Instructions For Form Uct-6 - Employer'S Quarterly Report Page 2

ADVERTISEMENT

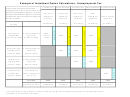

Example of Installment Option Calculations - Unemployment Tax

First Quarter

Second Quarter

Third Quarter

Final Installment

Fourth Quarter

In this example, the employer owes $1,000

unemployment tax for the 1st quarter of 2010, and is

choosing to make installment payments. He is also

UCT-6 and

UCT-6 and

UCT-6 and

Final

choosing to make installment payments for the 2nd

installment

installment

installment

installment

UCT-6 and full

and 3rd quarter, 2010. The employer must pay a $5

payment

payments

payments

payments

payment

fee in the 1st quarter.

04/30/2010

7/31/2010

10/31/2010

12/31/2010

01/31/2011

Tax Due

First Quarter

4 equal installment

$250

Jan/Feb/Mar

payments;

+ $5 fee

$250

$250

$250

(Tax Due: $1,000)

$1,000/4 = $250

= $255

Second Quarter

3 equal installment

April/May/June

payments;

$300

$300

$300

(Tax due: $900)

$900/3 = $300

Third Quarter

2 equal installment

July/Aug/Sept

payments;

$250

$250

(Tax due: $500)

$500/2 = $250

Fourth Quarter

No installment

Oct/Nov/Dec

option; tax payment

$300

(Tax due: $300)

due in full

$255

$550

$800

$800

$300

Total due:

*04/30/2010

7/31/2010

10/31/2010

12/31/2010

01/31/2011

Penalty After Date:

*You must file your UCT-6 Report, and pay the $5 fee and the first installment payment by the Penalty After Date to

participate in the Installment Program.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3