Instructions For Form M-11a - Fire Insurance Tax

ADVERTISEMENT

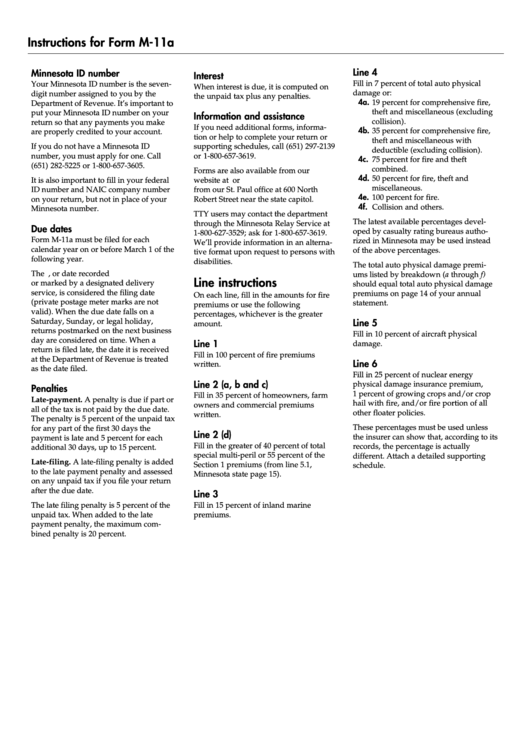

Instructions for Form M-11a

Line 4

Minnesota ID number

Interest

Fill in 7 percent of total auto physical

Your Minnesota ID number is the seven-

When interest is due, it is computed on

damage or:

digit number assigned to you by the

the unpaid tax plus any penalties.

4a. 19 percent for comprehensive fire,

Department of Revenue. It’s important to

theft and miscellaneous (excluding

put your Minnesota ID number on your

Information and assistance

collision).

return so that any payments you make

If you need additional forms, informa-

4b. 35 percent for comprehensive fire,

are properly credited to your account.

tion or help to complete your return or

theft and miscellaneous with

If you do not have a Minnesota ID

supporting schedules, call (651) 297-2139

deductible (excluding collision).

number, you must apply for one. Call

or 1-800-657-3619.

4c. 75 percent for fire and theft

(651) 282-5225 or 1-800-657-3605.

combined.

Forms are also available from our

4d. 50 percent for fire, theft and

It is also important to fill in your federal

website at or

miscellaneous.

ID number and NAIC company number

from our St. Paul office at 600 North

4e. 100 percent for fire.

on your return, but not in place of your

Robert Street near the state capitol.

4f. Collision and others.

Minnesota number.

TTY users may contact the department

The latest available percentages devel-

through the Minnesota Relay Service at

Due dates

oped by casualty rating bureaus autho-

1-800-627-3529; ask for 1-800-657-3619.

Form M-11a must be filed for each

rized in Minnesota may be used instead

We’ll provide information in an alterna-

calendar year on or before March 1 of the

of the above percentages.

tive format upon request to persons with

following year.

disabilities.

The total auto physical damage premi-

The U.S. postmark date, or date recorded

ums listed by breakdown (a through f)

Line instructions

or marked by a designated delivery

should equal total auto physical damage

service, is considered the filing date

premiums on page 14 of your annual

On each line, fill in the amounts for fire

(private postage meter marks are not

statement.

premiums or use the following

valid). When the due date falls on a

percentages, whichever is the greater

Saturday, Sunday, or legal holiday,

Line 5

amount.

returns postmarked on the next business

Fill in 10 percent of aircraft physical

day are considered on time. When a

Line 1

damage.

return is filed late, the date it is received

Fill in 100 percent of fire premiums

at the Department of Revenue is treated

Line 6

written.

as the date filed.

Fill in 25 percent of nuclear energy

Line 2 (a, b and c)

physical damage insurance premium,

Penalties

1 percent of growing crops and/or crop

Fill in 35 percent of homeowners, farm

Late-payment. A penalty is due if part or

hail with fire, and/or fire portion of all

owners and commercial premiums

all of the tax is not paid by the due date.

other floater policies.

written.

The penalty is 5 percent of the unpaid tax

These percentages must be used unless

for any part of the first 30 days the

Line 2 (d)

the insurer can show that, according to its

payment is late and 5 percent for each

Fill in the greater of 40 percent of total

records, the percentage is actually

additional 30 days, up to 15 percent.

special multi-peril or 55 percent of the

different. Attach a detailed supporting

Late-filing. A late-filing penalty is added

Section 1 premiums (from line 5.1,

schedule.

to the late payment penalty and assessed

Minnesota state page 15).

on any unpaid tax if you file your return

after the due date.

Line 3

The late filing penalty is 5 percent of the

Fill in 15 percent of inland marine

unpaid tax. When added to the late

premiums.

payment penalty, the maximum com-

bined penalty is 20 percent.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1