Instructions For Form M-18 - Making Estimated Tax Payments - 2001

ADVERTISEMENT

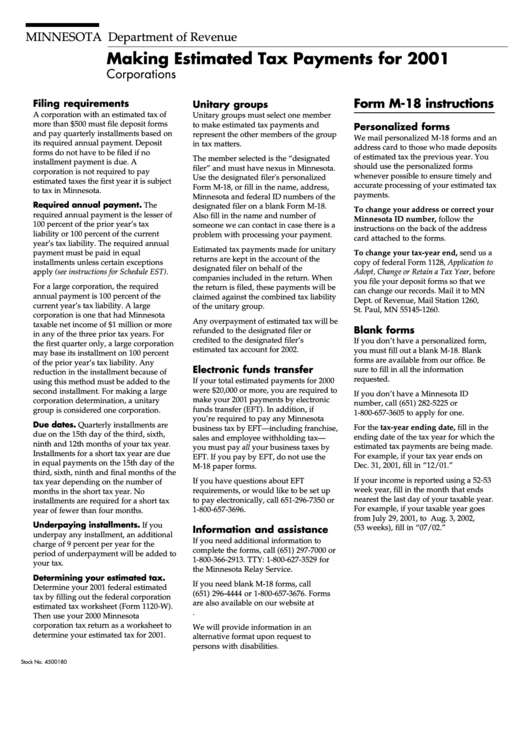

MINNESOTA Department of Revenue

Making Estimated Tax Payments for 2001

Corporations

Form M-18 instructions

Filing requirements

Unitary groups

A corporation with an estimated tax of

Unitary groups must select one member

more than $500 must file deposit forms

to make estimated tax payments and

Personalized forms

and pay quarterly installments based on

represent the other members of the group

We mail personalized M-18 forms and an

its required annual payment. Deposit

in tax matters.

address card to those who made deposits

forms do not have to be filed if no

of estimated tax the previous year. You

The member selected is the “designated

installment payment is due. A

should use the personalized forms

filer” and must have nexus in Minnesota.

corporation is not required to pay

whenever possible to ensure timely and

Use the designated filer's personalized

estimated taxes the first year it is subject

accurate processing of your estimated tax

Form M-18, or fill in the name, address,

to tax in Minnesota.

payments.

Minnesota and federal ID numbers of the

Required annual payment. The

designated filer on a blank Form M-18.

To change your address or correct your

required annual payment is the lesser of

Also fill in the name and number of

Minnesota ID number, follow the

100 percent of the prior year’s tax

someone we can contact in case there is a

instructions on the back of the address

liability or 100 percent of the current

problem with processing your payment.

card attached to the forms.

year’s tax liability. The required annual

Estimated tax payments made for unitary

payment must be paid in equal

To change your tax-year end, send us a

returns are kept in the account of the

installments unless certain exceptions

copy of federal Form 1128, Application to

designated filer on behalf of the

apply (see instructions for Schedule EST).

Adopt, Change or Retain a Tax Year, before

companies included in the return. When

you file your deposit forms so that we

For a large corporation, the required

the return is filed, these payments will be

can change our records. Mail it to MN

annual payment is 100 percent of the

claimed against the combined tax liability

Dept. of Revenue, Mail Station 1260,

current year’s tax liability. A large

of the unitary group.

St. Paul, MN 55145-1260.

corporation is one that had Minnesota

Any overpayment of estimated tax will be

taxable net income of $1 million or more

Blank forms

refunded to the designated filer or

in any of the three prior tax years. For

credited to the designated filer’s

If you don’t have a personalized form,

the first quarter only, a large corporation

estimated tax account for 2002.

you must fill out a blank M-18. Blank

may base its installment on 100 percent

forms are available from our office. Be

of the prior year’s tax liability. Any

Electronic funds transfer

sure to fill in all the information

reduction in the installment because of

requested.

If your total estimated payments for 2000

using this method must be added to the

were $20,000 or more, you are required to

second installment. For making a large

If you don’t have a Minnesota ID

make your 2001 payments by electronic

corporation determination, a unitary

number, call (651) 282-5225 or

funds transfer (EFT). In addition, if

group is considered one corporation.

1-800-657-3605 to apply for one.

you’re required to pay any Minnesota

Due dates. Quarterly installments are

For the tax-year ending date, fill in the

business tax by EFT—including franchise,

due on the 15th day of the third, sixth,

ending date of the tax year for which the

sales and employee withholding tax—

ninth and 12th months of your tax year.

estimated tax payments are being made.

you must pay all your business taxes by

Installments for a short tax year are due

For example, if your tax year ends on

EFT. If you pay by EFT, do not use the

in equal payments on the 15th day of the

Dec. 31, 2001, fill in “12/01.”

M-18 paper forms.

third, sixth, ninth and final months of the

If your income is reported using a 52-53

If you have questions about EFT

tax year depending on the number of

week year, fill in the month that ends

requirements, or would like to be set up

months in the short tax year. No

nearest the last day of your taxable year.

to pay electronically, call 651-296-7350 or

installments are required for a short tax

For example, if your taxable year goes

1-800-657-3696.

year of fewer than four months.

from July 29, 2001, to Aug. 3, 2002,

Underpaying installments. If you

(53 weeks), fill in “07/02.”

Information and assistance

underpay any installment, an additional

If you need additional information to

charge of 9 percent per year for the

complete the forms, call (651) 297-7000 or

period of underpayment will be added to

1-800-366-2913. TTY: 1-800-627-3529 for

your tax.

the Minnesota Relay Service.

Determining your estimated tax.

If you need blank M-18 forms, call

Determine your 2001 federal estimated

(651) 296-4444 or 1-800-657-3676. Forms

tax by filling out the federal corporation

are also available on our website at

estimated tax worksheet (Form 1120-W).

Then use your 2000 Minnesota

corporation tax return as a worksheet to

We will provide information in an

determine your estimated tax for 2001.

alternative format upon request to

persons with disabilities.

Stock No. 4500180

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1