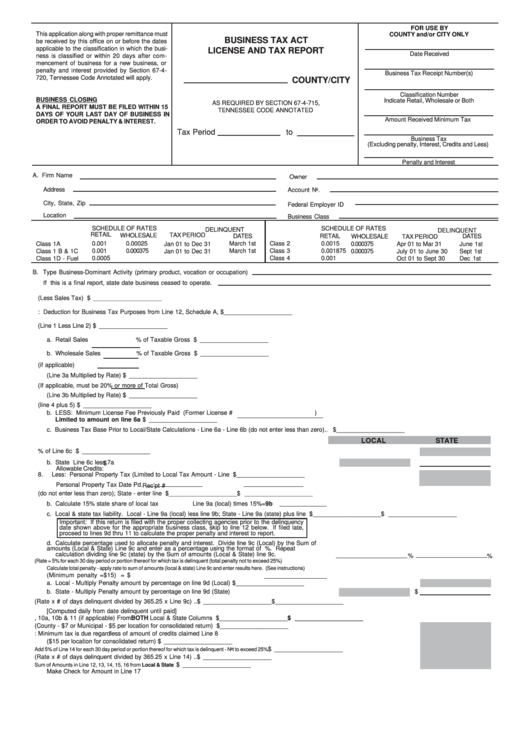

Business Tax Act License And Tax Report Form - Tennessee Department Of Revenue

ADVERTISEMENT

FOR USE BY

This application along with proper remittance must

COUNTY and/or CITY ONLY

BUSINESS TAX ACT

be received by this office on or before the dates

applicable to the classification in which the busi-

LICENSE AND TAX REPORT

Date Received

ness is classified or within 20 days after com-

mencement of business for a new business, or

penalty and interest provided by Section 67-4-

Business Tax Receipt Number(s)

720, Tennessee Code Annotated will apply.

COUNTY/CITY

Classification Number

BUSINESS CLOSING

Indicate Retail, Wholesale or Both

AS REQUIRED BY SECTION 67-4-715,

A FINAL REPORT MUST BE FILED WITHIN 15

TENNESSEE CODE ANNOTATED

DAYS OF YOUR LAST DAY OF BUSINESS IN

Amount Received Minimum Tax

ORDER TO AVOID PENALTY & INTEREST.

Tax Period

to

Business Tax

(Excluding penalty, Interest, Credits and Less)

Penalty and Interest

A. Firm Name

Owner

Address

Account No.

City, State, Zip

Federal Employer ID

Location

Business Class

SCHEDULE OF RATES

SCHEDULE OF RATES

DELINQUENT

DELINQUENT

RETAIL

TAX PERIOD

WHOLESALE

DATES

RETAIL

WHOLESALE

TAX PERIOD

DATES

Class 1A

0.001

0.00025

March 1st

Class 2

0.0015

0.000375

Apr 01 to Mar 31

June 1st

Jan 01 to Dec 31

0.001

0.000375

March 1st

Class 3

0.001875

0.000375

Class 1 B & 1C

Jan 01 to Dec 31

July 01 to June 30

Sept 1st

0.0005

Class 4

0.001

Class 1D - Fuel

Oct 01 to Sept 30

Dec 1st

B. Type Business-Dominant Activity (primary product, vocation or occupation)

If this is a final report, state date business ceased to operate.

1. Total Gross Sales for Tax Period (Less Sales Tax) ....................................................................................... $ ____________________

2. Less: Deduction for Business Tax Purposes from Line 12, Schedule A, .................................................... $ ____________________

3. Taxable Gross Sales for Tax Period (Line 1 Less Line 2) .............................................................................. $ ____________________

a. Retail Sales

% of Taxable Gross Sales .................................................................... $ ____________________

b. Wholesale Sales

% of Taxable Gross Sales ..................................................................... $ ____________________

4. Retail Rate of Tax

(if applicable)

(Line 3a Multiplied by Rate) ........................................................................................................................... $ ____________________

5. Wholesale Rate of Tax

(If applicable, must be 20% or more of Total Gross)

(Line 3b Multiplied by Rate) ........................................................................................................................... $ ____________________

6. a. Preliminary Gross Business Tax Due (line 4 plus 5) ................................................................................ $ ____________________

b. LESS: Minimum License Fee Previously Paid (Former License #

)

Limited to amount on line 6a .............................................................................................................. $ ____________________

c. Business Tax Base Prior to Local/State Calculations - Line 6a - Line 6b (do not enter less than zero) .. $ ____________________

LOCAL

STATE

7. a. Local 66.67% of Line 6c ......................................................................................................................... $ ____________________

b. State Line 6c less 7a ..............................................................................................................................

$

Allowable Credits:

8.

Less: Personal Property Tax (Limited to Local Tax Amount - Line 7a ................................................... $ ____________________

Personal Property Tax Date Pd.

Rec’pt #

9. a. Tax-Local - Lines 7a less Line 8 (do not enter less than zero); State - enter line 7b ............................... $ ____________________ $ ____________________

b. Calculate 15% state share of local tax

Line 9a (local) times 15%=9b

c. Local & state tax liability. Local - Line 9a (local) less line 9b; State - Line 9a (state) plus line 9b ........ $ ____________________ $ ____________________

Important: If this return is filed with the proper collecting agencies prior to the delinquency

date shown above for the appropriate business class, skip to line 12 below. If filed late,

proceed to lines 9d thru 11 to calculate the proper penalty and interest to report.

d. Calculate percentage used to allocate penalty and interest. Divide line 9c (Local) by the Sum of

amounts (Local & State) Line 9c and enter as a percentage using the format of xx.xx%. Repeat

calculation dividing line 9c (state) by the Sum of amounts (Local & State) line 9c.

%

%

10. Penalty

(Rate = 5% for each 30 day period or portion thereof for which tax is delinquent (total penalty not to exceed 25%)

Calculate total penalty - apply rate to sum of amounts (local & state) Line 9c and enter results here. (See instructions)

(Minimum penalty =$15) ......................................................... Penalty = $

a. Local - Multiply Penalty amount by percentage on line 9d (Local) .......................................................... $ ____________________

b. State - Multiply Penalty amount by percentage on line 9d (State) ..........................................................

$

11. Interest (Rate x # of days delinquent divided by 365.25 x Line 9c) ............................................................ $ ____________________ $ ____________________

[Computed daily from date delinquent until paid]

12. Total Add Lines 9c, 10a, 10b & 11 (if applicable) From BOTH Local & State Columns ............................. $ ____________________ $ ____________________

13. Collecting/Recording Fees (County - $7 or Municipal - $5 per location for consolidated return) ................. $ ____________________

14. Minimum Tax For Next Period Note: Minimum tax is due regardless of amount of credits claimed Line 8

($15 per location for consolidated return) ..................................................................................................... $ ____________________

15. Penalty

$ ____________________

Add 5% of Line 14 for each 30 day period or portion thereof for which tax is delinquent - Not to exceed 25% ....................

16. Interest (Rate x # of days delinquent divided by 365.25 x Line 14) ........................................................... $ ____________________

17. Total Minimum Tax and Business Tax

$ ____________________

Sum of Amounts in Line 12, 13, 14, 15, 16 from Local & State Columns ................

Make Check for Amount in Line 17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2