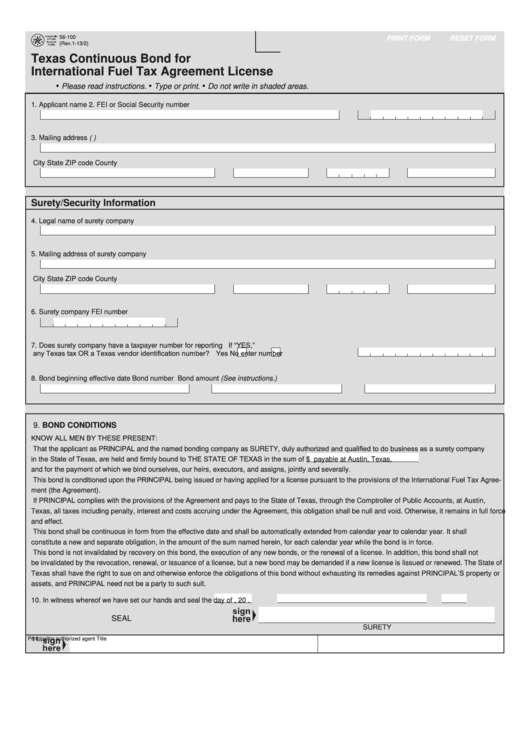

56-100

PRINT FORM

RESET FORM

(Rev.1-13/2)

Texas Continuous Bond for

International Fuel Tax Agreement License

•

•

•

Please read instructions.

type or print.

do not write in shaded areas.

1. Applicant name

2. FEI or Social Security number

3. Mailing address (P.O. Box or street number)

City

State

ZIP code

County

Surety/Security Information

4. Legal name of surety company

5. Mailing address of surety company

City

State

ZIP code

County

6. Surety company FEI number

7. Does surety company have a taxpayer number for reporting

If “YES,”

any Texas tax OR a Texas vendor identification number?

Yes

No

enter number

8. Bond beginning effective date

Bond number

Bond amount (See instructions.)

9. Bond CondITIonS

kNOw all meN bY These pReseNT:

That the applicant as pRiNcipal and the named bonding company as SuRETY, duly authorized and qualified to do business as a surety company

in the state of Texas, are held and firmly bound to The sTaTe Of Texas in the sum of $

payable at Austin, Texas,

and for the payment of which we bind ourselves, our heirs, executors, and assigns, jointly and severally.

This bond is conditioned upon the pRiNcipal being issued or having applied for a license pursuant to the provisions of the International Fuel Tax Agree-

ment (the Agreement).

If pRiNcipal complies with the provisions of the Agreement and pays to the State of Texas, through the Comptroller of Public Accounts, at Austin,

Texas, all taxes including penalty, interest and costs accruing under the Agreement, this obligation shall be null and void. Otherwise, it remains in full force

and effect.

This bond shall be continuous in form from the effective date and shall be automatically extended from calendar year to calendar year. It shall

constitute a new and separate obligation, in the amount of the sum named herein, for each calendar year while the bond is in force.

This bond is not invalidated by recovery on this bond, the execution of any new bonds, or the renewal of a license. In addition, this bond shall not

be invalidated by the revocation, renewal, or issuance of a license, but a new bond may be demanded if a new license is lissued or renewed. The State of

Texas shall have the right to sue on and otherwise enforce the obligations of this bond without exhausting its remedies against pRiNcipal’s property or

assets, and pRiNcipal need not be a party to such suit.

10. In witness whereof we have set our hands and seal the

day of

, 20

.

SEAL

SuRETY

11.

Principal or authorized agent

Title

1

1 2

2