need more space, complete this procedure again for

whichever is earlier. The period should end as close to

Page 3.

the expiration date of your license as possible.

Step 4: Sign below

Step 2: Figure your expenditure of funds

This report must be signed by an authorized member of

Line 1 - Write the gross proceeds from bingo conducted

your organization.

during the report period.

Gross proceeds is the amount you took in from each

event, including the amount you charged, in whatever

form, for playing bingo. Gross proceeds is also the

amount upon which you paid the 5 percent bingo tax.

RB-32 (R-5/98)

Page 4 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1