Form Ap-178 - International Fuel Tax Agreement License Application

ADVERTISEMENT

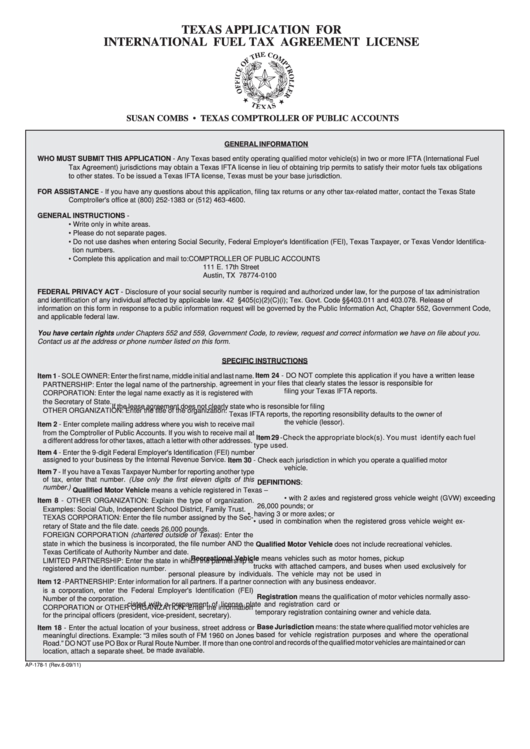

TEXAS APPLICATION FOR

INTERNATIONAL FUEL TAX AGREEMENT LICENSE

Instrucciones Especificas

SUSAN COMBS • TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

GENERAL INFORMATION

WHO MUST SUBMIT THIS APPLICATION - Any Texas based entity operating qualified motor vehicle(s) in two or more IFTA (International Fuel

Tax Agreement) jurisdictions may obtain a Texas IFTA license in lieu of obtaining trip permits to satisfy their motor fuels tax obligations

to other states. To be issued a Texas IFTA license, Texas must be your base jurisdiction.

FOR ASSISTANCE - If you have any questions about this application, filing tax returns or any other tax-related matter, contact the Texas State

Comptroller's office at (800) 252-1383 or (512) 463-4600.

GENERAL INSTRUCTIONS -

• Write only in white areas.

• Please do not separate pages.

• Do not use dashes when entering Social Security, Federal Employer's Identification (FEI), Texas Taxpayer, or Texas Vendor Identifica-

tion numbers.

• Complete this application and mail to:

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, TX 78774-0100

FEDERAL PRIVACY ACT - Disclosure of your social security number is required and authorized under law, for the purpose of tax administration

and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of

information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government Code,

and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.

SPECIFIC INSTRUCTIONS

Item 24 - DO NOT complete this application if you have a written lease

Item 1 - SOLE OWNER: Enter the first name, middle initial and last name.

agreement in your files that clearly states the lessor is responsible for

PARTNERSHIP: Enter the legal name of the partnership.

filing your Texas IFTA reports.

CORPORATION: Enter the legal name exactly as it is registered with

the Secretary of State.

If the lease agreement does not clearly state who is resonsible for filing

OTHER ORGANIZATION: Enter the title of the organization.

Texas IFTA reports, the reporting resonsibility defaults to the owner of

the vehicle (lessor).

Item 2 - Enter complete mailing address where you wish to receive mail

from the Comptroller of Public Accounts. If you wish to receive mail at

Item 29 - Check the appropriate block(s). You must identify each fuel

a different address for other taxes, attach a letter with other addresses.

type used.

Item 4 - Enter the 9-digit Federal Employer's Identification (FEI) number

assigned to your business by the Internal Revenue Service.

Item 30 - Check each jurisdiction in which you operate a qualified motor

vehicle.

Item 7 - If you have a Texas Taxpayer Number for reporting another type

of tax, enter that number. (Use only the first eleven digits of this

DEFINITIONS:

number.)

Qualified Motor Vehicle means a vehicle registered in Texas –

• with 2 axles and registered gross vehicle weight (GVW) exceeding

Item 8 - OTHER ORGANIZATION: Explain the type of organization.

26,000 pounds; or

Examples: Social Club, Independent School District, Family Trust.

• having 3 or more axles; or

TEXAS CORPORATION: Enter the file number assigned by the Sec-

• used in combination when the registered gross vehicle weight ex-

retary of State and the file date.

ceeds 26,000 pounds.

FOREIGN CORPORATION (chartered outside of Texas): Enter the

state in which the business is incorporated, the file number AND the

Qualified Motor Vehicle does not include recreational vehicles.

Texas Certificate of Authority Number and date.

Recreational Vehicle means vehicles such as motor homes, pickup

LIMITED PARTNERSHIP: Enter the state in which the partnership is

trucks with attached campers, and buses when used exclusively for

registered and the identification number.

personal pleasure by individuals. The vehicle may not be used in

Item 12 - PARTNERSHIP: Enter information for all partners. If a partner

connection with any business endeavor.

is a corporation, enter the Federal Employer's Identification (FEI)

Registration means the qualification of motor vehicles normally asso-

Number of the corporation.

ciated with a prepayment of license plate and registration card or

CORPORATION or OTHER ORGANIZATION: Enter the information

temporary registration containing owner and vehicle data.

for the principal officers (president, vice-president, secretary).

Base Jurisdiction means: the state where qualified motor vehicles are

Item 18 - Enter the actual location of your business, street address or

based for vehicle registration purposes and where the operational

meaningful directions. Example: “3 miles south of FM 1960 on Jones

control and records of the qualified motor vehicles are maintained or can

Road.” DO NOT use PO Box or Rural Route Number. If more than one

be made available.

location, attach a separate sheet.

AP-178-1 (Rev.6-09/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4