Application For A Real Estate Tax Credit For Active Duty Reserve And National Guard Members Form - City Of Philadelphia Department Of Revenue - 2011 Page 2

ADVERTISEMENT

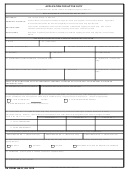

2011 Application for a Real Estate Tax Credit

for Active Duty Reserve and National Guard

Members

on Active Duty Outside of Pennsylvania

Information and Instructions

City Council Bill #050740 provides for a tax credit against real estate taxes for a member

of the National Guard or a reserve component of the Armed Forces of the United States

who is called to active duty outside of Pennsylvania.

> The credit shall apply only to property that is the principal residence of the person

called to active duty.

> The first tax year eligible for the credit is the 2007 Real Estate Tax.

> The 2011 Real Estate Tax Credit is based on 2010 active duty.

> The applicant must provide documentary proof to establish eligibility for the tax

credit if requested by the Department of Revenue.

> Line 2 - City Tax Factor: This represents the City portion of the real estate tax.

The credit is not available on the School District portion of the real estate tax.

> Line 4 - Active Duty OUTSIDE of Pennsylvania: Include all active duty days served

anywhere outside of Pennsylvania.

> The applicant must be the owner of the property. Applicants who are sole owners,

joint tenants with right of survivorship, and tenants by entireties are entitled to the

credit from Line 7. Applicants that are Tenants in Common deed holders on the

property must multiply Line 7 by their percentage of ownership to determine

their allowable credit.

> Official Certification: To be signed by an officer who supports the applicant's claim

based on available duty records.

> Questions - Send e-mail to revenue@phila.gov or call 215-686-6442. This form can

be downloaded from , then click on "Tax Forms".

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2