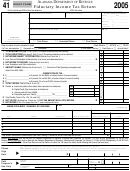

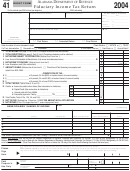

Instructions For Form 41 - Fiduciary Income Tax - Oregon Department Of Reveue - 2005 Page 4

ADVERTISEMENT

Additional interest on deficiencies and de lin quen cies.

Schedule 2—Fiduciary adjustment

In ter est will increase by one-third of 1 per cent per month

(4 per cent annually) on deficiencies or de lin quen cies if the

This schedule is for figuring net Oregon mod i fi ca tions to

fol low ing occur:

federal taxable income.

• You file a return showing taxes owing, or the De part ment

Line 31. Federal income tax subtraction. This sub trac tion

of Revenue has assessed an existing de fi cien cy, and

can’t exceed $4,500. To figure the subtraction, de duct the

• The tax assessed is not paid within 60 days after the re turn

amount on federal Form 1041, Schedule G, line 6, from the

is filed or the notice of assessment is issued, and

amount on federal Form 1041, line 23. For ad di tion al fed er al

• You have not filed a timely appeal.

tax paid for years prior to 2005, see in struc tions for line 34.

Line 20. Total Due. Enclose a check or money order with

Line 32. Interest on U.S. obligations. Enter the amount

your return and payment voucher, payable to “Oregon

of interest from U.S. government obligations included in

De part ment of Rev e nue.” Please use blue or black ink.

fed er al income and not otherwise deducted. U.S. gov-

Do not use gel pens or red ink. Write your Ore gon BIN

ern ment interest received from another fiduciary should be

or FEIN, and “2005” on your check. Do not send cash or

sub tract ed on line 34. Don’t subtract that in come a second

post dat ed checks.

time on this line. The total of interest or div i dends from U.S.

ob li ga tions included on federal Form 1041 must be reduced

Special instructions. Do you owe penalty or interest and

by the de duc tions al lo ca ble to such income (see Form 1041

have an overpayment? If your overpayment is less than

in struc tions, “Al lo ca tion of Deductions for Tax Exempt In-

to tal penalty and interest, fill in on line 20 the result of line

come”). Use the same for mu la to allocate deductions to U.S.

18 plus line 19 minus line 17.

gov ern ment in ter est.

Line 34. Other subtractions. Enter other subtractions re-

Schedule 1—Oregon changes

quired by ORS 316.680 and ORS 316.695 that do not have a

Line 24. Changes in depreciation. You may have a de pre -

specific line. Attach a schedule that details the amount and

ci a tion difference for Oregon and may need the Ore gon

nature of each subtraction included on this line. En ter the

De pre ci a tion Schedule and instructions. See “Taxpayer

fiduciary’s share of the fiduciary ad just ment from an oth er

as sis tance.”

estate or trust that is a subtraction on this line. Also, enter

any additional federal income tax paid dur ing the tax year

Line 25. Other changes. Changes include differences in gains

for prior years and not de duct ed on any pri or year return.

or losses from the sale of property. Also use this line to re port

To determine the amount deductible, refer to the 2005 in di -

differences in capital gains from the sale of farm use and

vid u al return in struc tions for Form 40, line 18.

forest use lands acquired from a de ce dent who died before

1987. Enter the amount in col umn B. Also enter the amount

Line 37. Interest on obligations of other states. Enter in ter est

in column A if an authorized distribution was made, and the

income from bonds of a state or political sub di vi sion oth er

gains qualify for in clu sion in distributable net income.

than Oregon. (This type of income from another fi du cia ry

is included in that fiduciary’s ad just ment and should not be

Electing small business trust. Amounts not included in fed-

duplicated on this line.)

er al distributable net income of an electing small business

trust under IRC Section 641(c) must be in clud ed in column

Line 38. Depletion. If natural resource depletion en tered on

B, line 25.

Form 1041 is in excess of the adjusted basis of the property,

enter the excess on this line.

Net long-term capital gain. Enter the net long-term cap i tal

gain (NLTCG) from farm assets that was not dis trib ut ed as a

Line 39. Estate tax paid on “income in respect of a de-

negative number in Schedule 1, column B, line 25. The sub-

ce dent” (IRD). To figure the amount of the federal es tate

trac tion cannot exceed the amount of income that is re port ed

tax de duc tion that must be added to taxable in come on the

for the fiduciary from federal Form 1041, line 22.

Or e gon re turn, use this formula:

Line 29. Oregon changes distributed. Enter Oregon

A = IRD in clud ed in federal taxable inc ome

chang es from column A, line 26, that were distributed to

B = IRD not taxable by Oregon

the ben e fi cia ries. Enter zero if the amount on Form 1041,

C = estate tax de duct ed on Form 1041

Schedule B, line 8 or line 11, is less than the amount on

Formula: B

× C = $___________ amount of the ad di tion

Schedule B, line 7.

A

The total of this line, plus the amounts from Form 1041,

Enter amount on line 39.

Sched ule B, lines 12 and 15, can’t exceed the amount on

Line 40. Other additions. Enter other additions re quired by

Sched ule B, line 8 or 11.

ORS 316.680 and 316.695 that do not have a spe cif ic line. At-

tach a schedule that details the amount and na ture of each

ad di tion included on this line. En ter this fi du cia ry’s share

of the fiduciary adjustment from an oth er estate or trust that

is an ad di tion on this line. Also en ter federal tax refunds

4

Questions? See “Taxpayer assistance.”

Visit our Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6