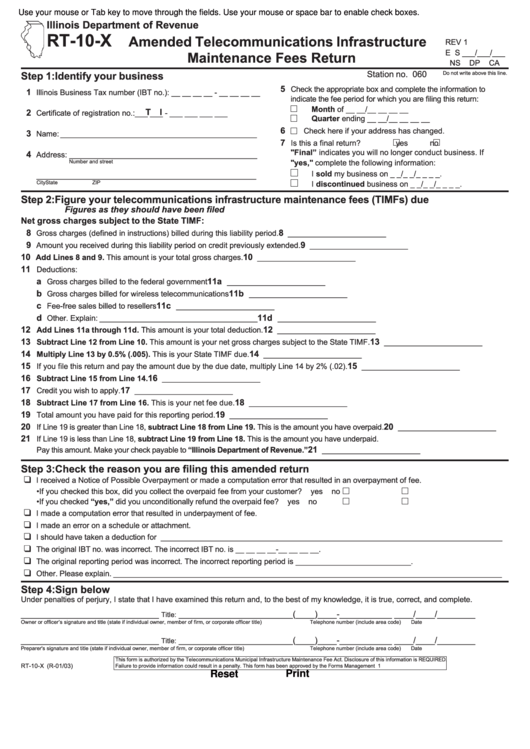

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RT-10-X

Amended Telecommunications Infrastructure

REV 1

E S ___/___/___

Maintenance Fees Return

NS

DP

CA

Station no. 060

Do not write above this line.

Step 1: Identify your business

5

Check the appropriate box and complete the information to

1

Illinois Business Tax number (IBT no.): __ __ __ __ - __ __ __ __

indicate the fee period for which you are filing this return:

Month of

__ __/__ __ __ __

T I

2

Certificate of registration no.: ___ ___ - ___ ___ ___ ___

Quarter ending __ __/__ __ __ __

6

Check here if your address has changed.

3

Name: ______________________________________________

7

Is this a final return?

yes

no

"Final” indicates you will no longer conduct business. If

4

Address: ____________________________________________

Number and street

"yes," complete the following information:

I sold my business on _ _/_ _/_ _ _ _.

___________________________________________________

City

State

ZIP

I discontinued business on _ _/_ _/_ _ _ _.

Step 2: Figure your telecommunications infrastructure maintenance fees (TIMFs) due

Figures as they should have been filed

Net gross charges subject to the State TIMF:

8

8

Gross charges (defined in instructions) billed during this liability period.

_______________________

9

9

Amount you received during this liability period on credit previously extended.

_______________________

10

10

Add Lines 8 and 9. This amount is your total gross charges.

_______________________

11

Deductions:

a

11a

Gross charges billed to the federal government

_______________________

b

11b

Gross charges billed for wireless telecommunications

_______________________

c

11c

Fee-free sales billed to resellers

_______________________

d

11d

Other. Explain: _____________________________________

_______________________

12

12

Add Lines 11a through 11d. This amount is your total deduction.

_______________________

13

13

Subtract Line 12 from Line 10. This amount is your net gross charges subject to the State TIMF.

_______________________

14

14

Multiply Line 13 by 0.5% (.005). This is your State TIMF due.

_______________________

15

15

If you file this return and pay the amount due by the due date, multiply Line 14 by 2% (.02).

_______________________

16

16

Subtract Line 15 from Line 14.

_______________________

17

17

Credit you wish to apply.

_______________________

18

18

Subtract Line 17 from Line 16. This is your net fee due.

_______________________

19

19

Total amount you have paid for this reporting period.

_______________________

20

20

If Line 19 is greater than Line 18, subtract Line 18 from Line 19. This is the amount you have overpaid.

_______________________

21

If Line 19 is less than Line 18, subtract Line 19 from Line 18. This is the amount you have underpaid.

21

Pay this amount. Make your check payable to “Illinois Department of Revenue.”

_______________________

Step 3: Check the reason you are filing this amended return

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of fee.

• If you checked this box, did you collect the overpaid fee from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid fee?

yes

no

I made a computation error that resulted in underpayment of fee.

I made an error on a schedule or attachment.

I should have taken a deduction for ________________________________________________________________________________

The original IBT no. was incorrect. The incorrect IBT no. is __ __ __ __-__ __ __ __.

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

Other. Please explain. ___________________________________________________________________________________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Owner or officer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Preparer's signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

This form is authorized by the Telecommunications Municipal Infrastructure Maintenance Fee Act. Disclosure of this information is REQUIRED.

RT-10-X (R-01/03)

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3781

Reset

Print

1

1 2

2