Form Rt-10 - Telecommunications Infrastructure Maintenance Fees Return - 1999

ADVERTISEMENT

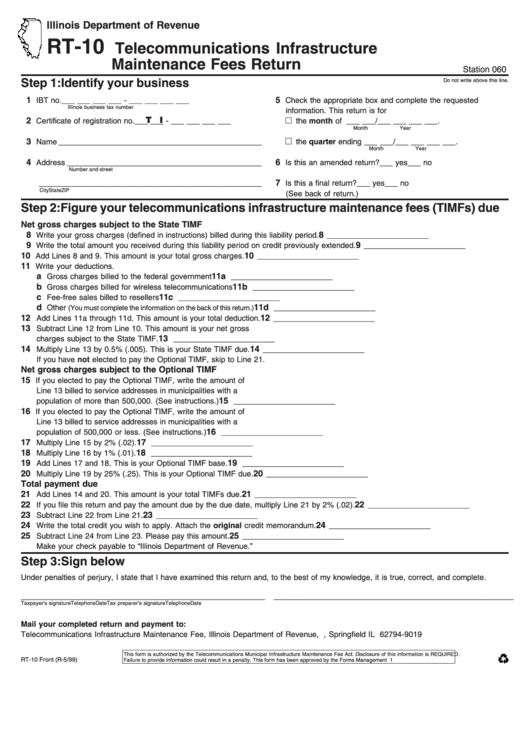

Illinois Department of Revenue

RT-10

Telecommunications Infrastructure

Maintenance Fees Return

Station 060

Step 1: Identify your business

Do not write above this line.

1

5

IBT no. ___ ___ ___ ___ - ___ ___ ___ ___

Check the appropriate box and complete the requested

Illinois business tax number

information. This return is for

T I

2

Certificate of registration no. ___ ___ - ___ ___ ___ ___

the month of ___ ___/___ ___ ___ ___.

Month

Year

3

Name ______________________________________________

the quarter ending ___ ___/___ ___ ___ ___.

Month

Year

4

6

Address ____________________________________________

Is this an amended return? ___ yes

___ no

Number and street

7

__________________________________________________

Is this a final return?

___ yes

___ no

City

State

ZIP

(See back of return.)

Step 2: Figure your telecommunications infrastructure maintenance fees (TIMFs) due

Net gross charges subject to the State TIMF

8

8

Write your gross charges (defined in instructions) billed during this liability period.

_______________________

9

9

Write the total amount you received during this liability period on credit previously extended.

_______________________

10

10

Add Lines 8 and 9. This amount is your total gross charges.

_______________________

11

Write your deductions.

a

11a

Gross charges billed to the federal government

_______________________

b

11b

Gross charges billed for wireless telecommunications

_______________________

c

11c

Fee-free sales billed to resellers

_______________________

d

11d

Other

_______________________

(You must complete the information on the back of this return.)

12

12

Add Lines 11a through 11d. This amount is your total deduction.

_______________________

13

Subtract Line 12 from Line 10. This amount is your net gross

13

charges subject to the State TIMF.

_______________________

14

14

Multiply Line 13 by 0.5% (.005). This is your State TIMF due.

_______________________

If you have not elected to pay the Optional TIMF, skip to Line 21.

Net gross charges subject to the Optional TIMF

15

If you elected to pay the Optional TIMF, write the amount of

Line 13 billed to service addresses in municipalities with a

15

population of more than 500,000. (See instructions.)

_______________________

16

If you elected to pay the Optional TIMF, write the amount of

Line 13 billed to service addresses in municipalities with a

16

population of 500,000 or less. (See instructions.)

_______________________

17

17

Multiply Line 15 by 2% (.02).

_______________________

18

18

Multiply Line 16 by 1% (.01).

_______________________

19

19

Add Lines 17 and 18. This is your Optional TIMF base.

_______________________

20

20

Multiply Line 19 by 25% (.25). This is your Optional TIMF due.

_______________________

Total payment due

21

21

Add Lines 14 and 20. This amount is your total TIMFs due.

_______________________

22

22

If you file this return and pay the amount due by the due date, multiply Line 21 by 2% (.02).

_______________________

23

23

Subtract Line 22 from Line 21.

_______________________

24

24

Write the total credit you wish to apply. Attach the original credit memorandum.

_______________________

25

25

Subtract Line 24 from Line 23. Please pay this amount.

_______________________

Make your check payable to “Illinois Department of Revenue.”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer's signature

Telephone

Date

Tax preparer’s signature

Telephone

Date

Mail your completed return and payment to:

Telecommunications Infrastructure Maintenance Fee, Illinois Department of Revenue, P .O. Box 19019, Springfield IL 62794-9019

This form is authorized by the Telecommunications Municipal Infrastructure Maintenance Fee Act. Disclosure of this information is REQUIRED.

RT-10 Front (R-5/99)

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3781

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2