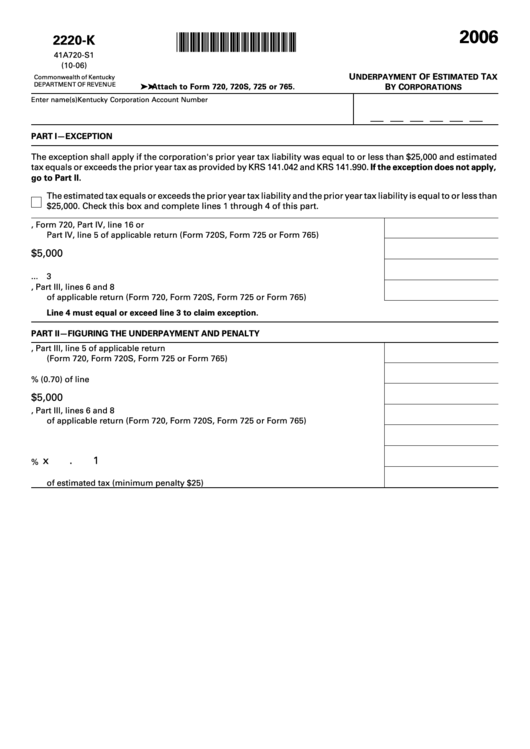

Form 2220-K - Underpayment Of Estimated Tax By Corporations 2006

ADVERTISEMENT

2006

*0600010209*

2220-K

41A720-S1

(10-06)

U

O

E

T

NDERPAYMENT

F

STIMATED

AX

Commonwealth of Kentucky

➤ ➤ ➤ ➤ ➤ Attach to Form 720, 720S, 725 or 765.

DEPARTMENT OF REVENUE

B

C

Y

ORPORATIONS

Enter name(s)

Kentucky Corporation Account Number

__ __ __ __ __ __

PART I—EXCEPTION

The exception shall apply if the corporation's prior year tax liability was equal to or less than $25,000 and estimated

tax equals or exceeds the prior year tax as provided by KRS 141.042 and KRS 141.990. If the exception does not apply,

go to Part II.

The estimated tax equals or exceeds the prior year tax liability and the prior year tax liability is equal to or less than

$25,000. Check this box and complete lines 1 through 4 of this part.

1.

Enter the liability from the 2005 return, Form 720, Part IV, line 16 or

Part IV, line 5 of applicable return (Form 720S, Form 725 or Form 765) ..................... 1

$5,000

2.

Statutory exemption ........................................................................................................ 2

3.

Line 1 less line 2 .............................................................................................................. 3

4.

Enter the total of the amounts from 2006 return, Part III, lines 6 and 8

of applicable return (Form 720, Form 720S, Form 725 or Form 765) .......................... 4

Line 4 must equal or exceed line 3 to claim exception.

PART II—FIGURING THE UNDERPAYMENT AND PENALTY

1.

Enter the liability from the 2006 return, Part III, line 5 of applicable return

(Form 720, Form 720S, Form 725 or Form 765) ............................................................ 1

2.

Enter 70% (0.70) of line 1 ................................................................................................ 2

$5,000

3.

Statutory exemption ........................................................................................................ 3

4.

Enter the total of the amounts from 2006 return, Part III, lines 6 and 8

of applicable return (Form 720, Form 720S, Form 725 or Form 765) .......................... 4

5.

Line 2 less lines 3 and 4 .................................................................................................. 5

x

.1

6.

Penalty percentage is 10% .............................................................................................. 6

7.

Multiply line 5 by line 6. This is the amount of the penalty for underpayment

of estimated tax (minimum penalty $25) ....................................................................... 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1