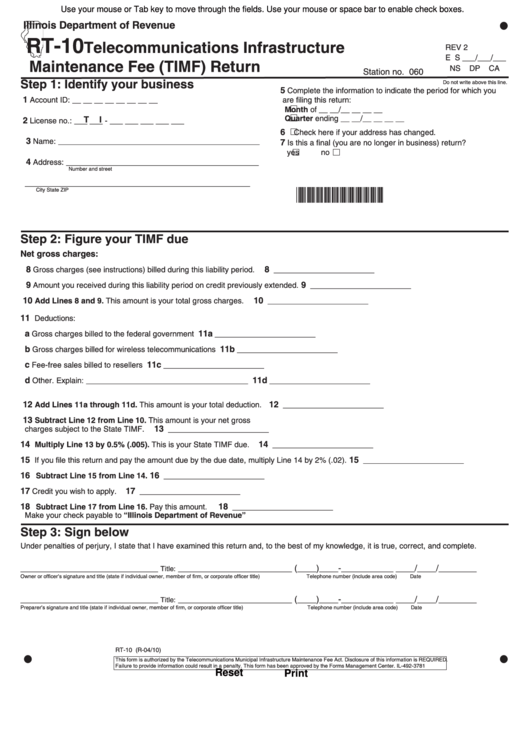

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RT-10

Telecommunications Infrastructure

REV 2

E S ___/___/___

Maintenance Fee (TIMF) Return

NS DP CA

Station no. 060

Step 1: Identify your business

Do not write above this line.

5

Complete the information to indicate the period for which you

1

Account ID: __ __ __ __ __ __ __ __

are filing this return:

Month of __ __/__ __ __ __

Quarter ending __ __/__ __ __ __

T

I

2

License no.: ___ ___ - ___ ___ ___ ___ ___

6

Check here if your address has changed.

3

Name: ______________________________________________

7

Is this a final (you are no longer in business) return?

yes no

4

Address: ____________________________________________

Number and street

___________________________________________________

City

State

ZIP

*089521110*

Step 2: Figure your TIMF due

Net gross charges:

8

8

Gross charges (see instructions) billed during this liability period.

_______________________

9

9

Amount you received during this liability period on credit previously extended.

_______________________

1 0

10

Add Lines 8 and 9. This amount is your total gross charges.

_______________________

11

Deductions:

a

11a

Gross charges billed to the federal government

_______________________

b

11b

Gross charges billed for wireless telecommunications

_______________________

c

11c

Fee-free sales billed to resellers

_______________________

d

11d

Other. Explain: _____________________________________

_______________________

1 2

12

Add Lines 11a through 11d. This amount is your total deduction.

_______________________

1 3

Subtract Line 12 from Line 10. This amount is your net gross

13

charges subject to the State TIMF.

_______________________

14

14

Multiply Line 13 by 0.5% (.005). This is your State TIMF due.

_______________________

15

15

If you file this return and pay the amount due by the due date, multiply Line 14 by 2% (.02).

_______________________

16

16

Subtract Line 15 from Line 14.

_______________________

17

17

Credit you wish to apply.

_______________________

18

18

Subtract Line 17 from Line 16. Pay this amount.

_______________________

Make your check payable to “Illinois Department of Revenue”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Owner or officer’s signature and title (state if individual owner, member of firm, or corporate officer title) Telephone number (include area code) Date

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Preparer’s signature and title (state if individual owner, member of firm, or corporate officer title) Telephone number (include area code) Date

RT-10 (R-04/10)

This form is authorized by the Telecommunications Municipal Infrastructure Maintenance Fee Act. Disclosure of this information is REQUIRED.

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3781

Reset

Print

1

1